Alliance Global Partners Issues Buy Rating for Global Self Storage

On October 18, 2024, Alliance Global Partners began tracking Global Self Storage (NasdaqCM:SELF) with a Buy recommendation.

Analysts Predict Strong Growth Ahead

As of June 2, 2023, analysts have set an average one-year price target for Global Self Storage at $7.14 per share, with estimates ranging from $7.07 to $7.35. This target indicates a potential increase of 40.83% from its recent closing price of $5.07 per share.

Institutional Interest in Global Self Storage

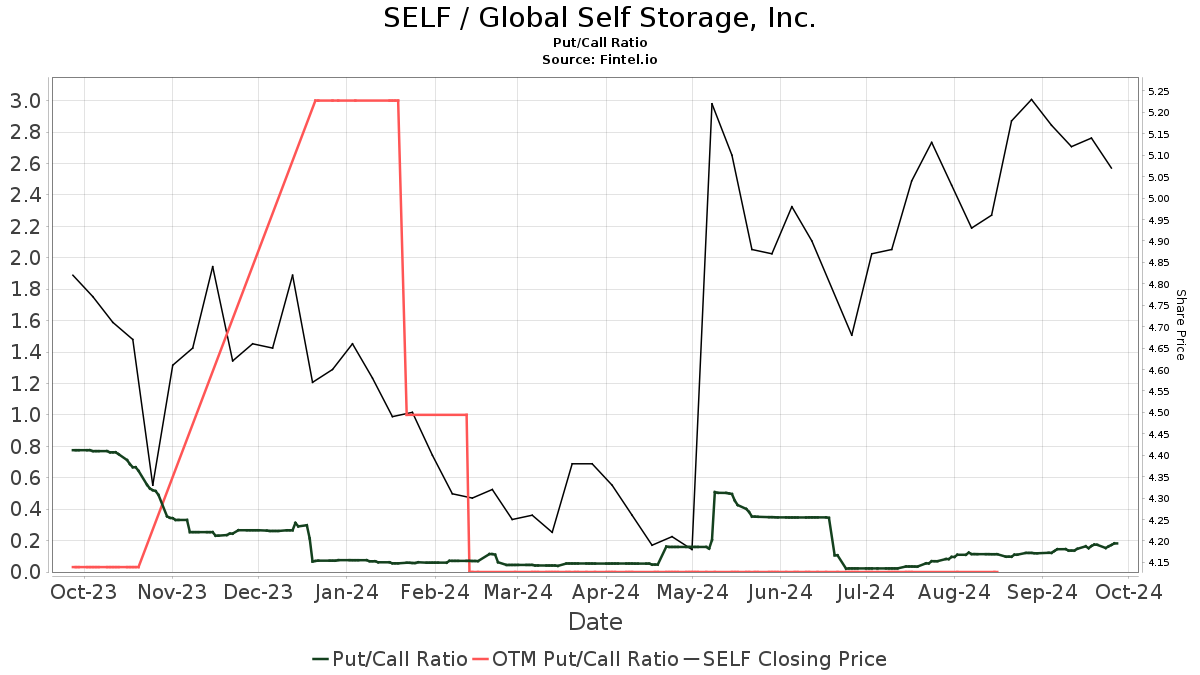

A total of 64 funds have reported their positions in Global Self Storage, reflecting a gain of 2 new owners or 3.23% since the last quarter. The average portfolio weight dedicated to SELF by these funds is 0.11%, marking a significant increase of 54.76%. Over the past three months, institutional shares ownership has risen by 29.44%, totaling 4,243,000 shares. The current put/call ratio of 0.21 suggests a bullish sentiment amongst investors.

Institutional Shareholders’ Actions

Northwest Capital Management owns 909,000 shares, equating to 8.07% of the company.

Bard Associates has 665,000 shares, holding 5.90% of ownership. While they were previously reported at 671,000 shares, this indicates a minor decrease of 0.80%. However, their allocation to SELF has seen a growth of 15.31% over the last quarter.

Winmill & Co. holds steady with 440,000 shares, marking a 3.90% ownership with no change in the last quarter.

Marathon Capital Management increased its holdings slightly to 370,000 shares, representing 3.28% ownership, up from 368,000 shares — an increase of 0.46%. This firm increased its portfolio allocation in SELF by 17.17% recently.

The Vanguard Total Stock Market Index Fund Investor Shares has retained 320,000 shares, representing a 2.84% stake in the company, without any changes in the last quarter.

Overview of Global Self Storage

(Information courtesy of the company.)

Global Self Storage is a self-administered and self-managed Real Estate Investment Trust (REIT). It specializes in owning, operating, managing, acquiring, and redeveloping self-storage properties tailored for residential and commercial customers. The company operates 13 self-storage facilities across various states including Connecticut, Illinois, Indiana, New York, Ohio, Pennsylvania, South Carolina, and Oklahoma.

Fintel provides extensive investment research tools for individual investors, financial advisors, and small hedge funds.

Our comprehensive data encompasses fundamental analysis, ownership insights, fund sentiment, options trading, and more. Additionally, we offer exclusive stock recommendations based on advanced quantitative models.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.