Alibaba Unveils Emotion-Reading AI Model Amid Competitor Showdown

Alibaba Group Holding Ltd. BABA BABAF has introduced a groundbreaking artificial intelligence model that can read human emotions. This release intensifies competition with OpenAI as Alibaba deepens its focus on AI technologies following the recent DeepSeek AI developments from January.

Market Reaction

After the announcement, Alibaba’s shares fell by 2.45%, landing at 131.50 HKD ($16.92) on the Hong Kong Exchange.

New AI Capabilities

The newly launched open-source R1-Omni model, created by Alibaba’s Tongyi Lab, excels at interpreting emotional states from video footage while also providing descriptions of people’s clothing and surroundings, according to a report from Bloomberg.

Notably, Alibaba’s R1-Omni is available freely on Hugging Face. This positions it as a cost-effective alternative to OpenAI’s GPT-4.5, which is priced at $200 monthly.

Future Market Projections

This launch occurs as Alibaba Chairman Joe Tsai forecasts that the AI market could soar to $10 trillion. Tsai emphasized that AI technology has the potential to “enhance the quality of work by managing tedious research-related tasks” across various sectors including finance and law. He expressed confidence that Alibaba will leverage significant advantages from its cloud computing services.

see also: Ray Dalio Warns US Debt Crisis Could Trigger ‘Shocking Developments’ Calls To Reduce Deficit At 3% Of GDP

Investment in AI Infrastructure

Alibaba has pledged $53 billion towards enhancing its cloud and AI infrastructure over the next three years. Recently, it launched QwQ-32B, a reasoning model that claims to match the performance of DeepSeek’s R1, even with a lower parameter count.

Goals for AI Adoption

The president of Alibaba.com, Zhang Kuo, aims for full AI tool utilization among its 200,000 merchants by the end of 2025, with over half already employing these tools on a weekly basis.

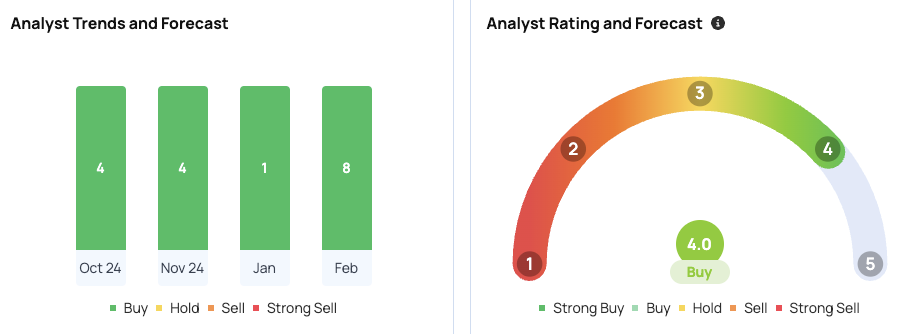

Analyst Insights

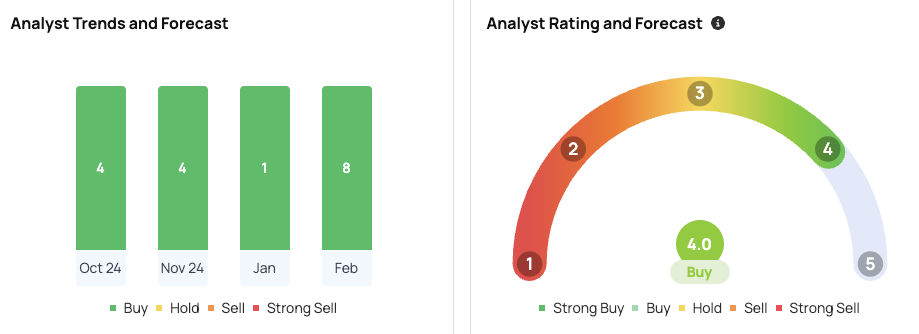

Analysts currently set a price target for Alibaba at $138.26. Recent evaluations from Benchmark, Bernstein, and Morgan Stanley suggest an average target of $178.33, indicating a possible upside of 32.39%.

Read Next:

Image Via Shutterstock

Momentum96.59

Growth65.04

Quality61.42

Value76.22

Market News and Data brought to you by Benzinga APIs