Alibaba (BABA) reported a 60% year-over-year increase in revenue for the second quarter of fiscal 2026, bolstered by strong order momentum and the expansion of Taobao Instant Commerce. Despite this growth, the company is facing significant challenges in profitability due to rising costs, particularly in its China e-commerce segment, where EBITA plummeted by 76% year over year. Cash flow has also deteriorated, impacted by ongoing investments in quick commerce and infrastructure.

Competition is intensifying with JD.com and PDD Holdings pushing aggressive pricing strategies and efficient operational models. JD.com achieved a revenue increase of 14.9% to RMB299.1 billion in Q3 2025, while PDD Holdings has seen solid growth through a low-cost, socially-driven approach. Both companies are hampering Alibaba’s market position.

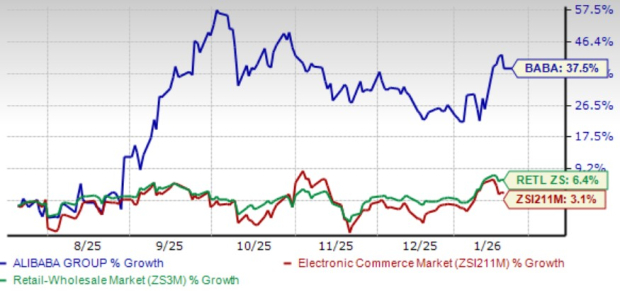

Alibaba’s shares have increased by 37.5% over the past six months, outperforming both the Zacks Internet – Commerce industry and the Zacks Retail-Wholesale sector. However, estimates suggest fiscal 2026 earnings of $6.10 per share, reflecting a 32.3% year-over-year decline.