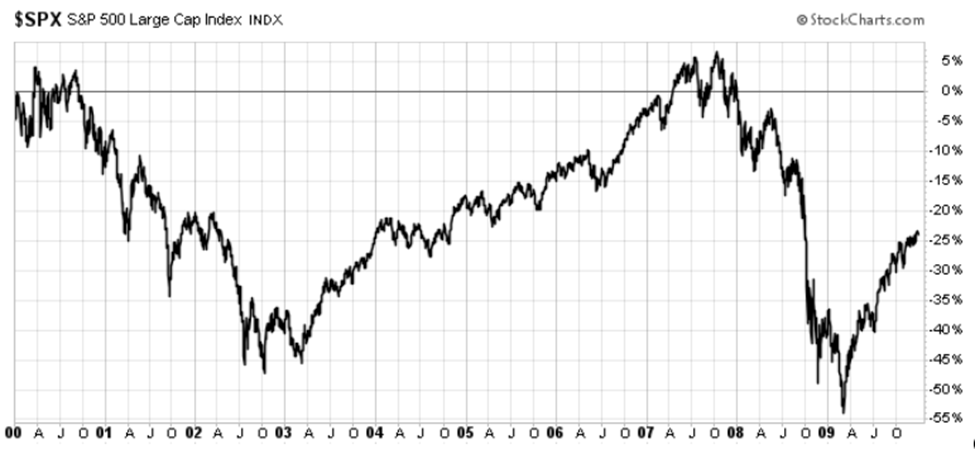

For most investors in most companies, 2023 ended up being a fantastic year. Including dividends, the S&P 500 jumped 26.3%. That follows a rather difficult 2022 fiscal year in which all the market, including dividends, drop by 18.4%. But not every company fared well during the year. Specialty chemicals producer Albemarle Corporation (NYSE:ALB) was one of the unlucky ones, with a total return negative to the tune of 32.8%. Although we still don’t have data covering the final quarter of 2023, the first nine months of the year saw attractive revenue growth driven in large part by high prices for lithium. Overall profits were also on the rise, but the picture changed significantly and in a negative way in the third quarter. A surge in costs pushed profits and cash flows down. Add on top of these concerns about future lithium demand, and it’s understandable that the stock would take a hit too. But when you look at the long-term potential of the company and consider just how cheap shares are, it’s difficult to not be optimistic.

Unfortunately, optimism doesn’t always pay off. And even when it does, the wait for it can be painful. As an example, back in early September of last year, I wrote a bullish article about Albemarle in response to its agreement to acquire Liontown Resources (OTCPK:LINRF). That transaction ended up falling through. Regardless of that, however, from the time the bullish article that I wrote about the business was published through to the present day, shares are down 26.4%. That drop has occurred at the same time that the S&P 500 has jumped by 5.6%. Clearly, the pain in the third quarter of the year and growing concerns over lithium demand proved to be the cause of most of the company’s downside. But I view these problems as being short term in nature. In the long run, I fully anticipate that Albemarle will perform quite well.

Adjusting to New Challenges

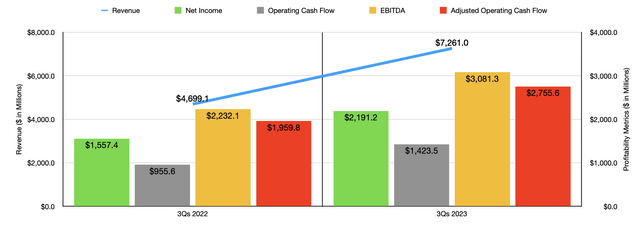

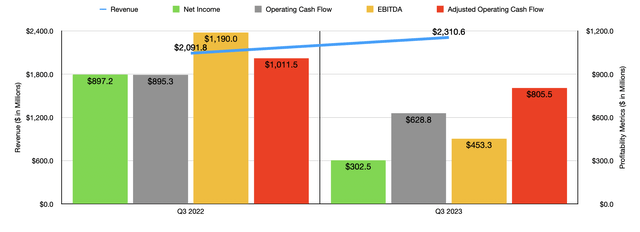

If you were to look at only the first nine months of the 2023 fiscal year and compare them to the same time in 2022, you’d be perplexed as to why shares of Albemarle have taken such a beating. In the chart above, you can see precisely what I mean. In the chart below, however, you can see something a little different covering the third quarter of last year relative to the same time one year earlier. Just as was the case with the rest of the year, revenue continued to grow nicely. However, net profits were cut by nearly two-thirds and every measure of cash flow took a rather significant pullback.

Looking at the numbers fresh again after a couple of months of not looking into the company, I had hoped that the bottom line pane was caused by something further down on the income statement. Impairment charges or one-time legal costs would have been ideal. But that’s not where I discovered the issue for the firm. The issue was up near the very top, in the form of the cost of goods sold. In the third quarter of 2022, the company’s gross profit margin was 49.9%. In the third quarter of 2023, gross profit margin had declined to a paltry 2.4%. This accounted for the vast majority of the weakness that the enterprise experienced during this window of time.

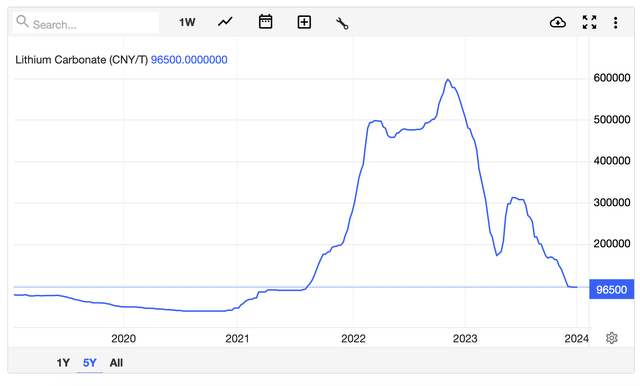

In the third quarter of 2023, the company benefited to the tune of $540.3 million because of higher sales volume that was largely associated with its Energy Storage segment. However, this was offset to a large extent in the amount of $285.4 million because of a drop in pricing from both the Energy Storage and Specialties segments. There has been concern on the pricing front regarding lithium. After peaking at nearly 600,000CNY per ton in late 2022, lithium carbonate prices have been on a rather significant decline. As of this writing, they are going for around 96,500CNY per ton. For context, lithium carbonate is a more general type of lithium that has a wide array of uses. It can be used to produce cement densifiers, adhesives, and even flooring treatments. It also has some medicinal purposes, with medical professionals viewing it as an essential medication for treating those with bipolar disorder. It can be used directly in the production of batteries for electric vehicles. But it can also be converted into lithium hydroxide, which is highly preferred when it comes to producing top-grade electric vehicle batteries.

This on its own is bad. In addition to this, spodumene, which is a mineral from which lithium is primarily sourced, has seen its price remain stubbornly high. I found reports dating back to April of 2023 that show that spodumene prices were on the ascent even as lithium prices were falling. Sure enough, this hurt the company in the third quarter. Management did not quantify exactly how much of its price increase was driven by a surge in pricing here. But it was listed as the highest item on the list responsible for the pain the company was contending with from a margin perspective.

In order to contend with pricing volatility in the long run, management has been investing in different lithium initiatives. In fact, as of the end of the most recent quarter, almost 20% of the spodumene that the company utilizes comes from company-owned assets. Regardless of how these types of investments turn out, management remains committed to the idea that lithium will be a major source of revenue and profit

The Electric Vehicle Revolution

Albemarle Corporation, a major player in the lithium market, is taking a hit from a margin perspective. Management’s EBITDA expectations for 2023 suggest net profits around the $2.6 billion mark with an adjusted operating cash flow of $3.4 billion. Yet, despite the current challenges, the company remains bullish on its future prospects. And there are good reasons for this optimism.

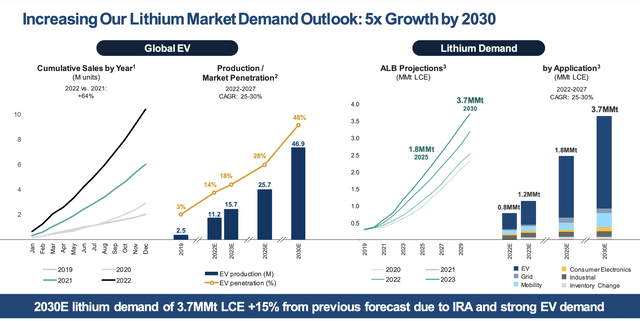

The Future of Lithium Demand

By taking the long view, Albemarle sees a surge in global lithium demand driven by the growing number of electric vehicles hitting the streets. Their forecast indicates that in 2025, lithium demand will be 125% higher than in 2022. Looking further ahead, the company projects a staggering 362.5% increase in demand by 2030. With the number of electric vehicles produced globally expected to reach 46.9 million by the end of the decade, representing around 48% of the total market, the race for lithium is heating up.

Market Position and Valuation

Amid the current margin challenges, Albemarle’s valuation is a point of contention. The company is projected to reach an EBITDA of $3.2-3.4 billion in 2023. Even in the face of these difficulties, when comparing against five other specialty chemical firms using 2023 estimates for valuation, Albemarle is the most attractively priced based on the price-to-earnings, price-to-operating cash flow, and EV-to-EBITDA approaches.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Albemarle | 6.6 | 5.6 | 5.8 |

| Celanese Corp. (CE) | 8.3 | 10.5 | 12.4 |

| PPG Industries (PPG) | 24.7 | 16.6 | 15.2 |

| DuPont de Nemours (DD) | 8.0 | 33.6 | 13.9 |

| RPM International (RPM) | 27.6 | 15.5 | 17.0 |

| Ashland (ASH) | 25.7 | 18.7 | 11.4 |

Why Albemarle is a Buy

While the market may appear worried about Albemarle, it’s important to consider the long-term trajectory. The company’s outlook, combined with the undervaluation of its shares, indicates a solid ‘buy’ opportunity. With the heightened demand for lithium brought about by the electric vehicle revolution, savvy long-term investors may find Albemarle an enticing prospect.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.