“`html

Altimeter Capital, led by CEO Brad Gerstner, recently updated its portfolio with significant shifts in its AI investments. The hedge fund reduced its stake in Nvidia and completely divested from Micron and Taiwan Semiconductor Manufacturing in the first quarter of 2023. Notably, Altimeter holds approximately 2,999,536 shares of AI IPO CoreWeave (NASDAQ: CRWV), valued at around $489 million as of June 4, 2023.

Nvidia currently dominates over 90% of the data center GPU market, but risks from major clients developing alternative AI chips and geopolitical tensions may impact its growth. Micron and TSMC also face challenges as market maturity and changing demand dynamics could affect their businesses. In contrast, CoreWeave provides cloud computing infrastructure with rapid scalability, positioning it as potentially more agile than established chip manufacturers.

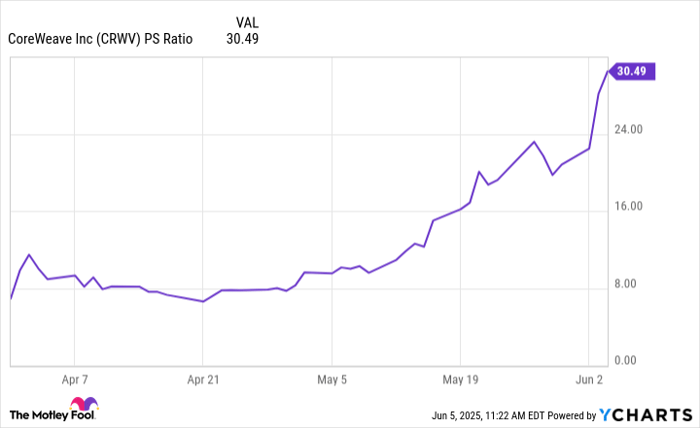

As of its IPO earlier this year, CoreWeave’s price-to-sales ratio has increased significantly, suggesting strong momentum but raising concerns about valuation, especially compared to mature companies like Oracle. Investors are advised to be cautious given these dynamics.

“`