“`html

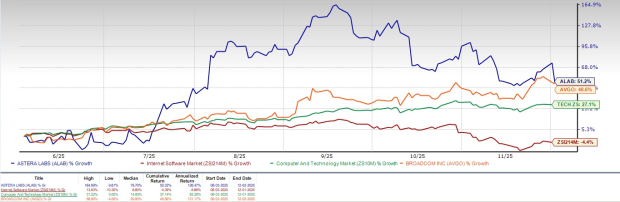

Astera Labs (ALAB) shares increased by 51.2% over the past six months, significantly outperforming the Zacks Computer & Technology sector’s 27.1% rise and the Zacks Internet – Software industry’s 4.4% decline. The company anticipates fourth-quarter 2025 revenues between $245 million and $253 million, with a year-over-year increase of 77.03% from the Zacks Consensus Estimate of $249.79 million.

A key contributor to ALAB’s performance is its growing partner base with companies like Microsoft (MSFT) and NVIDIA. Notably, ALAB’s Leo CXL Smart Memory Controllers enable the first deployment of CXL-attached memory, supporting up to 2TB of expandable memory, enhancing performance for memory-intensive applications. Additionally, the Zacks Consensus Estimate for fourth-quarter earnings stands at approximately 51 cents per share, a 37.84% year-over-year increase.

Despite its strong momentum, ALAB faces stiff competition from industry peers such as Broadcom (AVGO) and Credo Technology (CRDO). Moreover, ALAB’s stock trades at a premium, indicated by a forward Price/Sales ratio of 21.22X, compared to the sector’s 6.68X, raising concerns about stretched valuations.

“`