“`html

Market Volatility: The Rollercoaster of 2025 and AI’s Resurgence

What started as a hopeful rally swiftly unraveled into market turmoil.

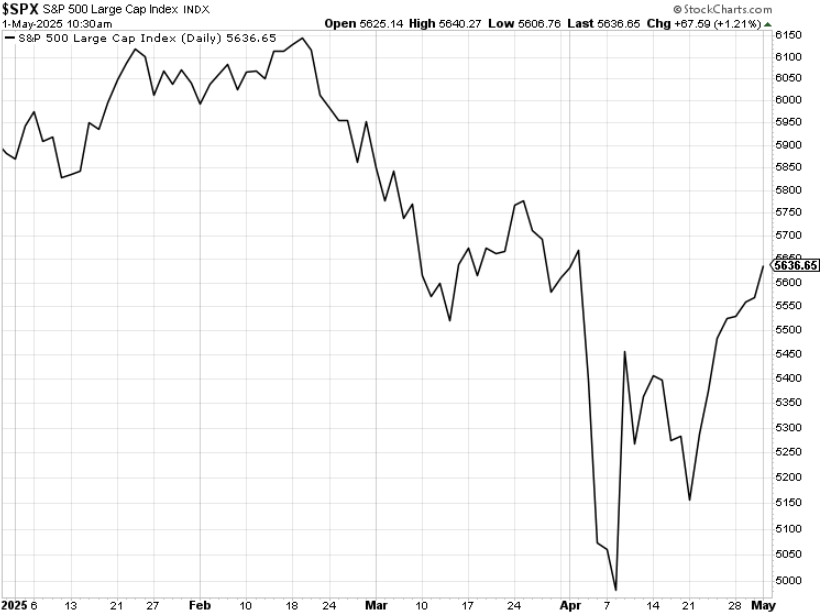

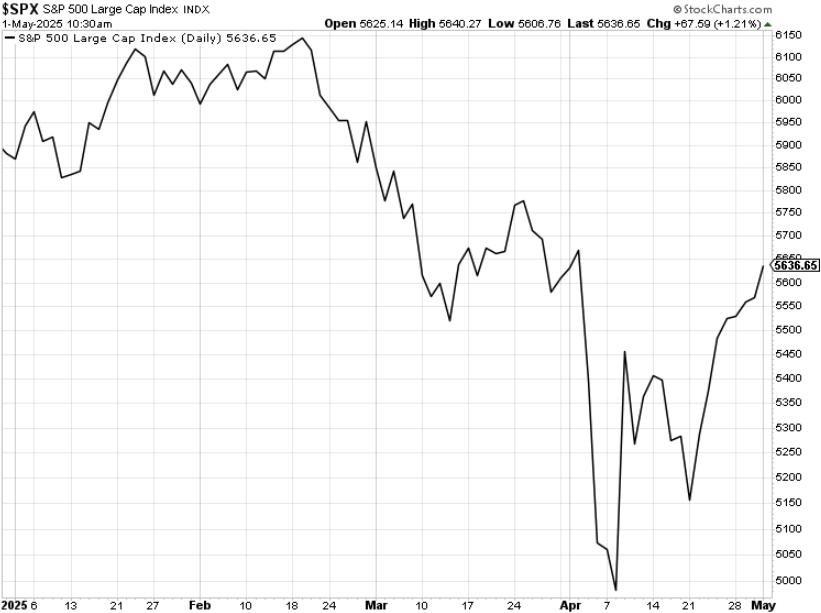

The stock market kicked off this year on a strong note, achieving 3% gains in January. Fueled by a surge in AI interest and discussions surrounding potential tax cuts and deregulation from President Trump, it seemed like we were headed for another bull market breakout. However, this optimism swiftly turned to panic.

In February, the White House initiated its first tariff threats. The result? Stocks fell 10% in just 20 days—one of the fastest corrections in contemporary market history.

By April, the “Liberation Day” tariffs further exacerbated the situation, leading markets to plunge nearly 20%. At one point, the S&P 500 was on track for its third-worst start to a year in the past century.

The market appeared to be spiraling downward. Some investors compared it to a slow-motion crash akin to 1987, while others feared a repeat of 2008.

However, just as quickly as market sentiment soured, it began to rebound.

From Crash to Comeback: Trade War Sparks Stock Market Volatility

In an unexpected turnaround, Trump retracted the most severe tariffs and postponed reciprocal duties for 90 days. Electronics and later auto parts were exempted from Chinese tariffs, while trade negotiations began with Japan, India, the EU, and even China. The overall rhetoric softened.

This shift buoyed market confidence, leading to a remarkable recovery. In the last three weeks, the S&P has surged nearly 12%, marking one of the fastest recovery rallies recorded.

What’s next for the market?

This question looms large for every investor. Many are looking in the wrong direction, trying to predict the next moves in the trade war.

Will a deal with Japan materialize? Could China retaliate once more? Might Trump abolish exemptions and escalate tariffs?

While these are certainly pressing questions, they may not provide the answers sought by investors.

What is likely to move markets next isn’t the trade war itself but something significantly larger: the escalating influence of artificial intelligence.

AI Demand Surges Amid Economic Uncertainty

Let’s take a broader view.

Despite the looming threat of a global trade war and potential recession, the AI boom continues to thrive.

Recent earnings reports from major players reflect this reality. Last night, Microsoft (Stock-ticker”>MSFT) and Meta (Stock-ticker”>META) showcased significant growth in their AI operations. These earnings reveal that the AI boom is accelerating.

Microsoft’s Azure cloud sector, which houses most of its AI services, experienced a 35% increase year-over-year last quarter. This growth marks an uptick from 31% in the previous quarter, signifying the first acceleration seen in over a year.

Management indicated that AI demand is surpassing supply. In response, Microsoft plans to invest heavily—approximately $80 billion in data centers in fiscal year 2025—to support the rising need for AI technologies like Copilot and Microsoft Fabric.

Meta shared similar insights, noting a 30% increase in advertisers utilizing its AI creative tools. Time spent on Facebook and Instagram has also risen, aided by AI-driven enhancements. To accommodate growing demand, Meta intends to allocate between $64 billion and $72 billion on capital expenditures in 2025, significantly elevating previous forecasts.

It’s important to remember: these are trillion-dollar companies. They don’t tend to exaggerate unless necessary. Both assert that AI demand is flourishing despite the ongoing trade war.

And they are not alone.

AI Stock Surge: TSM and Other Leaders Break New Ground

Recently, Taiwan Semiconductor (Stock-ticker”>TSM)—a leading AI chip provider—reported impressive earnings and guidance. With a 60% year-over-year increase in net profit for Q1 2025, reaching approximately $11.12 billion, TSM surpassed analyst expectations. The company projects that its AI revenue will double in 2025.

The overarching takeaway is clear: AI demand is resilient, even amidst trade tensions.

Similar affirmations are emerging from other companies, including Lam Research (Stock-ticker”>LRCX), as well as Vertiv…

“`# Upcoming AI Catalyst May Trigger Major Market Panic

Companies mentioned: Stock-ticker”>VRT, Seagate (Stock-ticker”>STX), Western Digital (Stock-ticker”>WDC), ServiceNow (Stock-ticker”>NOW), Alphabet (Stock-ticker”>GOOG). The list is extensive.

Artificial intelligence development is accelerating rapidly.

Investors may be overlooking significant opportunities.

While Wall Street concentrates on tariff updates, attention should shift toward potential AI breakthroughs.

Significantly, we anticipate that a major announcement is imminent next week.

This development could trigger a $7 trillion disruption across the financial markets.

Positioning for the Upcoming AI Stock Breakout

This anticipated trillion-dollar impact is unrelated to tariffs or trade agreements. It transcends sectors like steel, aluminum, electric vehicles, and semiconductors.

Instead, it revolves around a factor capable of supercharging the AI market. We believe this could initiate an unprecedented rally in AI stocks.

Tonight, May 1, at 7 PM EST, I invite you to join my urgent discussion, The 2025 Summer Panic Summit (click the link to RSVP).

During this session, we will cover:

- The specifics of this $7 trillion impact

- Its connections to Donald Trump

- Why it could unlock substantial profits in a select area of the AI sector

- And how to position yourself ahead of these changes

I will disclose the seven AI stocks I believe are optimally positioned for growth during this upcoming market shift.

Collectively termed the MAGA 7 stocks – Make AI Great in America, these emerging companies are poised to capitalize on the intersection of technology and policy.

If this year has left you feeling overwhelmed by market volatility and conflicting news, you are not alone. The market has exhibited unpredictability that feels unprecedented.

However, clarity is beginning to emerge.

The AI revolution is gaining momentum, and this $7 trillion shift could transform market dynamics in mere days.

RSVP to The 2025 Summer Panic Summit today to uncover the seven AI stocks set to thrive.

On the publication date, Luke Lango held no direct or indirect positions in the securities mentioned.

For questions or comments, please contact us at [email protected].