Alibaba Settles $433.5M Class Action Lawsuit Amid Monopolistic Claims

The Chinese e-commerce giant Alibaba Group (BABA) has agreed to a $433.5 million settlement to settle a class action lawsuit initiated by shareholders in a federal court in Manhattan. The lawsuit accused Alibaba of monopolistic behaviors, specifically coercing merchants to sell exclusively through its platform.

This settlement is pending court approval and includes a cash payout to affected shareholders. Notably, Alibaba maintains that it has done nothing wrong and opted for the settlement to avoid further legal expenses and disruptions.

Background on the Lawsuit

The class action was filed in March 2023, alleging that Alibaba violated federal securities laws by making false claims related to its antitrust practices. The lawsuit asserted that these misleading statements led to inflated stock prices, causing substantial losses for investors.

Additionally, the lawsuit claimed that Alibaba pressured merchants into exclusive agreements and penalized those who offered products on competing platforms. Despite a 2020 commitment to amend such practices, the alleged behavior reportedly continued.

Legal Challenges Facing Alibaba

Legal issues are not new for Alibaba. The company has faced numerous investigations over the past few years regarding accusations of monopolistic conduct, data privacy issues, and antitrust probes.

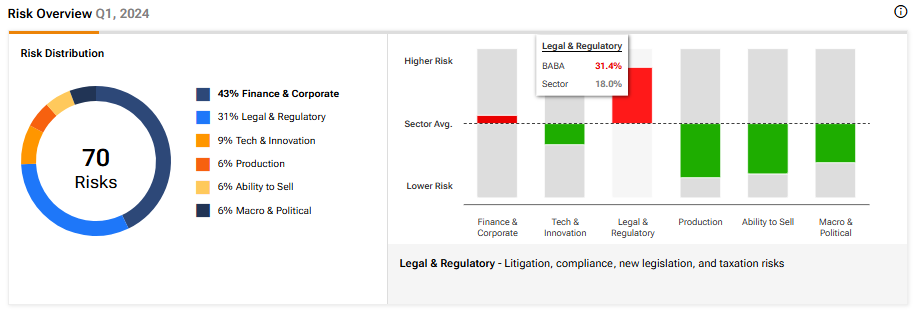

According to TipRanks’ Risk Analysis tool, Alibaba’s legal and regulatory risks are considerably higher than the industry average. Notably, legal matters account for 31.4% of BABA’s total risk exposure, in contrast to the industry average of 18%. This considerable discrepancy warrants careful attention from investors.

Assessing Alibaba’s Investment Outlook

On Wall Street, Alibaba has earned a Strong Buy consensus rating, supported by 16 Buys and three Holds within the last three months. The average price target for Alibaba stands at $125.11, suggesting a potential upside of 28.42%. Year-to-date, the company’s shares have risen over 28%.

Explore More BABA Analyst Ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.