Alibaba and JD.com Unite: A Strategic Response to Regulatory Challenges

Alibaba Group Holding BABA and its competitors in China have begun collaborating in light of recent regulatory hurdles and economic challenges, leading to a more open approach in the market.

Merchants on Alibaba’s e-commerce platforms can now utilize logistics services from rival JD.com Inc JD. This partnership aims to help businesses reach their growth goals amid a struggling economy.

JD Logistics, boasting over 1,600 automated warehouses and approximately 370,000 delivery staff, poses significant competition to Alibaba’s Cainiao Smart Logistics Network.

Also Read: Alibaba And Baidu Bet Big On Autonomous Driving, Back $700M Horizon Robotics IPO

According to JD Logistics, a variety of logistics solutions—including warehousing and shipping—will now be accessible for sellers on Alibaba’s leading platforms, Taobao and Tmall, as reported by SCMP.

Merchants can now select JD.com as their delivery service, allowing consumers to track shipments seamlessly via Alibaba’s platforms.

Historically, these two companies have clashed, often restricting each other’s services. However, the current regulatory landscape and sluggish economy have prompted a change in strategy for China’s tech giants.

The move toward collaboration is becoming more evident. Recently, Tencent Holdings TCEHY enabled users to shop directly on Alibaba’s Taobao through the WeChat app. Moreover, Taobao and Tmall are set to integrate WeChat Pay for transactions.

China is contemplating a significant fiscal stimulus of 6 trillion yuan, roughly $850 billion, through ultra-long special treasury bonds to rejuvenate the economy after substantial rate cuts.

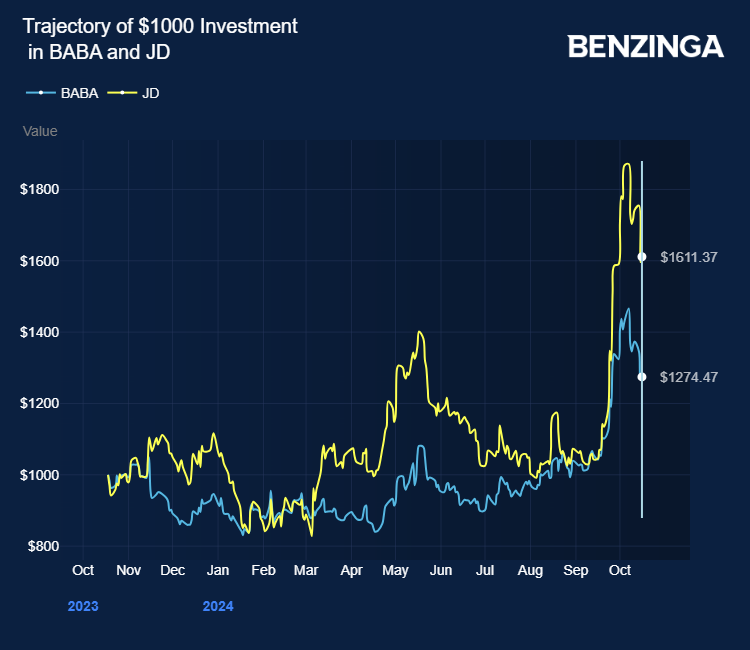

As a result of these stimulus proposals, shares of Alibaba and JD.com have surged between 21% and 51% over the past month.

Investors looking to engage with China’s tech sector can consider SPDR NYSE Technology ETF XNTK and Invesco Nasdaq Internet ETF PNQI for exposure to Alibaba.

Price Actions: The latest figures indicate BABA stock dipped 0.86%, trading at $101.29, while JD saw a decline of 1.95%.

Also Read:

Image by Tada Images via Shutterstock

Market News and Data brought to you by Benzinga APIs