AI Stocks Gaining Momentum as Market Conditions Improve

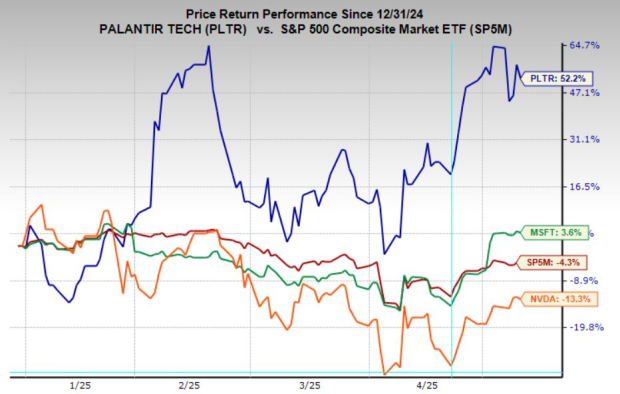

After weeks of market turbulence fueled by tariff headlines, investor focus is returning to a key growth area: artificial intelligence. With geopolitical concerns easing and volatility subsiding, AI stocks are regaining traction, creating a favorable investment environment.

The AI sector continues to thrive, with adoption accelerating in cloud infrastructure, enterprise software, and national defense. For those looking to invest, Microsoft (MSFT), Nvidia (NVDA), and Palantir (PLTR) emerge as notable choices for gaining exposure to this growing field.

This article examines why these stocks are leading in the AI space and highlights critical technical levels to watch.

Image Source: Zacks Investment Research

Microsoft: Leading the Magnificent 7

Microsoft has emerged as a top performer in the Magnificent 7 this year. Its success stems from strong fundamentals and lower exposure to tariff risks compared to competitors like Apple and Amazon. Microsoft’s business model is less dependent on hardware supply chains, making it a safer investment in the current economic climate.

The company’s momentum is buoyed by its close partnership with OpenAI and rising demand for cloud services, largely driven by AI adoption. Microsoft’s Azure platform has grown faster than its peers, Amazon Web Services (AWS) and Google Cloud, as enterprise customers increase their AI-related workloads.

From a technical standpoint, Microsoft appears strong. Following its recent earnings report, the stock gapped higher and broke out of a long-term bull flag pattern—a bullish indication. If shares remain above the $420 breakout level, the upward trend should continue, positioning Microsoft to lead the next market rally.

Image Source: TradingView

Palantir: Unique Position in AI

Palantir Technologies has also performed well in the market over the past two years, capitalizing on AI excitement. Its focus on defense, government, and enterprise data analytics makes it a unique player, reflected in its high valuation—over 200 times forward earnings.

The stock remains volatile but is currently consolidating in a promising pattern. Palantir appears to be forming a nested bull flag, with support around $108 and resistance near $125. A breakout past $125 could signal a continuation of its upward trend, while a dip below $108 may trigger a retest of support around $70.

For traders seeking specialized exposure to AI, Palantir presents a dynamic and potentially rewarding option. Additionally, it carries a Zacks Rank #2 (Buy), indicating favorable earnings revisions.

Image Source: TradingView

Nvidia: Key AI Infrastructure Provider

Nvidia remains a leader in the AI space, supplying essential chips for major data centers. Its GPUs are critical for training advanced AI models and the demand for these products shows little sign of abating. CEO Jensen Huang’s commitment to innovation positions Nvidia ahead of both established and emerging rivals.

Despite its leading market position, Nvidia’s stock is trading at a reasonable 27.3 times forward earnings, significantly lower than its five-year average of 55 times.

Technically, NVDA has recently broken out of a descending bull channel, suggesting potential for further upward movement. As long as it stays above the key breakout level of $114, the trend remains strong, indicating higher resistance levels may be ahead.

Image Source: TradingView

Should Investors Consider NVDA, PLTR, and MSFT?

AI Stocks Like Microsoft, Nvidia, and Palantir Bounce Back

As tariff-related volatility recedes and investor sentiment shifts toward long-term growth, AI stocks are regaining their momentum. Microsoft, Nvidia, and Palantir each provide unique perspectives on the AI opportunities within the market.

These three stocks demonstrate robust technical setups, improving fundamentals, and, in certain cases, appealing valuations. For investors aiming to re-enter the AI trade, this trio warrants attention as a high-conviction watchlist.

Zacks Research Highlights Promising Stock with High Growth Potential

Zacks’ team of experts has identified five stocks with the highest probability of gaining 100% or more in the coming months. Among these, Director of Research Sheraz Mian has spotlighted one stock that is projected to experience the most significant climb.

This standout pick is a highly innovative financial firm with a rapidly expanding customer base, currently exceeding 50 million. It offers a diverse array of cutting-edge solutions, positioning it for substantial gains. While not all of Zacks’ elite picks succeed, this stock has the potential to significantly outperform previous top selections, such as Nano-X Imaging, which surged by 129.6% in just over nine months.

For further insights into this promising stock and its four competitors, download Zacks’ report on the “7 Best Stocks for the Next 30 Days.”

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Palantir Technologies Inc. (PLTR): Free Stock Analysis Report

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.