Alibaba Group Holding Limited (NYSE:BABA) has experienced a tumultuous 77% decline from its peak three years ago. The stock’s sales, earnings, and net cash pile have continued to grow, but at a slower pace than anticipated. Despite this, the company now offers a 13% free cash flow yield, extending to 22% against its enterprise value due to its impressive net cash position. Notably, the stock’s valuations make it an enormous outlier in the global mega-cap tech space. With $35bn in buybacks scheduled over the next three years, equivalent to almost 20% of the stock’s market cap and almost one-third of its enterprise value, Alibaba no longer needs substantial growth to deliver strong returns to shareholders.

Shifting From Growth Stock To Free Cash Flow King

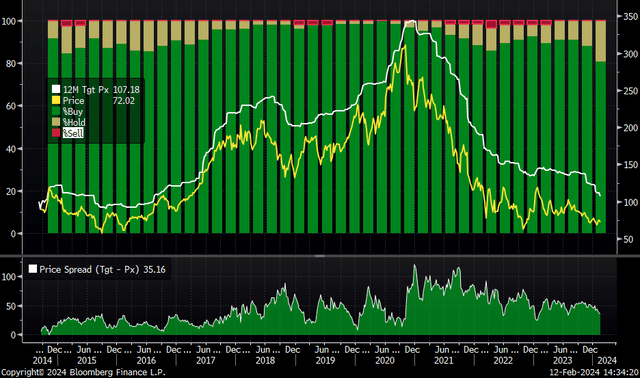

In October 2020, at the peak of its bubble, BABA had a market cap of $839bn, positioning it as one of the largest companies globally, with investors expecting it to grow into its 60x earnings multiple. The subsequent decline in earnings expectations has led to the stock’s dramatic fall from grace. Prior to its peak, the company demonstrated a 5-year CAGR of 44% for sales and 37% for earnings. However, current sales growth expectations for the next 12 months rest at just 7%, while the buy rating percentage has fallen to 81%, the lowest in the stock’s 10-year history.

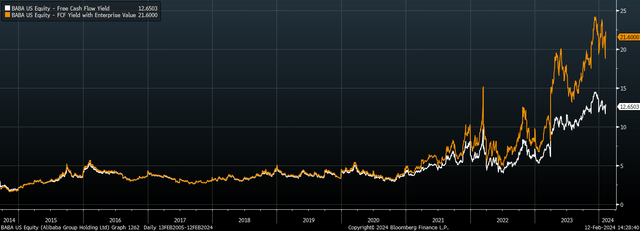

At current valuations, Alibaba does not require substantial growth for shareholders to receive strong returns. With free cash flows of $23.2bn over the past 12 months, the trailing FCF yield stands at an impressive 12.8%, up from 3.0% in 2020. Furthermore, BABA’s net cash pile has continued to swell, now reaching $76bn, resulting in a 21.8% yield when measured against its enterprise value.

It’s important to note that Alibaba’s stock-based compensation is exceptionally high, representing around 25% of free cash flow in recent years. Although this may inflate the company’s sustainable cash-generating ability, and dampen returns during market rallies, management has committed to utilizing these cheap valuations to return cash to shareholders. Announcement of an additional $25bn in buybacks following its recent earnings results brings the total allotted to its share repurchase program through the end of March 2027 to $35.3bn. Even with the assumption that stock-based compensation maintains its current pace and results in $15bn in share issuance over this period, the share count would still drop by around 11%, elevating per-share earnings and free cash flows by over 12%, even assuming no growth in the nominal figures. This significant buyback commitment should provide a price floor even if earnings and free cash flows remain stagnant in the coming years.

Uniquely Undervalued In The Mega Cap Tech Space

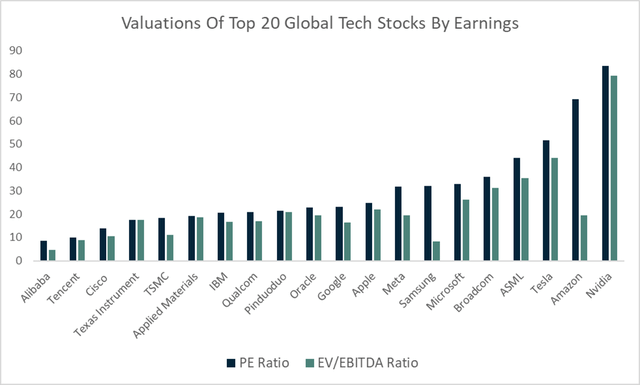

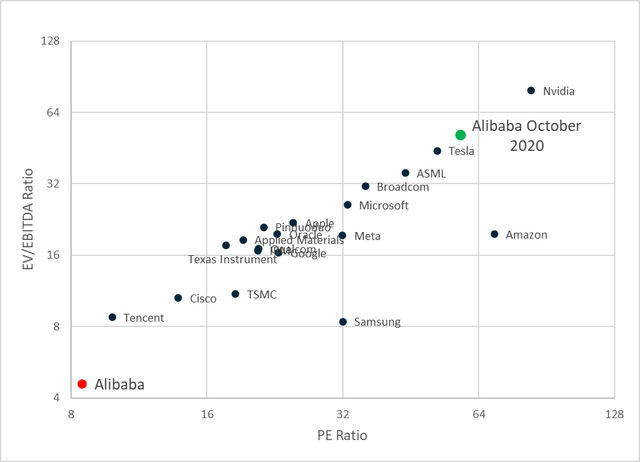

Alibaba’s PE ratios and EV/EBITDA ratios, when compared against the top 20 largest tech stocks globally, reflect a stark outlier, trading at approximately one third of the median PE for this group and one quarter of the median EV/EBITDA. While a China discount is possibly warranted due to regulatory risks, these risks were also evident three years ago when Alibaba was one of the most expensive tech stocks globally.

A scatter plot featuring the same data and Alibaba’s valuations at its October 2020 peak showcases Alibaba’s monumental shift from being one of the most expensive in this group to the cheapest in just over three years.

Possible Upside Momentum Above $78

Any positive sign on the growth front could trigger a significant upside reversal for Alibaba, given the subdued sentiment towards Chinese stocks. Recently, the market has witnessed a surge in call option buying, indicating that any upside momentum in Chinese stocks could prompt a substantial wave of forced buying by option sellers, resulting in a price spike. A move back above the pre-earnings peak of $78.34 would be an exceptionally bullish sign, marking a key pivot area for the stock as well as downtrend line resistance from the August 2023 highs.

In Conclusion

Alibaba’s stock price has undergone a historic de-rating over the past three years, with its trailing free cash flows now constituting 22% of its enterprise value, indicative of investors discounting any prospect of growth. Even if growth stagnates, the substantial cash pile and dedication to buybacks should enable the stock to yield strong returns over the coming years. With widespread bearish sentiment towards Chinese stocks, any upward momentum in Alibaba could be self-fulfilling, with $78 marking a key area to watch.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.