Amazon: A Hidden Opportunity Among the Magnificent 7 Stocks

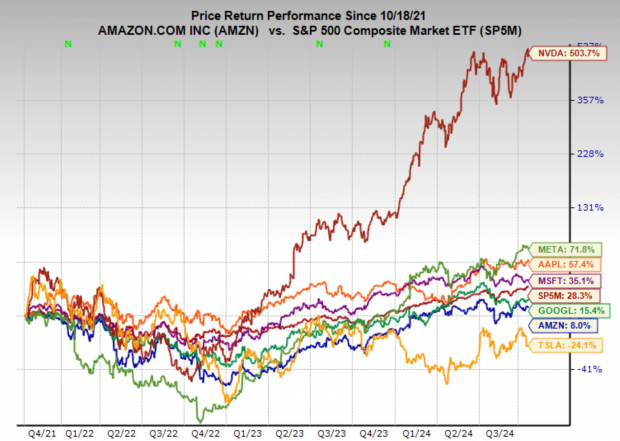

Among the Magnificent 7 stocks, Amazon (AMZN) stands out as a challenging investment. While most companies in this group, except for Tesla, have seen significant gains since 2021, Amazon’s stock price remains unchanged since July 2021. Does this stagnation present a chance for smart investors?

Over the past three years, Amazon’s stock has not shown much movement, yet its valuation has become increasingly appealing due to ongoing growth in earnings. This lull in stock performance along with consistent profit increases may signal an improved investment opportunity.

Currently, Amazon has a Zacks Rank #3 (Hold) rating, indicating flat earnings revisions. Still, its low valuation coupled with strong growth forecasts could make it a valuable addition to investors’ portfolios. Amazon is scheduled to report its earnings on Thursday, October 24. This article will explore the anticipated earnings for Amazon’s e-commerce and cloud computing sectors, the influence of artificial intelligence on its operations, and the potential attractiveness of the stock for investment. Comparisons with fellow Magnificent 7 members – Alphabet (GOOGL) and Microsoft (MSFT) will also be included.

Image Source: Zacks Investment Research

Amazon’s Earnings Insights

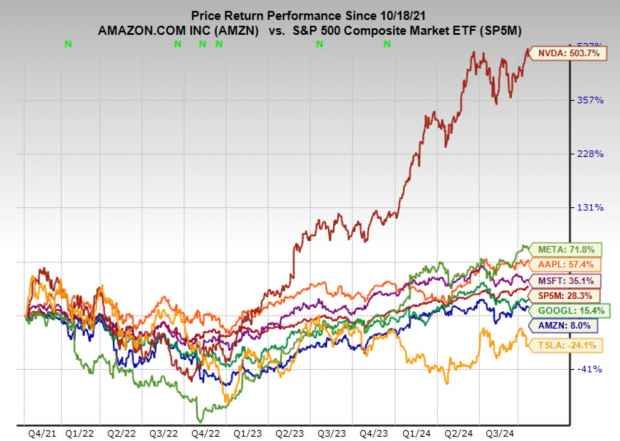

Although Amazon’s stock performance has been disappointing, the company has posted strong earnings over the past year. In the previous four quarterly earnings reports, Amazon exceeded analysts’ expectations with an average beat of 31.13%. While the Zacks earnings ESP does not currently project a gain this quarter, expectations for earnings and sales growth remain positive.

Its cloud computing division, Amazon Web Services (AWS), continues to lead the market and reported an impressive $100 billion annual revenue run rate last quarter. Crucially, AWS has seen reaccelerating revenue growth, aided by expanding margins. The demand for artificial intelligence is set to further boost AWS’s growth moving forward.

In terms of its retail operations, analysts anticipate close to double-digit year-over-year growth, though concerns persist. While expanding internationally presents opportunities for Amazon, it brings risks such as currency fluctuations impacting e-commerce results, especially with a strong dollar affecting profitability. Additionally, competition is strengthening as traditional retailers like Walmart and Target enhance their online offerings, alongside challenges from regional rivals such as MercadoLibre, Flipkart, and Alibaba in crucial international markets.

Image Source: Zacks Investment Research

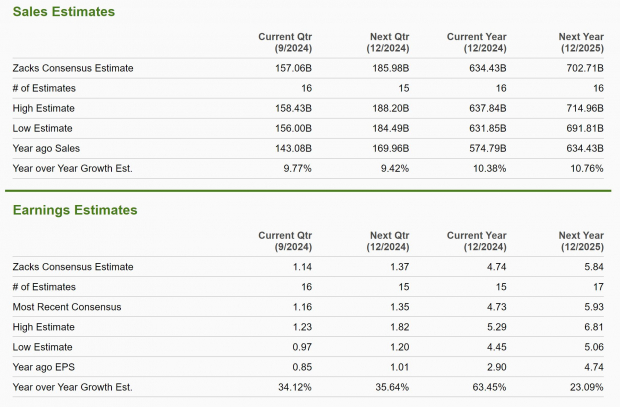

Analyzing Amazon Against Microsoft and Alphabet

Amazon, Microsoft, and Alphabet are leading players in the cloud computing arena, with Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, respectively. AWS currently holds the largest market share, but Azure and Google Cloud are quickly expanding their capabilities. Alphabet is utilizing its AI strengths, while Microsoft integrates cloud services within its software offerings.

Regarding valuation, Alphabet is priced attractively at 21.6x forward earnings, below its five-year median of 23.8x. Microsoft trades at a higher valuation of 32x forward earnings, surpassing its five-year median of 22.3x. In comparison, Amazon trades at 38.5x forward earnings, significantly lower than its five-year median of 70.1x, suggesting potential value given its consistent earnings and cloud revenue growth.

Image Source: Zacks Investment Research

Is it Time to Buy Amazon Stock?

For investors, Amazon’s stock has proved challenging over the last few years, especially compared to fellow “Magnificent 7” stocks. While peers like Alphabet and Microsoft have surged past their 2021 highs, Amazon’s stock price remains similar to where it was in mid-2021. This stagnation may offer an opportunity for patient investors who believe in the potential of Amazon’s evolving business and improved valuation.

Despite its flat stock performance, Amazon has seen its valuation become more attractive as earnings and revenues have consistently grown. The company has also launched several successful businesses like Advertising, Alexa, and Prime Video, which contribute positively and suggest that this tech giant shouldn’t be overlooked.

With the earnings report approaching on October 24, key areas of focus will include e-commerce, forecasted to grow by nearly double digits, and AWS, which continues to lead in the cloud market. Though risks exist, the combination of steady growth, appealing valuation, and dominance in cloud computing makes Amazon a noteworthy consideration for investors willing to look past short-term setbacks.

Unlock Zacks’ Insights for Just $1

No, it’s not a joke.

In an effort to keep you informed, we’ve offered our members 30-day access to all picks for just $1—no additional obligations.

Many have taken advantage while others hesitated, suspecting a catch. Our goal? To familiarize you with valuable portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that have collectively recorded 228 positions yielding double- and triple-digit gains in 2023 alone.

Discover Stocks Now >>

Interested in the latest from Zacks Investment Research? Download your free report on 5 Stocks Set to Double today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.