Alpha Metallurgical Resources AMR is scheduled to report first-quarter 2024 results, before the opening bell, on May 6.

Q1 Estimates

The Zacks Consensus Estimate for AMR’s first-quarter sales is pegged at $843 million, suggesting a 7.5% fall from the prior-year quarter’s reported figure. The consensus mark for earnings is pegged at $9.61 per share, indicating a year-over-year slump of 43.5%. Earnings estimates have moved up 12% in the past 30 days.

Q4 Performance

In the last reported quarter, Alpha Metallurgical witnessed a year-over-year decline in earnings despite higher revenues. The company beat the Zacks Consensus Estimate for both metrics. AMR has an average trailing four-quarter earnings surprise of 24.8%.

Alpha Metallurgical Resources, Inc. Price and EPS Surprise

Alpha Metallurgical Resources, Inc. price-eps-surprise | Alpha Metallurgical Resources, Inc. Quote

Factors to Note

In March 2024, the Institute for Supply Management’s manufacturing index was 50.3%, the first expansion in 16 months. Despite this uptick, the index averaged 49% for the January-March quarter. Per the Federal Reserve’s report, industrial production rebounded 0.4% in February and March 2024, following a 0.8% dip in January. However, the overall performance for the first quarter of 2024 reflected a decline at an annual rate of 1.8%

As compiled by the World Steel Association, crude steel production inched up a meager 0.5% to 469.1 Mt in the first quarter of 2024 from the year-ago quarter. China, the largest steel-producing country, produced 257 million metric tons in the period, 1.9% less than the output in Jan-March 2023. The next largest producer, India, however, posted an increase of 9.7% year over year to 37.3 Mt. Crude steel production in the United States was 19.9 Mt in the quarter, a 1.6% decline year over year.

This indicates that AMR is likely to have witnessed lower demand for metallurgical coal, which is an essential ingredient in the production of steel.

Alpha Metallurgical expects metallurgical coal shipments in 2024 to be between 15.5 million tons and 16.5 million tons. The company had sold 16.5 million tons of metallurgical coal in 2023. Thermal coal shipments are projected in the range of 0.9 million tons to 1.3 million tons compared with 0.5 million tons sold in 2023.

Metallurgical coal accounts for approximately 95% of the company’s coal revenues. The projected guidance indicates a year-over-year decline in metallurgical coal sales. The company’s first-quarter shipments are expected to have been lower on a year-over-year basis per this guidance, backed by the overall weak demand scenario witnessed through the quarter.

In the first quarter of 2023, AMR had sold 3.7 million tons of metallurgical coal at an average realized price of $208.93 per ton, leading to metallurgical coal revenues of $887 million. Coal revenues in all other categories were around $20 million, reflecting 0.18 million tons sold at a realized price of $109.36 per ton. Total coal revenues were $907 million, which was based on total sales of 3.9 million tons at an average realized price of $204.40.

The company has been witnessing higher costs of coal sales as a result of the ongoing inflationary pressure and increased levels of coal purchases and transportation costs. Also, labor costs have increased due to new agreements. This headwinds are expected to have hurt its margins.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Alpha Metallurgical this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Earnings ESP: Alpha Metallurgical has an Earnings ESP of 0.00%.

Zacks Rank: The company currently carries a Zacks Rank #5 (Strong Sell).

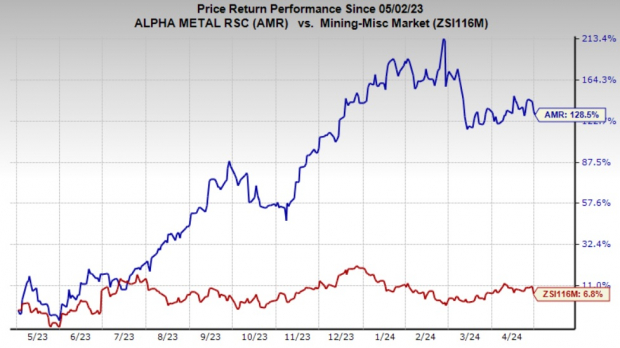

Price Performance

Shares of Alpha Metallurgical have soared 128.5% in the past year compared with the industry‘s 6.8% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter:

Innospec Inc. IOSP, scheduled to release earnings on May 9, has an Earnings ESP of +2.44% and a current Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for IOSP’s earnings for the first quarter is currently pegged at $1.64 per share. The estimate projects growth of 18.8% from the year-ago quarter.

Kinross Gold Corporation KGC, slated to release earnings on May 7, has an Earnings ESP of +4.49% and a Zacks Rank of 3, at present.

The Zacks Consensus Estimate for KGC’s first-quarter earnings is currently pegged at 6 cents per share, indicating a 14.3% year-over-year decline.

Avient AVNT, scheduled to release first-quarter earnings on May 7, has an Earnings ESP of +0.43%.

The Zacks Consensus Estimate for AVNT’s earnings is currently pegged at 69 cents per share, suggesting year-over-year growth of 9.5%. AVNT currently carries a Zacks Rank of 2.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.2% per year. So be sure to give these hand picked 7 your immediate attention.

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.