Astera Labs Anticipates Significant Revenue Growth in Q1 2025

Astera Labs (ALAB) is set to report its first-quarter 2025 results on May 6. For this quarter, the company projects revenues between $151 million and $155 million. The Zacks Consensus Estimate for first-quarter revenues is $153.34 million, reflecting a remarkable year-over-year increase of 134.97%.

In terms of earnings, Astera Labs expects non-GAAP earnings between 28 cents and 29 cents per share. The consensus marks for earnings is currently at 28 cents per share, unchanged over the last 30 days, indicating a year-over-year growth of 180%.

Notably, ALAB has consistently exceeded the Zacks Consensus Estimate in the previous four quarters, with an average surprise of 61.45%. (Find the latest EPS estimates and surprises on Zacks earnings Calendar)

Astera Labs, Inc. Stock Price and EPS Surprise

Astera Labs, Inc. price-eps-surprise | Astera Labs, Inc. Quote

Let’s examine how the upcoming earnings announcement may unfold.

Factors Likely to Affect Q1 Performance

Astera Labs’ Q1 2025 revenues are likely to have benefited from a rise in demand for artificial intelligence (AI) servers and data center infrastructure. Strong performance across its three main product lines – Aries, Taurus, and Leo – is anticipated to contribute significantly.

Particularly, the Aries Peripheral Component Interface Express (PCIe) retimers and Taurus Ethernet products are expected to drive significant revenue growth this quarter. Their continued adoption in AI platforms and general computing systems has likely sustained strong demand.

Revenues from Taurus 400 gig Ethernet solutions are anticipated to play a critical role in the top line, spurred by both AI and general-purpose compute applications.

Moreover, the expansion of the Scorpio Smart Fabric Switch family, already generating preproduction shipments, is expected to boost revenues in the first quarter.

ALAB Stock Trends Behind Sector and Industry

Year-to-date, ALAB shares have declined by 45.1%, underperforming the broader Zacks Computer & Technology sector, which is down 8.9%, and the Zacks Electronics – Semiconductors industry, which has seen a decline of 15.2%.

This underperformance is largely attributed to concerns regarding lower-than-expected gross margins due to a shift in the product mix toward hardware solutions. Broader tech sector weakness and persistent concerns over increasing tariffs have also contributed to this slide.

YTD ALAB Stock Performance

Image Source: Zacks Investment Research

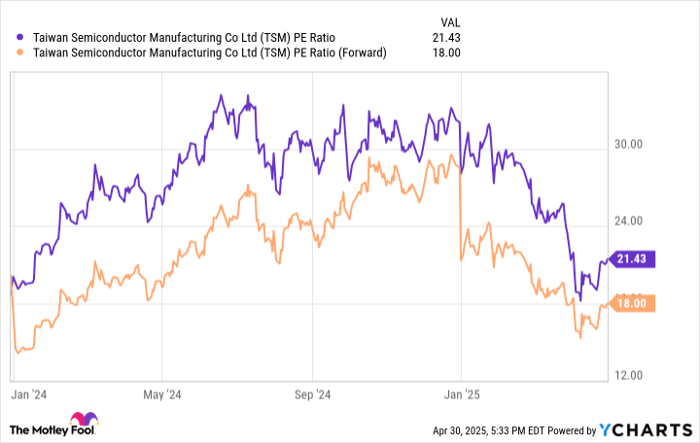

ALAB Stock Valuation Concerns

ALAB stock is currently rated poorly, evidenced by a Value Score of F. It is trading at a forward 12-month Price/Sales ratio of 15.36X, which is significantly higher than the Computer & Technology sector’s 5.71X.

Price/Sales Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

ALAB’s Expanding Product Portfolio

ALAB’s expanding product range is expected to be a significant growth driver. The company recently announced increased production for its PCIe6 connectivity portfolio, which includes gearbox solutions, fabric switches, retimers, and active cable modules. This effort aims to boost performance, scalability, and efficiency in AI and cloud infrastructure systems.

Moreover, this expansion is anticipated to provide a competitive edge against other industry players such as Broadcom (AVGO), which is also making strides in the PCIe Retimer market. In February 2025, Broadcom unveiled its PCIe Gen6 portfolio to enhance AI infrastructure solutions.

Additionally, Broadcom’s scalable and low-power 400G PCIe Gen 5.0 Ethernet adapters aim to transform data centers by addressing connectivity challenges.

ALAB Boosts AI Development with Collaborations

Astera Labs has made considerable inroads in the AI sector through partnerships with leading chipmakers, including NVIDIA (NVDA), Advanced Micro Devices (AMD), Micron Technology, and Intel. This collaboration is expected to support growth in the first quarter.

Recently, ALAB launched its Scorpio Smart Fabric Switches for PCIe 6-ready NVIDIA Blackwell-based MGX platforms, which are designed to provide high-performance, modular scalability for AI and cloud applications.

Additionally, the comprehensive design-in collateral and interoperability validation in its Cloud-Scale Interop Lab optimize NVIDIA MGX platform integration while enhancing GPU utilization and energy efficiency.

Advanced Micro Devices is also leveraging Astera Labs’ solutions to bolster the efficiency and scalability of its AI products, further solidifying both companies’ positions in the AI marketplace.

Conclusion: Recommended Hold on ALAB Stock

Despite a robust product lineup, ALAB faces intensifying competition in the AI and cloud sectors, especially from larger semiconductor firms. Such competition is likely to impact financial performance negatively. Furthermore, ongoing macroeconomic uncertainties and high valuations raise concerns.

Astera Labs currently holds a Zacks Rank #3 (Hold), suggesting that potential investors might consider waiting for a more favorable entry point before accumulating the stock.