Amazon Teams Up with Apple to Offer Apple TV+ on Prime Video

Amazon.com (AMZN) will soon include Apple’s (AAPL) Apple TV+ as part of its Prime Video service in the U.S., starting later this month. Subscribers will pay an additional $9.99 per month for access, a move aimed at boosting viewership for both companies.

Prime members can easily watch Apple TV+ shows directly through the Prime Video app without needing to download another app or have a cable subscription.

How the Partnership Benefits Both Amazon and Apple

Amazon’s ambition is to turn Prime Video into a comprehensive hub for streaming, offering nearly every viewing option available. The platform already includes numerous services like HBO Max, Discovery+, Showtime, MGM Studios, and Paramount+ (PARA), among around 100 other add-on subscription services in the U.S. Additionally, Amazon and Apple have collaborated before, with Apple TV+ already available on Amazon’s Fire TV devices.

While Amazon typically takes a percentage from subscription revenue generated through Prime Video, specifics on this arrangement between the two tech giants remain undisclosed.

On the other hand, Apple is focused on increasing the viewership of its original content on Apple TV+, which features hit series like Ted Lasso, The Morning Show, and Severance. Notably, it also broadcasts Major League Soccer and Major League Baseball games, which could lure more Prime members to subscribe to the service.

However, Apple TV+ trails competitors like Netflix (NFLX), Disney+ (DIS), and Amazon Prime Video in terms of audience numbers. Though Apple has made efforts to attract viewers with award-winning in-house productions, rising service costs and inflation are limiting consumer spending on streaming services.

Could Amazon Stock Be a Smart Investment Now?

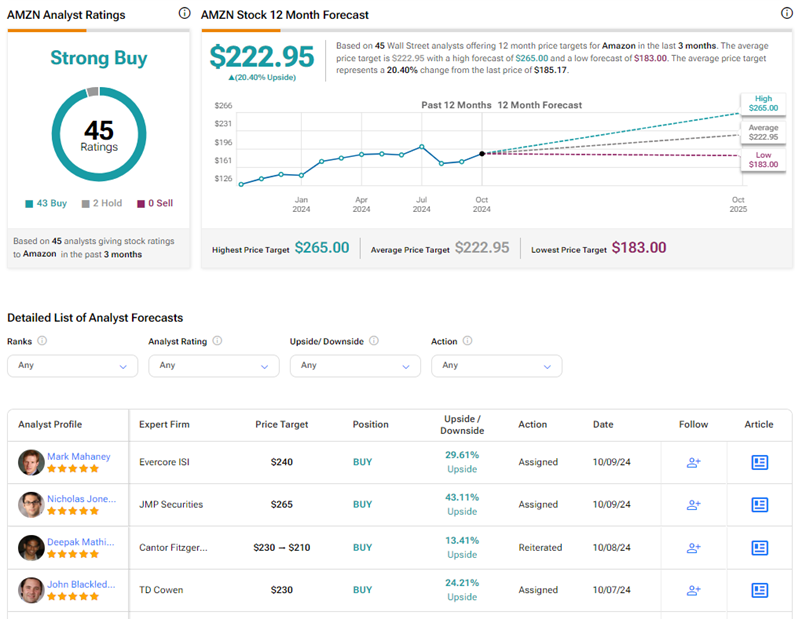

Investor sentiment towards Amazon stock is predominantly positive. According to TipRanks, AMZN holds a Strong Buy consensus rating, with 43 Buy ratings against just two Holds. The average price target for Amazon is set at $222.95, indicating a potential 20.4% upside from current trading levels. As of now, AMZN shares are up 21.9% this year.

Explore more AMZN analyst ratings

What About Apple Stock?

Wall Street has mixed feelings about Apple, the largest company valued at over a trillion dollars, as iPhone sales show signs of weakening in both the U.S. and China. On TipRanks, AAPL has a Moderate Buy consensus rating, with 23 Buys, ten Holds, and one Sell. The average price target for Apple stands at $248.90, suggesting an 8.4% upside from its current level. Year-to-date, AAPL shares have increased by 19.7%.

Explore more AAPL analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.