Big Tech Bets Big on AI: A $350 Billion Investment Surge

In the past two weeks, major technology companies like Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL), Meta (META), and Tesla (TSLA) shared their earnings reports.

These quarterly results demonstrate robust performance. However, the real insights come from the conference calls and investor presentations, revealing Wall Street’s perspective on the AI trend.

The bottom line? Big Tech is overwhelmingly optimistic – and they’re backing it up with significant investments.

Leading the charge were Microsoft, Meta, and Tesla, who dedicated considerable time during their calls to discuss new AI products and services slated for release in 2025. This demonstrates a promising outlook, but a different detail caught our attention.

That detail? The firms’ capital expenditures (capex).

Exploring the Bullish Capital Expenditures of Big Tech

This might seem surprising at first. Companies usually aim to minimize expenses since these can reduce free cash flow and affect their overall valuation significantly.

Ironically, the current capex trends in Big Tech indicate strong optimism about the future.

Specifically, Microsoft expects to invest $80 billion in capital expenditures, while Meta plans over $60 billion, and Tesla is looking to spend about $10 billion. Together, that’s a whopping $150 billion earmarked for AI infrastructure.

But the spending doesn’t stop there.

Recently, Amazon and Alphabet also reported impressive earnings and shared similar sentiments about AI’s transformative impact. Alphabet is preparing $75 billion in capex for this year, and Amazon is set to invest a staggering $100 billion.

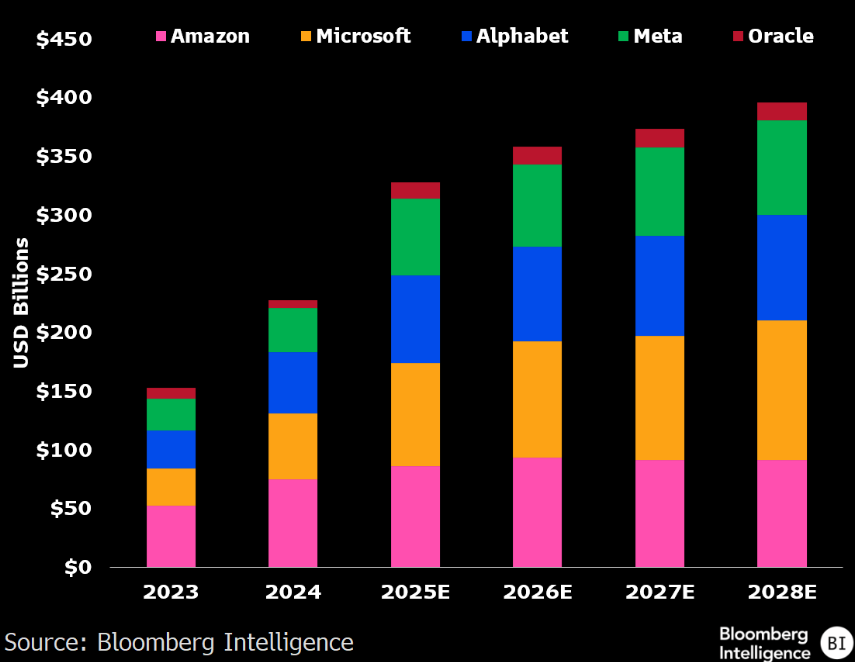

In total, Amazon, Microsoft, Alphabet, Meta, and Oracle (ORCL) are projected to allocate nearly $350 billion in capital expenditures this year, with estimates nearing $400 billion by 2028.

When the largest and most influential companies in the world plan to invest hundreds of billions in a single sector over the next few years, investors should take note.

Identifying the top stocks within that industry is essential.

This is the focus of our research efforts, recognizing that the AI boom is far from over. In fact, 2025 could turn out to be a pivotal year.

Final Insights on Investing

Diversification is critical for successful investing. While we seek the leading AI stocks, we are also exploring other lucrative trading opportunities.

Cryptocurrencies, in particular, have shown remarkable volatility. While they are inherently risky assets, they can also deliver significant returns during the right circumstances.

We believe the time could be ripe for a major cryptocurrency rally.

To share my insights, I recently hosted an emergency crypto market webinar where I discussed my expectations for the crypto markets in 2025. I believe this year could be reminiscent of 2021, when numerous altcoins surged over 5,000% within a year.

This time, I am equipped with an effective quantitative-based trading algorithm designed to identify patterns before crypto prices increase, potentially offering gains of 10X, 50X, or even 100X in a short span –sometimes within just 90 days.

For those who missed it, we’ve made a replay of the webinar available right here.

On the date of publication, Luke Lango did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. Stay informed on Luke’s latest market analysis by checking out our Daily Notes! You can find the latest issue on your Innovation Investor or Early Stage Investor subscriber sites.