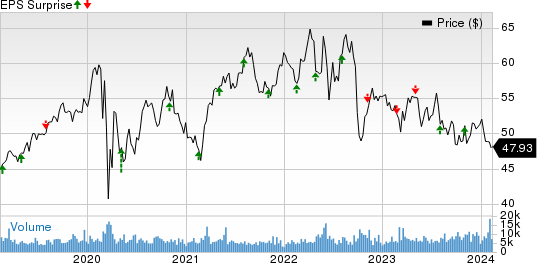

Alliant Energy LNT is gearing up to unveil its fourth-quarter 2023 financial results after the market closes on Feb 15. This eagerly-anticipated announcement follows a previous quarter that saw the company spring a positive earnings surprise of 14.13%.

Let’s delve into the factors likely to influence the upcoming quarterly results.

The Big Picture

The company’s fourth-quarter earnings are anticipated to have benefited from its capital expenditure and financing strategies, alongside reduced operating and maintenance expenses. Alliant Energy foresees robust earnings growth from its investments in solar projects in Wisconsin and Iowa, which may have significantly bolstered its performance in the fourth quarter.

However, possible spikes in interest and depreciation costs might have dampened some of the positivity during the quarter under review.

Expectations

The Zacks Consensus Estimate for LNT’s earnings stands at 55 cents per share, implying a substantial year-over-year upswing of 19.57%. Furthermore, the Zacks Consensus Estimate for the company’s fourth-quarter sales is pegged at $1.25 billion, indicating a noteworthy 18.15% surge from the figures reported a year ago.

Insight into Quantitative Model Predictions

Our tried-and-true model remains non-committal about an impending earnings beat for LNT this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) enhances the prospects of an earnings beat. This, unfortunately, is not the case. In fact, the details reveal otherwise.

An Eye on Other Options

Investors might find promise in several other players within the same sector which demonstrate the right mix of elements to outdo earnings forecasts in the subsequent releases.

Dominion D might deliver an earnings triumph when it unveils its fourth-quarter 2023 financials on Feb 22 before the market opens. Armed with an Earnings ESP of +0.63% and a current Zacks Rank of 3, the prospect seems promising.

AES AES is also vying for an earnings beat when it reports its fourth-quarter 2023 earnings on Feb 26 after the market closes. Bolstered by an Earnings ESP of +0.36% and a Zacks Rank of 3, it appears to be in a strong position.

Sempra Energy SRE is expected to announce an earnings beat when it releases its fourth-quarter financials on Feb 27 before the market opens. It boasts an Earnings ESP of +1.18% and a Zacks Rank of 3 at the moment.

It’s crucial to stay updated on forthcoming earnings disclosures via the Zacks Earnings Calendar.

Looking for the Next Big Investment Opportunity?

Discover our Top 10 Stocks for 2024, meticulously curated by Zacks Director of Research, Sheraz Mian. This dynamic portfolio has consistently and impressively outperformed. From its inception in 2012 through November 2023, the Zacks Top 10 Stocks soared to a remarkable +974.1%, almost tripling the S&P 500’s +340.1%. With a meticulous examination of the 4,400 companies featured by the Zacks Rank, Sheraz cherry-picked the top 10 stocks to seize and hold in 2024. Secure your privileged glimpse of these newly-released stocks with boundless potential.

Interested in Zacks Investment Research’s Latest Recommendations?

The opinions voiced in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.