Alibaba and BMW Join Forces for AI-Integrated Vehicles

AI Partnership Develops New Mobility Solutions

On March 26, 2025, Alibaba Group (BABA) announced a major expansion of its partnership with BMW in China. This collaboration aims to incorporate Alibaba’s Qwen large language model into BMW’s upcoming Neue Klasse vehicles, marking a significant advance in AI-driven mobility solutions and a noteworthy investment opportunity.

The integration will involve BMW’s Intelligent Personal Assistant utilizing Alibaba’s AI technology through Banma, Alibaba’s smart cockpit provider. This feature is set to roll out in BMW vehicles manufactured in China starting in 2026, paving the way for improved human-vehicle interactions.

Additionally, the partnership intends to create an AI companion that offers human-like conversations, multi-agent coordination, and integration within a digital ecosystem. These advancements are expected to enhance travel experiences and infotainment for BMW customers in China.

This initiative builds on a relationship that has existed since 2015, encompassing areas such as cloud computing, smart manufacturing, and intelligent networking. By embedding AI language models into BMW systems, Alibaba is showcasing the tangible application of its AI technologies within lucrative industries.

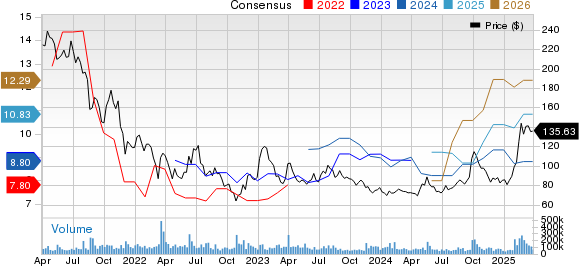

Alibaba Group Price and Consensus Overview

Alibaba Group Holding Limited price-consensus-chart | Alibaba Group Holding Limited Quote

Financial Results Reflect Robust AI Investment Capability

Alibaba’s recent financial disclosures underscore its readiness to leverage AI initiatives. In the December quarter of 2024, earnings released on February 20, 2025, revealed revenues of RMB280.2 billion ($38.4 billion), an 8% increase year-over-year. Particularly notable was the company’s cloud segment, which experienced revenue growth of 13%.

Furthermore, Alibaba has seen AI-related product revenues consistently achieve triple-digit growth for six straight quarters. This trend highlights the company’s effective monetization of AI technology. Adjusted EBITA rose 4% to RMB54.9 billion ($7.5 billion), reflecting strong profitability alongside ongoing growth investments.

The Zacks Consensus Estimate anticipates fiscal 2025 revenues at $138.29 billion, presenting year-over-year growth of 5.97%. Additionally, the Zacks Consensus Estimate for earnings suggests a 0.9% upward adjustment in the past 60 days, now projected at $8.80 per share, indicating market optimism regarding Alibaba’s growth outlook.

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

Aggressive Strategy for AI Investment

Alibaba’s leadership has vowed to ramp up investments in cloud and AI infrastructure significantly over the next three years, outpacing investments from the previous decade. This strategic initiative aims to position Alibaba as a leader in the AI revolution sweeping across Asia.

Management emphasizes that AI is a transformational technology capable of reshaping large sectors of the global economy, presenting a vast growth potential.

In line with this focus, Alibaba has also adopted a shareholder-friendly capital allocation approach. In the recent quarter, the company repurchased $1.3 billion of its shares, leading to a 5% reduction in share count over the past nine months.

However, Alibaba’s leading e-commerce position in China faces competition from global giants like Amazon (AMZN) and eBay (EBAY). Moreover, its growth in the global cloud sector has encountered challenges due to escalating competition from other major players such as Amazon, Microsoft (MSFT), and Google.

Investment Potential in Alibaba (BABA) Stock

The expanded partnership with BMW illustrates Alibaba’s ability to commercialize its AI technologies effectively, tapping into premium market segments. Given its solid financial backing, demonstrated ability to monetize AI, and strategic focus on transformative technologies, Alibaba presents a strong investment opportunity at current pricing.

As the firm implements its “user first, AI-driven” approach while exercising financial prudence, investors can capitalize on exposure to a leader in both e-commerce and innovation in the second-largest global economy. For those interested in AI investments with verified monetization, Alibaba is a stock worth considering in 2025. Currently, BABA carries a Zacks Rank #2 (Buy). You can see the full list of today’s Zacks #1 Rank stocks here.

Zacks’ Research Chief Identifies Promising Stock

Our team of analysts has identified five stocks with a high potential to gain 100% or more in the upcoming months. Among these, the Director of Research, Sheraz Mian, highlights one stock with the strongest growth potential.

This leading pick is part of an innovative financial firm with a rapidly expanding customer base of over 50 million and a wide array of advanced solutions, positioning it for significant gains. While not all selections guarantee success, this particular stock could outperform previous Zacks’ high performers, such as Nano-X Imaging, which surged by +129.6% within nine months.

Free: See Our Top Stock and Four Other Runners-Up

Keep up with Zacks Investment Research’s latest recommendations. You can download the report on the 7 Best Stocks for the Next 30 Days. Click for your free access.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

eBay Inc. (EBAY): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.