“`html

Alibaba’s International Digital Commerce (AIDC) segment reported a 19% year-over-year revenue growth in Q1 of fiscal 2026, indicating a promising shift toward profitability. The segment, driven by platforms like AliExpress and Trendyol, has significantly narrowed its adjusted EBITDA losses, signaling that breakeven is within reach.

As part of its growth strategy, AIDC is expanding its presence in Europe, Russia, and Latin America, utilizing improved logistics and AI-driven merchant tools. Despite the challenges posed by rising competition from rivals like Amazon and PDD Holdings, AIDC is expected to maintain its upward trajectory with projected revenue growth rates of 4.38% in fiscal 2026 and 11% in fiscal 2027.

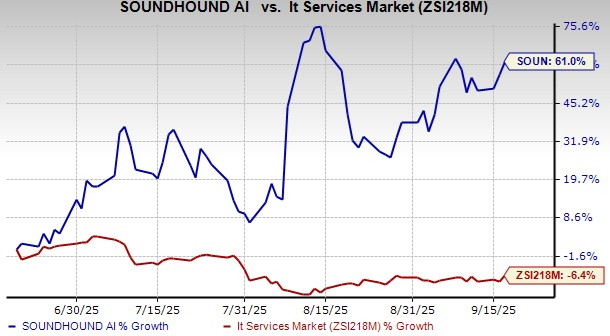

As of 2023, Alibaba’s shares have surged 96.5% year-to-date, outperforming the Zacks Internet – Commerce industry and the Retail-Wholesale sector, which grew by 15.4% and 10.8%, respectively. The Zacks Consensus Estimate for Alibaba’s fiscal 2026 earnings stands at $8.09 per share, reflecting a 10.21% year-over-year decline.

“`