Altimeter founder and CEO Brad Gerstner believes a bet on Elon Musk is a “no-brainer”

Source: Vitaliy Karimov / Shutterstock.com

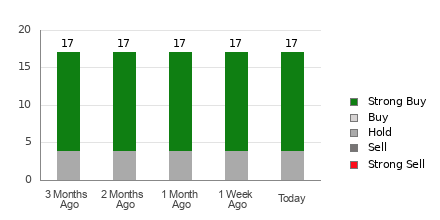

Altimeter Capital, a hedge fund run by Brad Gerstner, operates using a highly concentrated investment strategy. Its first-quarter 13F filing, submitted on May 15, revealed assets under management of $6.50 billion split across just 17 positions.

Electric vehicle (EV) leader Tesla (NASDAQ:TSLA) just happens to be one of those positions. Altimeter first purchased TSLA stock in Q3 of 2022 before completely selling out the next quarter. In Q4 of 2023, the hedge fund bought back in with a 156,670 share stake. In Q1, Altimeter tacked on another 433,030 shares, making the company its ninth-largest holding with a 1.59% portfolio allocation. It owns a total of 589,700 shares.

In addition, the hedge fund’s average 13F holding period is 6.71 quarters, compared to 10 quarters for the top 10 positions. The long holding period makes Altimeter an ideal hedge fund to track, as 13F positions are reported with a 45-day lag.

TSLA Stock: Altimeter Increases Stake by 276%

Back in March, Gerstner stated that he had a “ChatGPT moment” after trying out Tesla’s Full Self-Driving (FSD) feature:

“When I took a test drive in it, it was kind of a ChatGPT moment. (Tesla) totally scrapped their prior deterministic models and moved to an imitation learning model that really, for the first time, unlike Waymo — which is still a deterministic model — feels like a human driving the car.”

Gerstner added that Tesla’s FSD provides it with an advantage over other autonomous driving systems due to its large user base that continually provides Tesla with new data. He also conveyed his support for Tesla CEO Elon Musk, characterizing a bet on Musk as a “no-brainer.”

Gerstner wasn’t always a Tesla bull. Back in 2017, he bet 0.16% of his 13F portfolio on TSLA puts. That allocation increased to 0.27% by Q3 of 2018 before he completely sold out of the puts in Q4 of 2018. In a previous interview, Gerstner noted that he was bearish on Tesla in 2019 and 2020 due to bankruptcy and undercapitalization concerns.

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.