Before diving into the reliability of brokerage recommendations and how they impact investment decisions, let’s take a closer look at what the Wall Street experts have to say about Alibaba (BABA).

Broker Recommendations for Alibaba

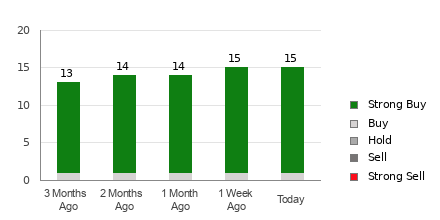

Alibaba currently holds an average brokerage recommendation (ABR) of 1.27, which falls between Strong Buy and Buy on a scale of 1 to 5. Out of the 15 recommendations contributing to the ABR, a staggering 86.7% are classified as Strong Buy.

While the ABR seems to lean toward buying Alibaba, relying solely on this information might not be in the best interest of investors. Studies have shown that brokerage recommendations have limited success in predicting stocks with the most potential for price appreciation.

Why is that the case? It’s no secret that brokerage analysts often exhibit a strong positive bias due to the vested interest of their firms in the stocks they cover. In fact, for every “Strong Sell” recommendation, there are five “Strong Buy” recommendations. This disparity underscores the potential misalignment of interests between brokerage firms and retail investors, offering little guidance on a stock’s future price movement.

Zacks Rank vs. ABR

Our proprietary stock rating tool, Zacks Rank, categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) based on their potential price performance. Comparatively, while both ABR and Zacks Rank are displayed on a 1-5 scale, they are distinctly different measures.

The ABR is solely based on broker recommendations and is often displayed in decimals. Conversely, the Zacks Rank utilizes a quantitative model focusing on earnings estimate revisions and is represented in whole numbers. Earnings estimate revisions, a core component of the Zacks Rank, are linked to near-term stock price movements according to empirical research.

Notably, the Zacks Rank maintains balance among the five ranks it assigns to all stocks for which brokerage analysts provide earnings estimates for the current year, making it an inherently unbiased tool.

Investing in BABA?

Examining the earnings estimate revisions for Alibaba, the Zacks Consensus Estimate for the current year has remained steady at $8.86 over the past month. This stagnant consensus estimate signifies analysts’ unwavering views on the company’s earnings prospects, resulting in a Zacks Rank #3 (Hold) for Alibaba.

Considering the recent lack of movement in the consensus estimate and other related factors, exercising caution with the Buy-equivalent ABR for Alibaba may be prudent.

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.