Align Technology’s ALGN robust product line, balanced growth across all channels and consistent focus on international markets to drive growth bolster our confidence in the stock. The stock carries a Zacks Rank #2 (Buy) currently.

Align Technology is strategically capturing the growing malocclusion market, one of the most prevalent clinical dental conditions in the world. According to Align Technology’s 2023 data, malocclusion currently affects approximately 60% to 75% of the global population. The company estimates that there are approximately 500 million people globally with malocclusion.

In the first quarter of 2024, among major milestones in Align Technology’s business, the company acquired Cubicure, a leader in direct 3D printing solutions. This acquisition is the foundation for the company’s next-generation aligner manufacturing. The company also launched the iTero Lumina intraoral scanner, its next generation of digital scanning technology and the Invisalign Palatal Expander system in the United States and Canada. It also received regulatory approval for the Invisalign Palatal Expander in Australia and New Zealand.

Align Technology is expanding its sales and marketing by reaching new countries and regions, including new areas within Africa and Latin America. Among the recent international updates, effective Jan 1, 2024, the company announced about a 5% global price increase for some Invisalign products across most markets. Invisalign Comprehensive Three and Three product is currently available in North America and in certain markets in EMEA and APAC. It was recently launched in France and in the Middle East.

Further, Align Technology’s slew of strategic alliances looks impressive. The company has well-established relationships with many dental service organizations, especially in the United States, and is continuously exploring collaborations with others that drive the adoption of digital dentistry.

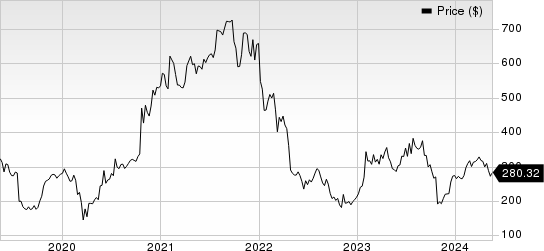

Align Technology, Inc. Price

Align Technology, Inc. price | Align Technology, Inc. Quote

In the United States, Align Technology is focused on reaching young adults as well as teens and their parents through famous athletes, influencers and fashion designers. According to the company, these partnerships are creating a compelling brand activation for Align Technology.

On the flip side, the ongoing industry-wide trend of staffing shortages and supply chain-related hazards is denting growth. Deteriorating international trade has resulted in a tough situation related to raw material and labor costs as well as freight charges. These, along with higher interest rates, have put the dental treatment space (which is highly elective) in a tight spot.

Added to this, Align Technology is also concerned about the military conflict between Russia and Ukraine that is likely to continue. Further, the company anticipates increasing headwinds from macroeconomic uncertainty and potential supply issues related to the war in the Middle East in the upcoming period.

Other Key Picks

Some other top-ranked stocks from the broader medical space are Medpace MEDP, ResMed RMD and Encompass Health Corporation EHC.

Medpace, sporting a Zacks Rank #1 (Strong Buy), reported first-quarter 2024 EPS of $3.20, which beat the Zacks Consensus Estimate by 30.6%. Revenues of $511 million improved 17.7% from last year’s comparable figure. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace has an estimated 2024 earnings growth rate of 26.5% compared with the industry’s 12.3%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 12.8%.

ResMed, carrying a Zacks Rank #2, reported first-quarter 2024 EPS of $2.13, which topped the Zacks Consensus Estimate by 10.9%. Revenues of $1.20 billion surpassed the Zacks Consensus Estimate by 1.9%.

RMD has an estimated fiscal 2024 earnings growth rate of 17.9% compared to the industry’s 15.7%. The company delivered an average four-quarter earnings surprise of 2.8%.

Encompass Health, carrying a Zacks Rank #2, reported a first-quarter 2024 adjusted EPS of $1.12, which surpassed the Zacks Consensus Estimate by 20.4%. Net operating revenues of $1.3 billion topped the Zacks Consensus Estimate by 3.6%.

EHC has an estimated long-term earnings growth rate of 15.6% compared with the industry’s 11.7% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 18.7%.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.