Riding the AI Wave: Boom or Bust?

In the aftermath of OpenAI’s ChatGPT’s meteoric rise, the tech industry behemoths are plunging headlong into the AI realm, aiming to either reap the profits of the impending revolution or shield themselves from potential disruption. The fervor has sparked debates about the sustainability of the AI market, with contrasting views from industry heavyweights like Peter Thiel, Bill Gates, and Elon Musk.

“The world’s first trillionaires will arise from those who master AI in ways we’ve never imagined.”~ Mark Cuban

Despite concerns of an AI bubble, leading figures in the tech industry remain bullish about AI’s potential. The likes of Thiel, Gates, and Musk, who were pivotal players in past technological upheavals, have expressed confidence in the transformative power of AI.

Top Tech Giants Fuel AI Expansion

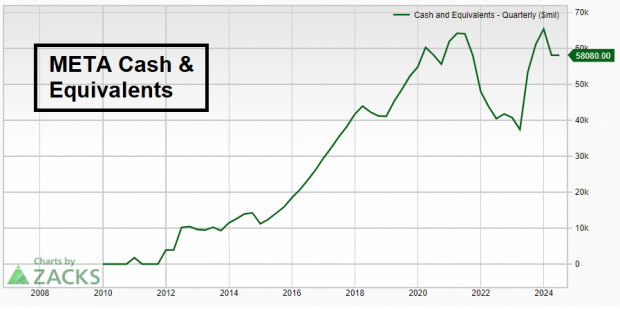

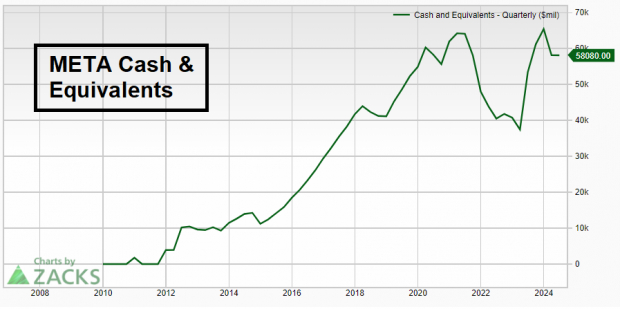

The “Magnificent Seven” tech stocks have outperformed the market, amassing substantial cash reserves. Companies like Amazon, Alphabet, Meta Platforms, and Microsoft collectively shelled out a staggering $100 billion on AI in the first half of 2024, nearly a 50% surge from the previous year. However, with revenue generation lagging behind expenditure, concerns loom over a potential correction in AI stock values.

Image Source: Zacks Investment Research

Despite their current dominance, tech giants are relentless in their pursuit of the next breakthrough. Amazon, Alphabet, Meta Platforms, and Microsoft are actively investing in AI technologies, anticipating future growth opportunities.

Nvidia’s Blackwell Chip Unleashes Unprecedented Demand

Nvidia, the uncontested leader in AI, introduced Blackwell, its groundbreaking next-gen chip, designed to propel AI capabilities to new heights. CEO Jensen Huang’s recent remarks in a televised interview allayed concerns about Blackwell’s supply, with Huang confirming a surge in demand for the cutting-edge chip, now in full-fledged production following a brief delay attributed to Nvidia’s supplier, Taiwan Semiconductor.

Accenture and Nvidia Forge a Revolutionary Alliance

In a strategic move, Nvidia partnered with consulting titan Accenture, leveraging its AI suite to elevate Accenture’s AI applications, foster innovation, streamline operations, and drive cost-efficiency. This collaboration signifies a significant step towards accelerating AI adoption across diverse industries.

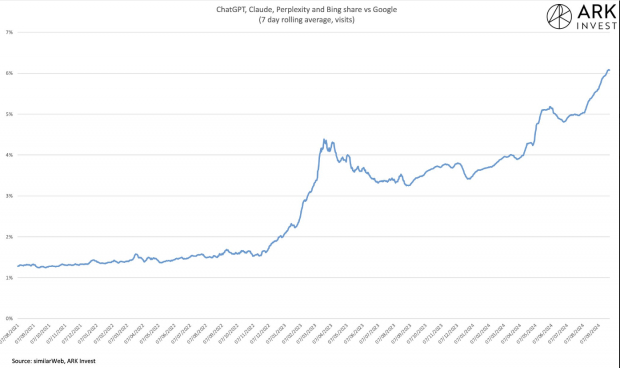

OpenAI Reaps Valuation Windfall, Surpassing $150 Billion

OpenAI’s transition from a non-profit entity to a for-profit enterprise culminated in a recent funding round that valued the company at a staggering $150 billion. Notable investors, including Cathie Wood’s Ark Invest, demonstrated confidence in OpenAI’s potential, with Ark investing $250 million in the AI start-up. OpenAI’s success poses a formidable challenge to Google’s supremacy in the search engine sector, fueled by advanced language models like ChatGPT, Claude, Perplexity, and Bing.

Image Source: similarWeb, Ark Invest

In Conclusion

While concerns persist regarding the sustainability of AI investment fervor, Nvidia’s soaring demand for Blackwell and OpenAI’s record valuation indicate that the AI boom shows no signs of abating. The landscape of tech innovation is rapidly evolving, and investors are eager to capitalize on the transformative potential of artificial intelligence.

Please note: The opinions expressed in this article are solely those of the author and do not reflect the views of Nasdaq, Inc.