“`html

Alibaba Set to Reveal Q3 Results: What to Expect

Alibaba Group Holding Limited BABA is scheduled to report third-quarter fiscal 2025 results on Feb. 20.

Revenue and Earnings Projections

For the fiscal third quarter, the Zacks Consensus Estimate for revenues is pegged at $38.19 billion, suggesting a 4.14% rise from the previous year’s figures.

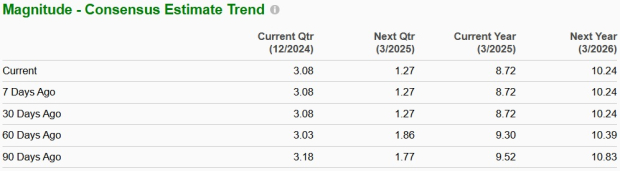

The Zacks Consensus Estimate for earnings stands at $3.08 per share, indicating a 15.36% increase from the same quarter last year. This estimate has remained unchanged over the last 30 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Image Source: Zacks Investment Research

Alibaba has a mixed earnings surprise history. In the last reported quarter, the company delivered a negative earnings surprise of 4.87%. It beat the Zacks Consensus Estimate in two out of the last four quarters and missed twice, with an average surprise of 2.14%.

Alibaba Group Holding Limited Price and EPS Surprise

Alibaba Group Holding Limited price-eps-surprise | Alibaba Group Holding Limited Quote

Earnings Expectations for BABA

Current analysis does not strongly support an earnings beat for Alibaba this quarter. For a positive projection, a combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) would be ideal, which is currently not the case. BABA has an Earnings ESP of 0.00% and holds a Zacks Rank #3. You can view the complete list of today’s Zacks #1 Rank stocks here.

Key Factors to Watch for BABA

Alibaba’s third-quarter earnings come amidst mixed operational results. While international growth is displaying promise, challenges persist in the domestic market, raising concerns for investors.

The company’s International Digital Commerce Group showed a significant 29% year-over-year revenue growth last quarter, fueled by strong performances from AliExpress and Trendyol. This upward trend may continue, supported by recent investments in European and Gulf markets. The new AliExpressDirect model, utilizing local inventories for better fulfillment, might also enhance international performance.

Conversely, the domestic e-commerce sector remains tough. While initiatives like a 0.6% software service fee and increased usage of the Quanzhantui marketing tool were implemented, Taobao and Tmall Group only saw 1% revenue growth last quarter. Though the partnership with Douyin, under the “Star Cube Plan,” may boost user acquisitions, economic pressures in China continue to challenge consumer spending.

The Cloud Intelligence Group also deserves attention, having achieved a 7% revenue increase last quarter. Triple-digit growth in AI products for five consecutive quarters indicates strong potential within this high-margin sector. However, aggressive pricing strategies aimed at international customers may harm near-term profitability even as market share potentially expands.

From a financial viewpoint, Alibaba boasts a strong balance sheet with RMB352.1 billion in net cash. However, a sharp 70% decline in free cash flow last quarter due to cloud infrastructure investments raises short-term capital allocation concerns. With these mixed signals and ongoing market uncertainties, investors might opt to wait for clearer signs of sustainable growth before increasing their stake. The current risk-reward profile suggests a hold recommendation, particularly observing domestic consumer trends and cloud segment margins in the upcoming results.

BABA Price and Valuation Insights

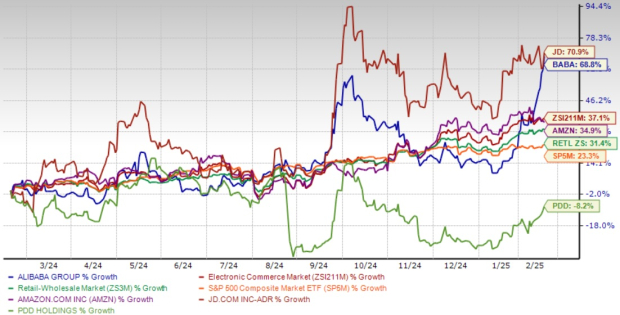

In the past year, Alibaba shares surged 68.8%, outpacing the industry, the Zacks Retail-Wholesale sector, and the S&P 500 index returns of 37.1%, 31.4%, and 23.3%, respectively.

BABA faces fierce competition from Amazon AMZN, JD.com JD, and PDD Holdings PDD. In contrast to BABA’s gains, JD and Amazon have risen by 70.9% and 34.9%, while PDD has dipped by 8.2%.

1-Year Price Performance

Image Source: Zacks Investment Research

It’s crucial to evaluate whether the stock’s current valuation accurately reflects its long-term growth potential. Presently, BABA trades at a forward 12-month P/E of 12.39X, a significant discount compared to the industry’s average of 24.8X.

BABA’s P/E Ratio Highlights a Discounted Valuation

Image Source: Zacks Investment Research

Investment Analysis

Alibaba presents a complex investment perspective as it approaches its third-quarter fiscal 2025 results. Despite strong revenue growth in the International Digital Commerce Group and promising opportunities in European and Gulf markets, challenges in its domestic operations persist. The Cloud Intelligence Group’s impressive growth in AI products indicates potential, though competitive pricing strategies may impact profit margins. Given uncertain economic conditions in China and investments affecting free cash flow, investors may find it prudent to wait for clearer signs of sustainable growth across vital segments before increasing exposure to the stock.

Final Thoughts

While Alibaba showcases potential through its international expansion and AI strategies, domestic market challenges, heightened competition in the cloud sector, and heavy infrastructure investments point towards a cautious approach. Investors should closely monitor the company’s performance across key growth areas and wait for stronger evidence of sustained profitability before making new investments in anticipation of the upcoming third-quarter fiscal 2025 results.

Just Released: Zacks Top 10 Stocks for 2025

Act quickly – you can still invest early in our 10 top picks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio has seen incredible success. Since its launch in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has increased by 2,112.6%, vastly outperforming the S&P 500’s +475.6%. Sheraz has carefully selected the best 10 companies to buy and hold in 2025. Don’t miss your chance to access these newly released stocks with substantial potential.

Want the latest stock recommendations from Zacks Investment Research? Download the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

PDD Holdings Inc. Sponsored ADR (PDD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.

“`