Performance: A Closer Look at the Profitability and Momentum

Amazon.com, Inc. (NASDAQ:AMZN) shares have experienced an impressive 110.38% surge over the past five years, outshining the S&P 500 by approximately 28.4%. This remarkable performance is indicative of its robust and improving financials. An innovative corporate culture ensures the company remains resilient to changing consumer needs, enhancing the overall customer experience. From a technical perspective, the upward trajectory is compelling, thus warranting a favorable “buy” rating for this corporation.

Technical Indicators

To further dissect these price movements, a closer examination of technical indicators reveals several noteworthy patterns. The stock has demonstrated a strong support level at approximately $80.46 and a formidable resistance zone near $187.62. Since January 2023, the stock has consistently rebounded from the support level, propelling a robust upward trajectory, accentuated by the bullish trend line. This trend is anticipated to persist until the price nears the resistance zone, potentially prompting a reversal or a breakout, contingent on market sentiments and growth catalysts.

Financials: The Stunning Financial Performance

Over the past decade, Amazon encountered challenges in converting revenues to profits. Nonetheless, a strategic emphasis on growth initiatives culminated in profitability, marking 2017 as the pivotal breakeven year. Following a tough 2022, characterized by a decline in net income to about $2.7 billion, the company has exhibited a commendable resurgence in both its top and bottom line.

Of particular interest is the most recent quarterly (MRQ) performance, underscoring the robust financial standing. Notably, net sales soared to $169.96 billion, representing a 14% year-over-year growth. Operating income also witnessed an astronomical 383% surge year-over-year, reaching $13.2 billion. Furthermore, the company’s net income ballooned from $278 million in Q4 2022 to a staggering $10.6 billion in Q4 2023.

Relative to industry medians, Amazon has surpassed growth and profitability metrics by over 100%, positioning itself as a formidable contender for growth-focused investors. In the profitability realm, the company has significantly outperformed sector medians across various measures, culminating in an overall “A+” grade in profitability according to Seeking Alpha.

Undoubtedly, Amazon’s stellar performance, both in absolute terms and relative to industry benchmarks, underscores its intrinsic appeal to investors seeking growth and profitability.

Critical Evaluation

Given this exceptional performance, a critical evaluation of the company’s strategies and initiatives is imperative to substantiate its sustainability.

The Amazon Phenomenon: A Closer Look at its Innovations and Customer Commitment

Adapting to Dynamic Consumer Needs

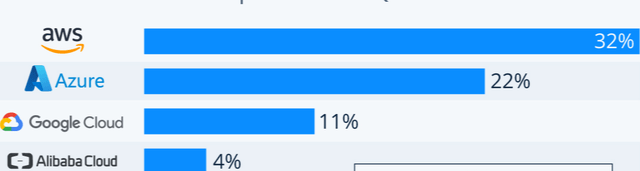

Amazon, the world’s leading online retailer with over 300 million users, has not only achieved its strong growth and performance due to its exceptional Amazon Web Services and e-commerce dominance but also due to its relentless innovation to meet emerging consumer trends.

The company’s significant presence in the online grocery market, second only to Walmart, and the invention of Amazon One and Lambda reflect a keen investment in high-growth market segments, indicating a strategic response to dynamic consumer needs.

The deployment of Amazon One, a biometric payment system, aligns with the contactless payment trends, while Lambda, a serverless computing service, capitalizes on the projected growth of the global serverless market share, validating Amazon’s agility in responding to consumer demands.

Enhancing Customer Experience

Amazon’s commitment to improving customer experience is exemplified by its remarkable delivery time and healthcare initiatives for Prime members, catering to the health and wellness of its customers, in addition to unparalleled convenience and reliability in their delivery services.

Investment Outlook

Amazon’s innovative culture and dedication to enhancing customer experience position the company for sustainable long-term performance, making it an attractive proposition for momentum, growth, and profit-oriented investors.

However, potential investors should be mindful of the increasing competition from other e-commerce companies, particularly in the online grocery business, where Amazon faces stiff competition, notably from Walmart. While Amazon’s diverse portfolio may mitigate the effects of such competition, vigilance is crucial.