The Upward Climb

Analysts have raised Amazon.com’s (NasdaqGS:AMZN) one-year price target to 209.14 per share, marking a substantial 12.63% increase from the previous projection of 185.68 dated January 16, 2024.

This enhanced target, crafted by amalgamating numerous analysts’ estimates, varies from a low of 161.60 to a high of 241.50 per share, embodying a 19.80% surge from the recent closing price of 174.58 per share.

Fundamentals in Focus

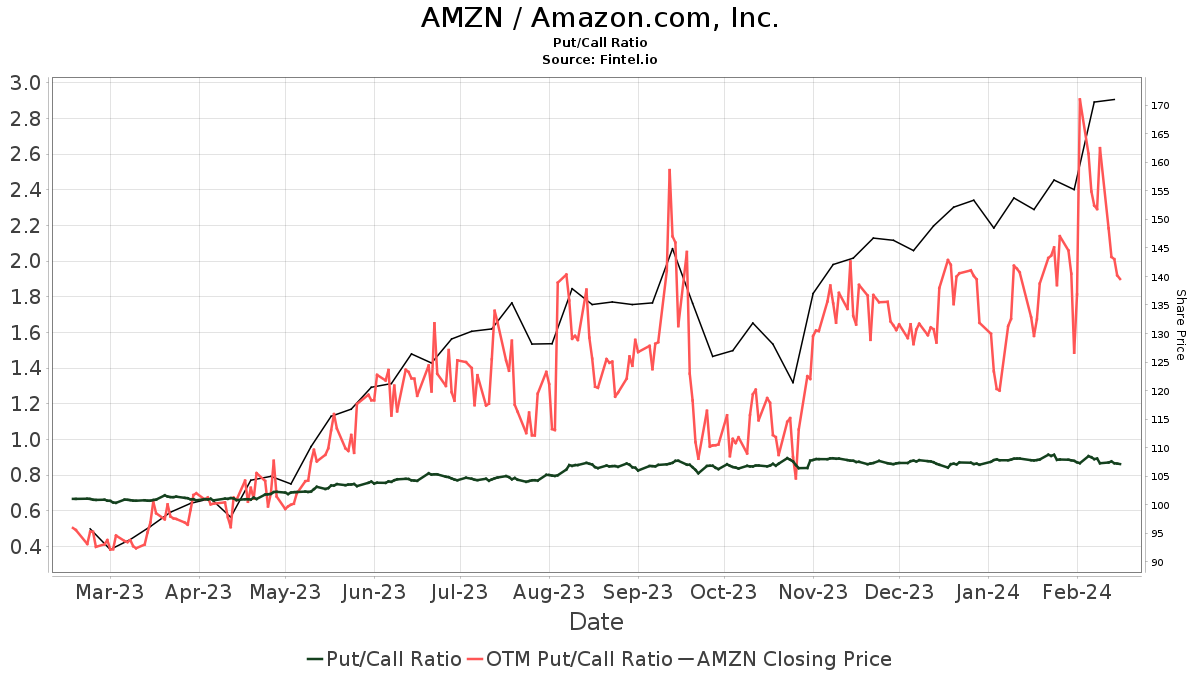

A whopping 6443 funds or institutions now hold positions in Amazon.com, a surge of 285 owners or 4.63% within the last quarter alone. The average portfolio weight of all funds dedicated to AMZN stands at 2.24%, showcasing a robust 3.79% increment. Institutional holdings have escalated by 2.56% over the past three months, reaching 7,114,014K shares. The put/call ratio of AMZN at 0.86 points towards a bullish outlook.

Insight into Shareholders

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 289,148K shares, accounting for 2.78% ownership of the company. Notably, the firm witnessed a remarkable 5.93% surge from its prior filing. Additionally, they bolstered their portfolio allocation in AMZN by 7.60% during the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares owns 218,189K shares, representing 2.10% ownership. The firm observed a 2.59% uptick from the prior period and hiked its portfolio allocation in AMZN by 2.50%.

Price T Rowe Associates hold 192,440K shares, amounting to 1.85% ownership, indicating a 7.97% decrease from the past. They still managed to increase their AMZN portfolio by 1.50%.

Geode Capital Management has presence with 180,839K shares, equal to 1.74% ownership, showcasing a 2.56% increase from previous holdings and a 7.69% hike in portfolio allocation during the last quarter.

Jpmorgan Chase, holding 164,160K shares (1.58% ownership), saw a 4.28% increase in shares and an 8.74% rise in AMZN portfolio allocation over the last quarter.

Amazon’s Enduring Legacy

Amazon’s ethos revolves around customer obsession, innovation, operational excellence, and futuristic planning. Pioneering innovative products and services like customer reviews, 1-Click shopping, Prime, and Amazon Echo – the company has left an indelible mark on the e-commerce and technological landscape.

Fintel stands out as a top-tier investment research platform, catering to individual investors, financial advisors, and hedge funds, offering a plethora of data such as fundamentals, analyst reports, ownership details, and fund sentiment.

Armed with a wealth of information that spans the globe, Fintel also provides insights on options sentiment, insider trading, unusual options activities, and exclusive stock picks driven by sophisticated, tried-and-tested quantitative models for maximizing returns.

Discover more by clicking below.

This article was first featured on Fintel.

The opinions conveyed herein solely reflect the standpoint of the author and not necessarily Nasdaq, Inc.