Comparing E-Commerce Titans: Alibaba vs. Amazon Investments

In the dynamic world of global e-commerce, Alibaba Group (BABA) and Amazon.com (AMZN) continue to lead the market. Both firms have reshaped consumer behaviors, built extensive cloud computing operations, and ventured into various technology sectors. While Amazon reigns in Western markets, Alibaba stands as the premier e-commerce force in China, making notable strides toward international expansion.

These two giants share similar business frameworks, offering extensive e-commerce platforms, cloud services, and digital entertainment. Nonetheless, they function in distinct primary markets characterized by unique regulatory frameworks, growth paths, and valuation standards. As global digital transformation accelerates—particularly in emerging technologies like artificial intelligence—both companies are poised at a nexus of commerce and tech innovation, meriting a detailed comparison.

This analysis seeks to compare the stock fundamentals of both companies to identify the more attractive investment option at present.

Why Consider Alibaba (BABA) Stock

Alibaba has demonstrated impressive resilience and growth in its business fundamentals despite navigating regulatory challenges over recent years. Its financial results from the December quarter reflect a robust market stance. The company reported consolidated revenues of RMB280,154 million ($38,381 million), marking an 8% increase compared to the same period last year. Notably, income from operations soared by 83%, reaching RMB41,205 million.

The core e-commerce operations of BABA are flourishing. Customer management revenues from its Taobao and Tmall Group experienced a 9% year-on-year increase. By prioritizing user experience and adopting seller-friendly policies, Alibaba expanded its high-value consumer group, the 88 VIP members, at double-digit rates, totaling 49 million. This expansion positions the company well for sustainable revenue growth.

Additionally, Alibaba’s cloud segment is gaining momentum, with revenues in the Cloud Intelligence Group rising 13% year-over-year. The company has become a leader in AI innovation, maintaining triple-digit growth in AI-related product revenues for six consecutive quarters. The recent launch of the QwQ-32B compact reasoning model demonstrates Alibaba’s ability to compete with larger models while optimizing resource usage—underscoring its commitment to cost-effective AI solutions. Strategic plans to invest $53 billion in cloud computing and AI infrastructure over the next three years illustrate Alibaba’s ambitions within this high-growth sector.

On the international front, Alibaba is experiencing substantial growth. Its International Digital Commerce Group posted an impressive 32% increase year-over-year, fueled by strong cross-border business performance. The company’s recent expansion includes a new cloud region in Mexico and a second data center in Thailand, aimed at meeting the surging demand for cloud services amid the AI boom.

The Zacks Consensus Estimate forecasts fiscal 2025 revenues at $138.29 billion, indicating a year-over-year growth of 5.97%. The consensus estimate for fiscal 2025 earnings has seen a 0.9% upward revision over the past 60 days, now projected at $8.80 per share, reflecting positive market sentiment about Alibaba’s prospects.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on the Zacks earnings calendar.

The Argument for Amazon (AMZN) Stock

Amazon continues to assert its dominance within the North American e-commerce sector. The company’s fourth-quarter 2024 results revealed a 10% revenue increase year-over-year in its North America segment. Reported total revenues reached $187.79 billion, up 10.49% from the previous year, with growth across diverse business lines. AMZN’s fortified logistics network and emphasis on delivery efficiency led to over nine billion units delivered with same-day or next-day shipping throughout 2024.

A significant competitive advantage stems from Amazon’s Prime membership program, which delivers fast shipping alongside streaming services, music, prescription discounts, and grocery delivery options. The introduction of premium brands, including Clinique, Estee Lauder, and Armani Beauty, further enriches its product portfolio.

Amazon Web Services (AWS) remains a critical growth driver, with revenues increasing by 19% year-over-year, reaching a $115 billion annual run rate. The company is also heavily investing in AI infrastructure by developing custom AI silicon, such as Trainium 2, which reportedly offers 30-40% better price performance than traditional GPU-powered solutions. Amazon’s collaboration with Anthropic on Project Rainier highlights its commitment to becoming a leader in the AI infrastructure sector.

Furthermore, Amazon’s advertising division has shown remarkable growth, generating $17.3 billion in revenues during the fourth quarter of 2024, an increase of 18% year-over-year. This segment has evolved into a powerful revenue generator, reaching an annual run rate of $69 billion, leveraging Amazon’s extensive customer data.

The Zacks Consensus Estimate for Amazon’s 2025 net sales stands at $696.84 billion, reflecting a growth rate of 9.23% from the previous year. In terms of earnings, the consensus estimate for 2025 is set at $6.32 per share, indicating a year-over-year increase of 14.29%. This figure has remained static over the past month.

Image Source: Zacks Investment Research

Valuation and Stock Performance Comparison

A comparative analysis of these e-commerce leaders reveals that Alibaba holds several valuation advantages. Alibaba’s price-to-cash flow ratio stands at 11.84X, slightly above the Zacks Internet-Commerce industry average of 11.55X, yet considerably more appealing than Amazon’s ratio of 16.29X. This suggests that Alibaba offers better relative value for investors interested in the e-commerce and cloud computing sectors.

BABA’s Valuation Is More Attractive than AMZN

Alibaba’s Stock Outshines Amazon Amid Strategic Investments

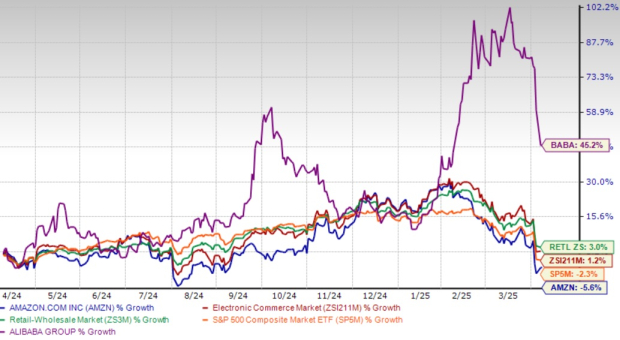

Recent performance metrics highlight Alibaba Group Holding Limited (BABA) as a strong contender in comparison to Amazon.com, Inc. (AMZN). Over the past year, Amazon shares have decreased by 5.6%, trailing behind the Zacks Retail-Wholesale sector’s growth of 3% and the S&P 500’s decline of 2.3%. In contrast, Alibaba’s stock has surged by 45.2%, significantly outperforming both Amazon and the broader market indices.

BABA Stock Surpasses AMZN and Sector Peers

Image Source: Zacks Investment Research

Both Alibaba and Amazon are navigating distinct challenges while investing in crucial sectors such as artificial intelligence, cloud infrastructure, and international market expansion. However, Alibaba stands out due to its favorable valuation, superior price performance over recent months, and ambitious growth plans in AI and cloud computing. These factors position Alibaba for potentially stronger returns as the market evolves.

Conclusion

In the context of global e-commerce and cloud computing, Alibaba emerges as a more attractive investment than Amazon. The company’s robust financial performance, strategic AI initiatives, and efforts to expand internationally provide it with a competitive edge. Moreover, Alibaba’s current valuation suggests greater growth potential compared to Amazon.

Investors looking for exposure to the ongoing digital transformation may find significant upside potential with Alibaba. As of now, Alibaba carries a Zacks Rank #2 (Buy), whereas Amazon has a Zacks Rank #3 (Hold). For a comprehensive overview, you can view the complete list of Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to Access All Zacks’ Buys and Sells

We’re not joking.

Previously, we amazed our members by offering a 30-day trial access to all our investment picks for just $1. There’s no obligation to spend additional amounts.

Many have benefited from this offer, while others hesitated, thinking there might be a catch. The truth is, we want you to explore our portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and others, which have collectively closed 256 positions with double- and triple-digit gains just in 2024.

Interested in the latest recommendations from Zacks Investment Research? You can download our report on the 7 Best Stocks for the Next 30 Days at no cost. Click here for your free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article was originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.