Albertsons Companies, Inc. ACI has reported third-quarter fiscal 2023 results, exceeding both the top and bottom lines’ respective Zacks Consensus Estimate. The company has shown unwavering commitment to operational excellence, expansion of digital and pharmacy operations, and deepening customer relationships, underpinning its pivotal strategy.

Despite challenging economic conditions, Albertsons continued its dedication to the strategy of creating “Customers for Life,” yielding solid results across its operational areas in the fiscal third quarter.

Positive Performance in Q3

Albertsons posted adjusted quarterly earnings of 79 cents per share, surpassing the Zacks Consensus Estimate of 66 cents. Although this was a decrease from 87 cents reported in the prior-year period, net sales and other revenues increased to $18,557.3 million, marking a 2.2% year-over-year rise. The top line outpaced the Zacks Consensus Estimate of $18,271 million, driven by a 2.9% increase in identical sales, particularly in pharmacy sales. Despite minor dips in non-perishable, fresh, and fuel sales, there was a significant 32.4% surge in pharmacy net sales to $2,282.8 million. Furthermore, digital sales grew by 21%, primarily propelled by home delivery and Drive Up & Go curbside pickup services.

Financial Snapshot

The gross profit stood at $5,197.3 million, up 1.4% year over year, while the gross margin experienced a contraction to 28.0% compared with 28.2% in third-quarter fiscal 2022. Excluding the impacts of fuel and LIFO expenses, the gross margin rate decreased 64 basis points from the third quarter of fiscal 2022, primarily due to robust growth in pharmacy operations, which generally have a lower gross margin rate, and an increase in shrink. These factors were partially mitigated by effective procurement and sourcing productivity initiatives.

Selling and administrative expenses increased 1.7% to $4,607.3 million but leveraged 20 basis points to 24.8% as a percentage of net sales and other revenues. Excluding the impact of fuel, selling and administrative expenses as a percentage of net sales and other revenues decreased 28 basis points. The company also reported a 4.4% decline in adjusted EBITDA to $1,106.5 million, with the adjusted EBITDA margin contracting 40 basis points. Looking ahead to the fourth quarter, the company anticipates significant growth and margin impact in pharmacy and digital operations.

Additional Financial Insights

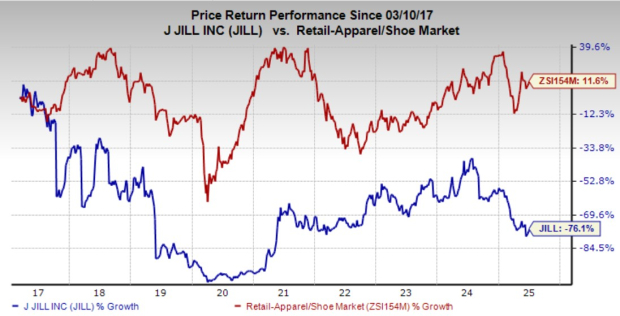

At the close of the quarter, Albertsons boasted $222.7 million in cash and cash equivalents. The company’s long-term debt and finance lease obligations totaled $7,797 million, while total stockholders’ equity amounted to $2527.3 million. Shares of this Zacks Rank #3 (Hold) company have gained 7.9% in the past year compared to the industry’s decline of 26.1%.

Stocks to Consider

Notable stocks to consider include Dutch Bros (BROS), Dole (DOLE), and Coca-Cola (KO). Dutch Bros, currently sporting a Zacks Rank #1 (Strong Buy), has seen significant growth, while Dole and Coca-Cola also hold favorable Zacks Ranks.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Each of these companies has shown promising data and could be worth keeping an eye on in the coming months. However, as with any investment, thorough research is crucial before making any financial decisions.

To read the full article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.