Airbnb Set to Release Q3 Earnings: Key Insights and Projections

Airbnb (ABNB) is scheduled to report its third-quarter results for 2024 on November 7.

ABNB anticipates third-quarter revenues to be between $3.67 billion and $3.73 billion, which reflects an 8-10% increase compared to the previous year.

The Zacks Consensus Estimate predicts revenues of $3.72 billion for the quarter, signifying a year-over-year growth of 9.58%.

For earnings per share (EPS), the consensus estimate is at $2.17, a slight decrease of one cent from 30 days ago. This projection shows a decline of 9.21% from the same quarter last year.

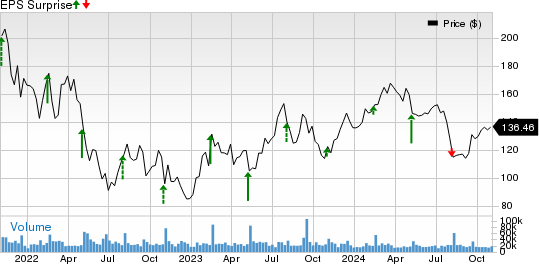

In the past four quarters, ABNB has surpassed the Zacks Consensus Estimate in three instances, with an average earnings surprise of 25.02%.

Airbnb, Inc. Price and EPS Surprise

Airbnb’s price and EPS surprise | Airbnb, Inc. Quote

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Here’s what we expect ahead of this earnings announcement.

What to Watch for in ABNB’s Q3 Earnings

Airbnb’s growth can be attributed to its solid core business, strategic investments, and expanding reach globally. The company is experiencing strong traction in both urban and suburban areas, with over 7.7 million listings across 100,000 cities worldwide.

In particular, the increasing demand for urban and cross-border travel has boosted its gross nights booked, with the Zacks Consensus Estimate set at 126 million, reflecting a 9.6% rise from the previous year.

Airbnb has enhanced its offerings with features aimed at improving user experience. A new feature, “Guest Favorites,” highlights popular homes based on guest ratings and reviews, which is expected to attract more users to the platform.

Additionally, a labeling feature that identifies the top 25% and 1% of listed properties helps customers make informed choices from a wide selection.

These enhancements likely contributed to an increase in gross booking value (GBV), projected at $21.3 billion—an 11.5% rise from last year’s figure.

The company’s initiative to broaden its service offerings continues to foster growth among hosts globally.

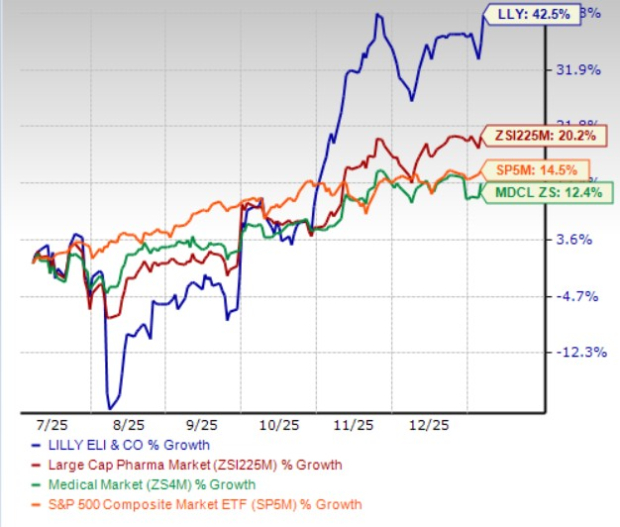

ABNB Shares Lag Behind Sector Competitors

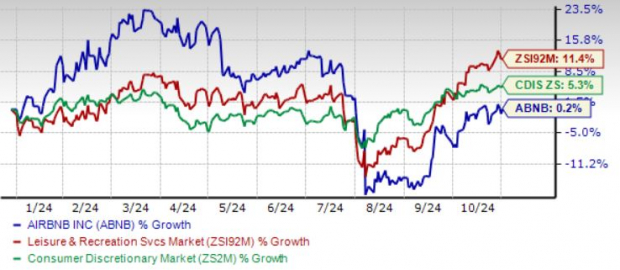

Airbnb shares have experienced modest growth at 0.2%, falling short compared to the Zacks Consumer Discretionary sector’s 5.3% return and the Zacks Leisure and Recreation Services sector’s 11.4% return.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

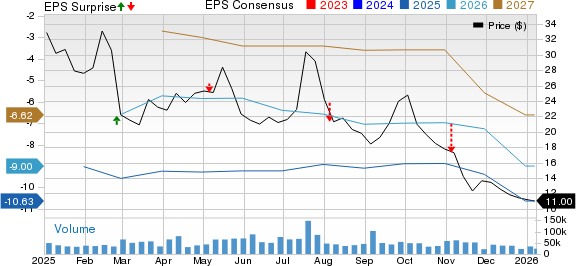

Currently, ABNB stock’s Value Score of D suggests it may be overvalued, trading at a 12-month forward Price/Earnings ratio of 28.93X versus the sector’s average of 20.23X.

Forward Price/Earnings Ratio

Image Source: Zacks Investment Research

Investments Bolstering ABNB’s Growth

Airbnb is investing in expanding its host community, which is essential for attracting new hosts to its platform. By enhancing the quality of stays and experiences, the company encourages more participation from hosts worldwide and has made it easier for newcomers to start hosting.

Furthermore, international growth remains a major focus. Airbnb plans to continue investing in underdeveloped markets in the coming years, seeking to unlock additional growth opportunities.

The company’s ongoing introduction of features and upgrades—over 430 in total—is aimed at making its platform more user-friendly and affordable, enhancing its position against competitors like Booking Holdings (BKNG), Expedia (EXPE), TripAdvisor (TRIP), and Trivago.

In comparison, Booking Holdings and Expedia have outperformed Airbnb, with returns of 33.8% and 5%, respectively, while TripAdvisor shares declined by 25.1%.

ABNB Stock Outlook: Buy, Sell, or Hold?

While Airbnb’s strong long-term growth prospects driven by its improving host business and international reach present an attractive investment opportunity, investors must remain aware of fierce competition and elevated valuation levels.

Currently, ABNB holds a Zacks Rank #3 (Hold), suggesting that investors may benefit from waiting for a better entry point before buying the stock. You can see the full list of current Zacks #1 Rank (Strong Buy) stocks here.

Research Chief Highlights “Top Pick for Doubling Investment”

Out of numerous stocks, five Zacks experts have chosen their favorites expected to surge by 100% or more in the upcoming months. Among them, the Director of Research, Sheraz Mian, highlights one stock with the greatest potential for significant gains.

This company targets millennial and Gen Z audiences and generated nearly $1 billion in revenue last quarter. A recent drop in stock price makes this an ideal opportunity for investors. While not every selection will be a winner, this one could outperform previous Zacks stocks like Nano-X Imaging, which increased by +129.6% in just over nine months.

Free: Discover Our Top Stock and Other Recommendations

Interested in the latest insights from Zacks Investment Research? Download 5 Stocks Set to Double today. Click to get this free report.

Expedia Group, Inc. (EXPE): Free Stock Analysis Report

TripAdvisor, Inc. (TRIP): Free Stock Analysis Report

Booking Holdings Inc. (BKNG): Free Stock Analysis Report

Airbnb, Inc. (ABNB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not reflect those of Nasdaq, Inc.