U.S. Black Friday: E-Commerce Excels While Brick-and-Mortar Struggles

Black Friday shopping trends indicate a clear shift towards online purchases, leaving traditional stores to grapple with stagnant sales.

According to Mastercard SpendingPulse, physical store sales grew only 0.7% from the previous year, while online sales soared by 14.6%. This data highlights e-commerce’s expanding influence during the holiday season, as reported by Reuters.

Additionally: Amazon Increases Workforce in China to Compete with Temu: Report

Adobe Inc. reported that U.S. shoppers spent $10.8 billion online this past Black Friday, marking a 10.2% increase compared to last year. An impressive 1,800% rise in retail website visits was attributed to generative AI chatbots enhancing consumer interactions, as stated in a report by Barron’s.

The most popular online products included makeup, Bluetooth speakers, and espresso machines, showcasing a wider range of consumer interests.

Salesforce, after analyzing data from over 1.5 billion global shoppers, indicated a 7% rise in U.S. online spending, amounting to $17.5 billion. Home appliances and furniture were particularly favored by online buyers.

In contrast, traditional retailers faced challenges, with Facteus recording a 5.4% drop in in-store sales. This figure deepens to an 8% decrease when factoring in inflation, illustrating the hurdles that physical stores continue to encounter.

Major retailers like Target Corp TGT and Best Buy Co Inc BBY reported flat sales year-over-year on Black Friday, reinforcing the trend towards online shopping.

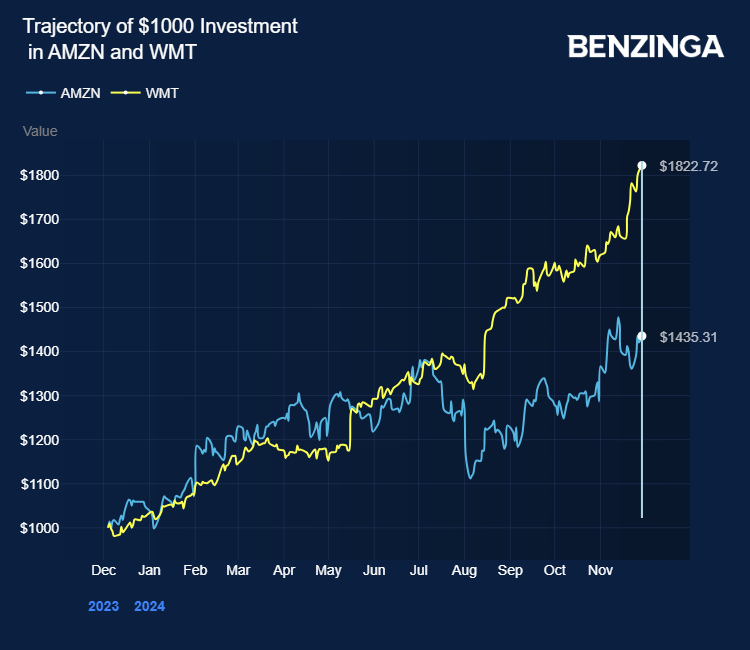

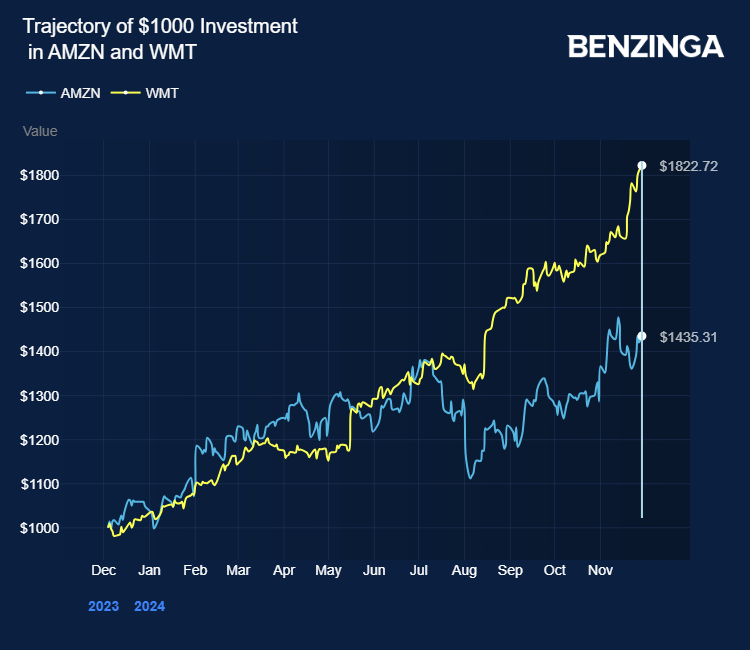

Retail giants such as Amazon.com Inc AMZN and Walmart Inc WMT saw increased demand online. Walmart’s strategy to enhance store-to-home delivery for online customers has proven successful in capturing this market. Newer platforms like TikTok Shop and PDD Holdings Inc PDD Temu also experienced notable sales growth during the holiday shopping period.

For the second year in a row, Amazon has prioritized Black Friday over Cyber Monday, a move that Deepwater Asset Management’s Gene Munster believes has proven effective. This approach fits well with Amazon’s tradition of creating special sales events, such as Prime Day.

Munster notes that the retail sector has seen notable improvements, with Amazon’s paid units rising from 8% in December 2022 to 12% in September 2024. He also estimates that retail operating margins have improved from -3% two years ago to 5% last quarter, with a potential rise to 7% in 2025. This could increase earnings per share (EPS) to $7.15.

Reflecting the growing demand, Amazon announced plans to hire 250,000 seasonal workers in the U.S. for the holiday season, while Target plans to add 100,000 temporary employees. In 2023, Amazon’s U.S. Cyber Monday sales reached $12.4 billion, a 9.6% increase that surpassed the $12 billion forecast. Cyber Week total online sales hit $38 billion, exceeding the $37.2 billion estimate.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs