Alcoa Corporation (AA) reported its fourth-quarter 2023 results, showcasing a mixed performance where the bottom line surpassed the Zacks Consensus Estimate, while the top line fell short. During the quarter, the company received approval for its Western Australia bauxite mine plans as part of its ongoing efforts to enhance its global asset portfolio.

The reported total revenues of $2,595 million missed the Zacks Consensus Estimate of $2,613 million, marking a 2.6% decline from the year-ago quarter but staying flat sequentially.

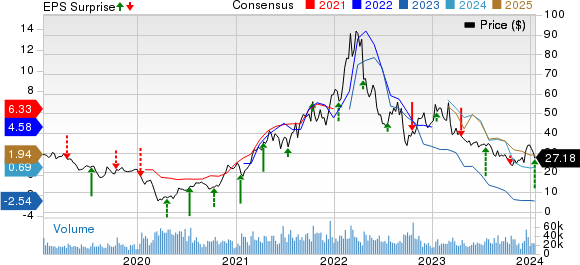

The company’s adjusted loss stood at 56 cents per share, surpassing the consensus estimate of a loss of 99 cents. The bottom line showed a significant improvement from the adjusted loss of 70 cents per share reported in the same quarter last year and also outperformed the adjusted loss of $1.14 reported in the third quarter.

Segmental Performance

In the fourth quarter, Alcoa’s alumina production experienced a 1% sequential decline to 2.79 million metric tons due to reduced production from the Australia refineries. Conversely, aluminum production increased by 2% sequentially to 541,000 metric tons.

The company’s overall third-party revenues totaled $2.60 billion in the quarter, remaining flat sequentially. The alumina segment’s third-party revenues witnessed a 5% decline due to an average realized third-party price reduction of 3% and lower shipments. On the other hand, the aluminum segment’s revenues increased by 2% driven by an average realized third-party price gain of 1% and a rise in shipments.

Costs & Expenses

The company’s total cost of sales in the reported quarter was $2,425 million, reflecting a 6.6% decrease year over year. Selling, general and administrative expenses stood at $64 million, unchanged from the previous year. The interest expense was $28 million, compared with $26 million a year ago.

The net loss (adjusted) in the fourth quarter was $100 million, an improvement from a net loss of $144 million in the year-ago quarter.

Balance Sheet/Cash Flow

Alcoa, currently holding a Zacks Rank #3 (Hold), reported cash and cash equivalents of $944 million compared with $1,363 million at the end of December 2022. Long-term debt declined to $1,732 million from $1,806 million at the end of 2022.

The company generated net cash of $198 million from operating activities during the quarter compared with $118 million in the year-ago period. Capital expenditures totaled $188 million, up from $171 million in the year-ago period. Free cash flow was $10 million, compared with a cash outflow of $53 million in the year-ago period.

Guidance and Conclusion

For 2024, Alcoa expects alumina production in the range of 9.8-10 million metric tons and alumina shipments between 12.7 million and 12.9 million metric tons. The Aluminum segment is expected to produce 2.2 to 2.3 million metric tons with shipments ranging from 2.5-2.6 million metric tons.

Despite the mixed quarterly performance, the company’s ongoing efforts to enhance its global asset portfolio and outlook for the coming year may signal a potential turnaround. Investors will be closely watching the company’s strategic initiatives and operational performance in the months ahead.

Investor Guidance

The broader industrial products sector offers potential investment opportunities for investors. Notable stocks from this sector, including Crane Company (CR), Flowserve Corporation (FLS), and Reliance Steel & Aluminum Co. (RS), each currently holding a Zacks Rank #2 (Buy), stand as interesting choices for investors aiming to diversify their portfolios. It’s worth exploring these options in the current market landscape.

Traders may also want to consider access to Zacks’ additional bonus reports to stay informed about potential growth stocks in promising sectors. As the AI industry continues to flourish, understanding and being part of this growth could prove beneficial for long-term investors.

Should investors decide to broaden their scope, the broader AI sector, especially stocks within it, could offer substantial opportunities for growth and diversification. This under-explored area could hold the key to substantial returns in the future.

Read the original article on Zacks.com