“`html

Alphabet Inc. Poised for Earnings Release: Strong Growth Prospects Ahead

Internet search engine behemoth Alphabet Inc. (GOOGL) will announce its fourth-quarter 2024 earnings results on February 4, 2025, after the market closes. Currently, GOOGL holds a Zacks Rank #3 (Hold) with a positive Earnings ESP of 5.96%. For perspective, stocks rated Zacks Rank #3 or better (Rank #1 or 2) with a positive Earnings ESP have a 70% chance of exceeding earnings expectations. Stocks with this combination often appreciate following their earnings announcements.

Key Growth Factors for Alphabet

Alphabet is benefiting from solid growth in its cloud and search divisions. Google Cloud has seen rapid expansion, driven by advancements in AI infrastructure, including its enterprise AI platform, Vertex, and generative AI (Gen AI) solutions. GOOGL’s robust AI offerings help attract new customers, secure larger contracts, and encourage deeper use of its products.

In the crowded cloud infrastructure market, Google Cloud stands as the third-largest player, trailing only behind Amazon.com Inc.‘s (AMZN) Amazon Web Services and Microsoft Corp.‘s (MSFT) Azure.

The company’s expanding GenAI capabilities could catalyze further growth. GOOGL maintains a significant lead in the search engine sector, benefiting from updates that enhance search quality and reduce misleading advertisements, which in turn increases user traffic.

With innovative AI solutions, GOOGL is meeting growing demand. They offer various AI accelerator options that include multiple types of NVIDIA Corp. (NVDA) GPUs and custom TPUs.

Additionally, GOOGL’s advancements with its AI model, Gemini, are noteworthy. Gemini powers Google Bard and the Search Generative Experience, enhancing user interactions. Google Cloud’s Duet AI further provides AI agents that facilitate software development tasks.

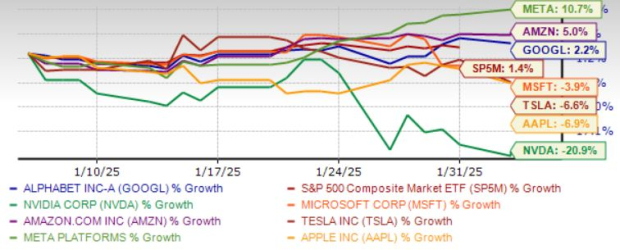

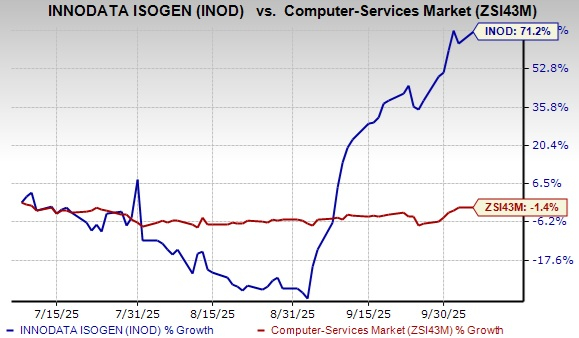

The chart below compares GOOGL’s price performance against other “Magnificent 7” stocks over the past month.

Image Source: Zacks Investment Research

Earnings Estimates for GOOGL

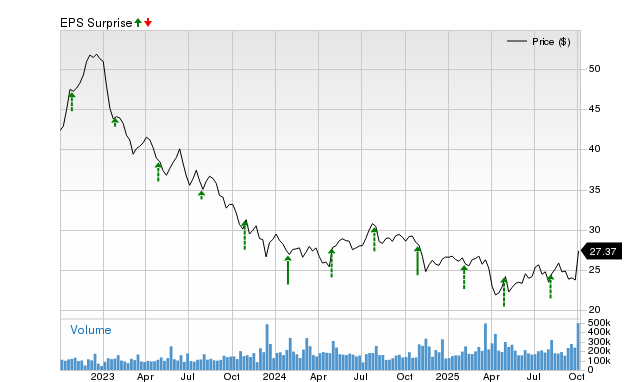

For the fourth quarter of 2024, the Zacks Consensus Estimate indicates revenues of $81.38 billion, a 12.5% year-over-year increase. Earnings per share (EPS) are projected to be $2.12, showing a 29.3% increase year-over-year. GOOGL has consistently surpassed earnings expectations for seven consecutive quarters.

Estimates for 2024 now suggest a year-over-year revenue increase of 16.6% and EPS growth of 38.3%. Moreover, forecasts for 2025 also reflect a potential upside of 12% in revenues and 11.3% in EPS.

Over the past month, the Zacks Consensus Estimate for 2025 earnings has increased by 0.1%. GOOGL is projected to have a long-term EPS growth rate of 17.3%, surpassing the S&P 500’s growth rate of 12.4%.

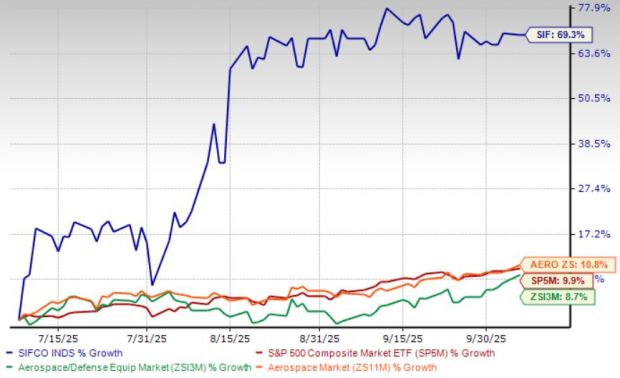

Image Source: Zacks Investment Research

GOOGL’s Attractive Valuation

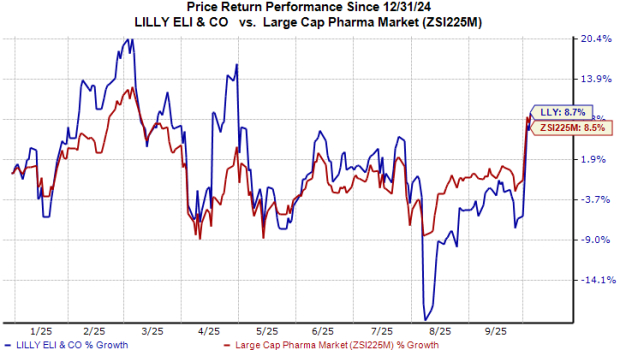

Currently, Alphabet’s forward P/E ratio stands at 22.84X for the fiscal year, compared to 24.50X for the industry average and 18.26X for the S&P 500. GOOGL registers a return on equity of 31.66%, contrasting with the industry’s -0.75% and the S&P 500 Index’s 16.89%. Presently, GOOGL has the lowest forward P/E among the “Magnificent 7” stocks.

Brokerage firms’ short-term price target average suggests a 6.6% rise from GOOGL’s previous closing price of $201.23, with target prices ranging from $185 to $240. This offers a maximum upside of 19.4% and a possible downside of 8%.

Image Source: Zacks Investment Research

Top Stock Pick Identified by Research Chief

From a pool of thousands of stocks, five Zacks experts have handpicked their favorites expected to rise by 100% or more in the coming months. Among them, the Director of Research Sheraz Mian has selected one stock predicted to have the most significant upside.

This particular company targets millennial and Gen Z audiences, earning nearly $1 billion in revenue last quarter. A recent drop in shares may present a favorable buying opportunity. Although not every elite pick pan out, this stock could outperform previous Zacks Stock Set to Double, like Nano-X Imaging, which surged by 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Runners-Up

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Read this article on Zacks.com

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`