Alibaba and JD Financial Performance: Earnings and Growth Strategies

Alibaba Group (BABA) and JD.com (JD) are major players in China’s e-commerce sector, significantly influencing the digital economy. Alibaba pursues growth in cloud, AI, and international markets, while JD.com capitalizes on its strong supply chain and retail operations. Both companies are also exploring new revenue streams in food delivery and instant commerce to enhance competitiveness.

With China’s economy on the mend and digital spending increasing, investors are eager to see which platform yields more sustainable growth. Below, we analyze their recent earnings and strategic initiatives.

Alibaba’s Growth Trajectory

Alibaba reported $32.81 billion in revenue for Q4 fiscal 2025, reflecting a year-over-year increase of 6.96%. The Taobao and Tmall platforms have improved monetization with a new 0.6% software fee and the introduction of the AI marketing tool Quanzhantui, leading to a 12% rise in customer management revenues.

The 88VIP membership program has successfully attracted over 50 million subscribers, boosting user retention through exclusive benefits across Alibaba’s ecosystem.

Rapid growth in international commerce is evident, with revenue up 22% year-over-year in the last quarter. Efforts to localize supply chains and refine models like AliExpress Choice have improved unit economics and reduced losses.

In AI, Alibaba Cloud revenues increased by 18%, and AI products have achieved triple-digit growth for seven consecutive quarters. The Qwen3 AI model family, launched in April, has been downloaded over 300 million times, enhancing adoption across various industries.

Alibaba is also investing RMB 10 billion in instant commerce initiatives with Taobao Shango and Ele.me, yielding positive early engagement results.

The company is focusing on core segments by divesting non-essential assets like Sun Art and Intime.

JD.com’s Strategic Focus

JD.com reported $41.79 billion in revenue for Q1 2025, a 16.01% increase year-over-year, bolstered by core retail growth. Key categories like electronics and home appliances rose by 17%, while general merchandise grew by 15%. Supermarkets and fashion categories have seen double-digit growth for five quarters.

User engagement continues to rise, driven by AI-powered recommendations, enhanced after-sales services, and personalized delivery options. Active customer growth exceeded 20% year-over-year in the last quarter.

JD’s 3P marketplace is expanding with more merchants and products, yielding 16% growth in marketing and marketplace revenues, particularly appealing to lower-tier markets.

In food delivery, JD is processing nearly 20 million daily orders, onboarding merchants without commission and optimizing its logistics infrastructure to boost efficiency and engagement.

JD Logistics reported an 11% revenue increase due to heightened automation in warehousing and last-mile delivery. Gross profit rose by 20%, while non-GAAP net income surged 43% year-over-year to RMB 12.8 billion.

The company is also investing in AI for ad automation, rural market expansion, and overall user engagement improvements.

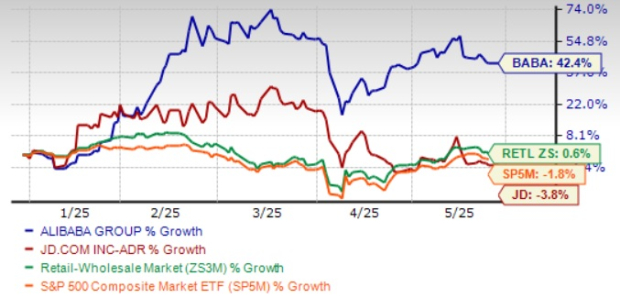

Comparative Stock Performance

Year-to-date, Alibaba shares have risen 42.4%, while JD shares have decreased by 3.8%. Alibaba has outperformed the Zacks Retail-Wholesale sector, which grew by 0.6%, and the S&P 500, which declined by 1.8%. This performance suggests increased investor confidence in Alibaba’s diversified business model despite concerns about China’s economy.

Valuation Insights

Alibaba currently holds a forward P/E ratio of 11.13X, compared to JD’s 7.63X. Although Alibaba’s higher valuation reflects confidence in its growth potential, JD’s lower ratio indicates cautious market sentiment regarding its near-term performance.

Earnings Estimates: A Snapshot

The Zacks Consensus Estimate for BABA’s Q1 fiscal 2026 earnings is $2.48 per share, indicating a 9.73% year-over-year increase and a 4.6% upward revision over the past week. Revenue estimates for the same quarter stand at $34.85 billion, suggesting a 4.13% rise year-over-year.

Alibaba’s Price and Consensus

Alibaba’s price-consensus chart.

For JD, the Q2 2025 earnings estimate is set at 97 cents per share, unchanged over the past week, reflecting a 24.81% year-over-year decline. Revenue is projected at $46.85 billion, indicating a year-over-year increase of 16.85%.

JD’s Price and Consensus

Alibaba Outperforms JD.com Amid Strong Growth

Comparative Growth Analysis

JD.com, Inc. has seen steady growth, but Alibaba is currently the stronger investment choice. Alibaba benefits from significant momentum in cloud services, artificial intelligence (AI), and international e-commerce. Its fourth-quarter fiscal 2025 performance showed an 18% increase in cloud revenues and consistent growth in AI products for the seventh consecutive quarter.

Strategic Developments

Furthermore, Alibaba is expanding instant delivery services with Ele.me and Taobao Shango, enhancing user engagement. Conversely, JD.com faces challenges, particularly in its food delivery segment, which is contributing to losses. Aggressive investments in AI, automation, and logistics are also impacting JD.com’s near-term profitability.

Investment Recommendations

Given Alibaba’s more balanced business and innovative capacity, it offers a more favorable risk-to-reward profile compared to JD.com. Currently, Alibaba has a Zacks Rank of #3 (Hold), while JD.com holds a Zacks Rank of #4 (Sell).

Disclaimer: The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.