Amid a surplus of 200,000 tonnes of lithium carbonate equivalent, comprising a staggering 17% of global demand, Goldman Sachs dauntlessly anticipates that this dismal scenario will prompt producers, predominantly those from Australia, to substantially curtail output to restore equilibrium in the market.

The US-based lithium juggernaut recently divulged its contemplation on how to sustain growth, slash expenses, and streamline cash flow amidst the prevailing market adversities.

This announcement was coupled with a projection of layoffs, and a decision to defer expenditure on various projects, including a colossal refinery endeavor in South Carolina.

As reported on Monday, Albemarle’s workforce reduction has impacted its legal, mergers and acquisitions, marketing, materials sciences, research and development, and recycling teams.

Analysts at BMI Research, a division of Fitch Solutions, suggested that the miner’s move was hardly surprising, given its predominant focus on major lithium expansions through conversion assets, rendering it susceptible to market disruptions.

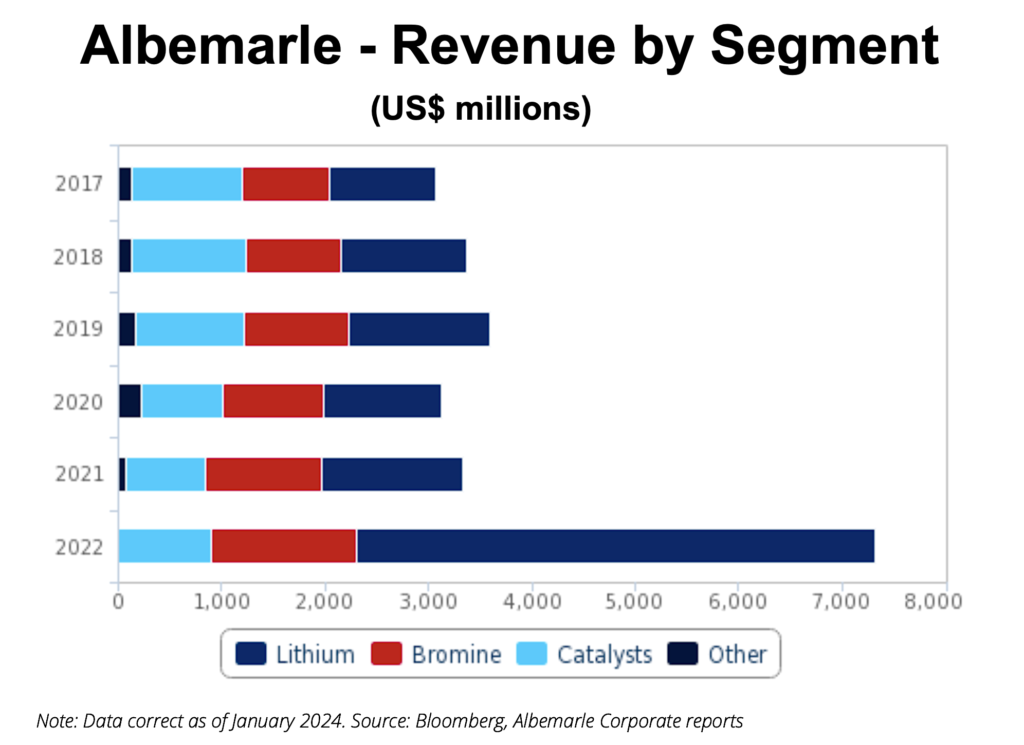

Albemarle’s Main Revenue Stream

BMI foresees lithium continuing as Albemarle’s primary revenue source, with the company showing a long-term inclination towards prioritizing low-cost lithium projects, which will position it to reap the benefits of a surge in lithium demand and prices.

The price of lithium has plummeted by over 80% in the past year to $13,200 per tonne, marking its lowest level since 2020, according to data from Benchmark Mineral Intelligence.

BMI Research expects prices to continue to be hampered by unfavorable supply-demand dynamics in the near term, potentially denting Albemarle’s profit margins.

“The company has the ability to further curtail capital expenditure to maintain liquidity,” stated in a note by BMI Research. “Its formidable financial position grants it the leeway to explore mergers and acquisitions and form joint ventures in the long run, adhering to its disciplined approach to investment for growth.”

BMI highlighted that accelerated electric vehicle (EV) production through 2030 and elevated lithium prices will bolster Albemarle’s revenue in the long term.

Albemarle has not yet responded to a MINING.COM request for comment.