Alphabet Inc (GOOG, GOOGL) demonstrated a solid performance in the last quarter, boasting higher revenue and margins. Consequently, some investors view GOOGL stock as inexpensive and an appealing option for short-put sellers looking for income.

In a previous Barchart article dated Feb. 2, “Alphabet Stock Drops as Its Free Cash Flow Dips, But GOOGL Could Be Cheap Here,” the stock stood at $140.63. It closed at $140.52 on Feb. 16, maintaining its level.

The discussion involved selling short the $135 strike price put options expiring on Feb. 23, which were then trading at $1.01 per put. Today, these put options are priced at 30 cents, indicating that this strategy continues to be profitable, warranting a rollover.

Now, let’s delve into the reasons why GOOGL stock is considered cheap at this juncture.

Alphabet’s Strong Free Cash Flow

Alphabet’s Q4 2023 results released on Jan. 30, 2024, reported a 13% year-over-year rise in revenue and a 9% year-over-year increase in full-year revenue. Furthermore, its operating margins saw a boost, climbing from 24% in Q4 2022 to 27% in Q4 2023.

The company also exhibited robust free cash flow (FCF), generating $69.5 billion in 2023, translating to an average FCF margin of 22.6% based on its $307.3 billion revenue. Extrapolating from analysts’ estimates ($342.4 billion in revenue for 2024), it could result in $75.3 billion in FCF for 2024, factoring in a consistent average FCF margin of 22% throughout the year.

Applying a 3.3% FCF yield metric suggests that the stock could ascend to a market value of $2.259 trillion, 29% higher than the current market value of $1.75 trillion. This implies that GOOGL stock is undervalued by 29%, positioning the price target at 181.27 per share.

One strategy for existing shareholders to capitalize on this disparity is to engage in short-selling out-of-the-money (OTM) put options in nearby expiry periods.

Selling OTM Puts in GOOGL Stock for Income

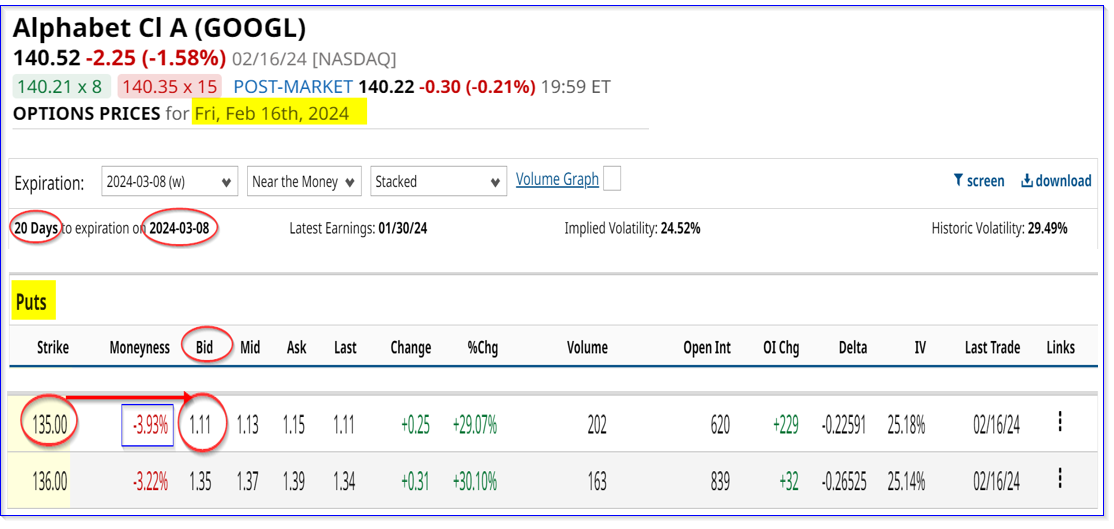

For instance, considering the March 8 expiration period for GOOGL stock, which is three weeks away, the $135 strike price puts, approximately 4% below the current price, are trading at $1.11 on the bid side, translating to an immediate yield of 0.82% for the short seller of these puts.

Assuming the investor secures $13,500 in cash and/or margin with their brokerage firm, “Selling to Open” 1 put contract at the $135 strike price for expiration on March 8 would immediately yield $111, accumulating to $444 if repeated 4 times during a quarter. This represents an expected return of 3.29% on the $13,500 invested.

In sum, GOOGL stock appears to be undervalued. One viable path to generate income during this phase is to sell short out-of-the-money puts.

More Stock Market News from Barchart

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.