Amazon.com, Inc. (NASDAQ:AMZN) recapped impressive earnings in Q3 2023, laying a vivid foundation for its sustained growth. Analyzing the company’s stock price yields a promising vista for continued ascension in 2024. The stock has leaped over a critical hurdle and concluded 2023 on a high note, signaling robust potential for the year ahead. Bullish hammers on monthly and weekly charts suggest an enduring upward drive.

A Close-Up of Amazon’s Q3 2023 Earnings

Amazon’s Q3 2023 earnings portrayed a robust performance, marked by substantial growth in net sales, operating income, and net income, along with significant improvements in free cash flow. The quarter witnessed net sales of $143.1 billion, a 13% surge from the same quarter in 2022. Notably, North American segment sales soared 11% to $87.9 billion, International segment sales climbed 16% to $32.1 billion, and AWS segments also rose by 12% year-over-year to $23.1 billion.

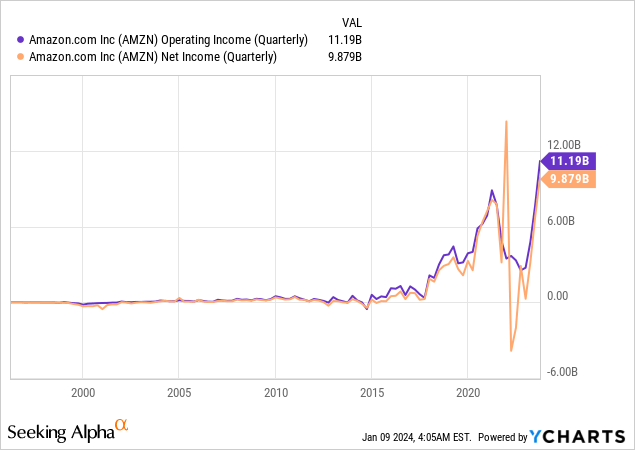

Operating income soared to $11.19 billion from $2.5 billion in Q3 2022. Various segments contributed to this upswing, with the North American segment and AWS witnessing remarkable growth. The net income for the quarter reached $9.879 billion, a substantial jump from $2.9 billion in 2022. The respiratory growth in net income and operating income foreshadows a profitable future for the company.

The company’s cash flow metrics painted a similarly rosy picture, with operating cash flow surging by 81% to $71.7 billion for the trailing twelve months. Free cash flow turned positive, reporting an inflow of $21.4 billion. CEO Andy Jassy attributed this impressive performance to multiple factors, including improvements in cost-to-serve and delivery speed, stable growth in AWS, and robust Advertising revenue.

Deciphering Technical Price Movements in Preparation for 2024

A Walk Down Memory Lane

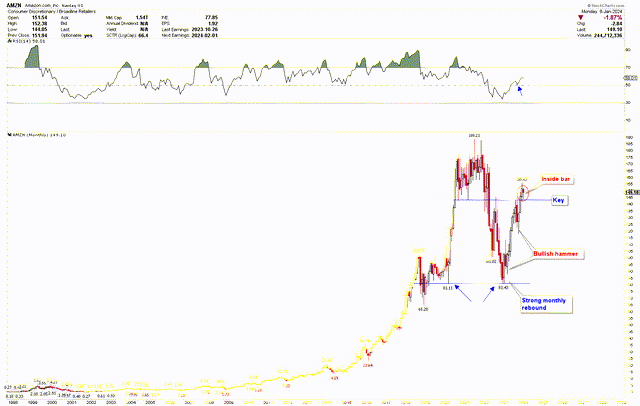

The long-term price action on the quarterly chart presented a parabolic price move from 2008 lows of $1.73 to record highs of $188.21. The significant correction towards the $81.43 was discussed as the potential bottom for the next price surge. This important bottom was also validated by RSI bottoming at the mid-level. The solid quarterly candles from the $81.43 lows indicated a strong potential for higher prices.

Moreover, this strong move challenged resistance at the critical level of $146 on the monthly chart, which was expected to be broken based on the solid price action from the bottom. The inverted head and shoulders marked this bullish price action pattern at the low of $81.43, further strengthening the bullish outlook.

The Unfolding of the Next Phase

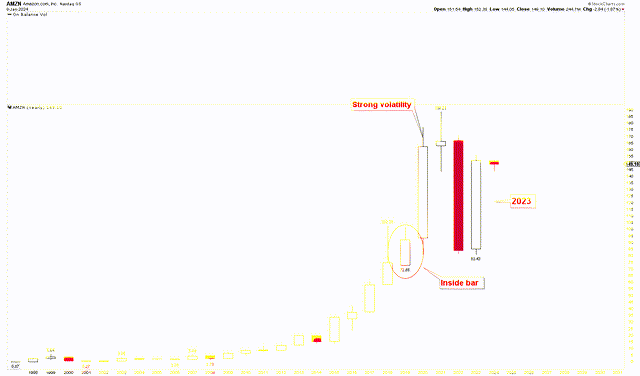

Amazon’s stock price recently broke the crucial threshold of $146, sparking a robust upward surge, validating the prophecies made in earlier analyses. This is further validated by the yearly chart, outlining Amazon’s long-term prospects. The chart reveals significant price fluctuations between 2020 and 2023. This is evident from the solid yearly candle for 2020, the subsequent peak in 2021, and a notable downturn in 2022.

Rebounding Amazon’s Stock Set to Surge in 2024, Analyzes Technical Charts

Amazon has weathered dramatic twists and turns in the financial markets, showcasing striking trends and substantial uncertainties. However, a remarkable resurgence in 2023, marked by a robust yearly candle, heralds a potential upswing for Amazon’s stock in 2024. It seems that the stock is poised to soar once it surpasses the all-time high of $188.21. If this anticipated uptrend manifests in 2024, it could mirror the significant volatility experienced from 2020 to 2023.

Delving deeper into the long-term prognosis, the revised monthly chart indicates a breakthrough in November 2023, with a monthly close above $146. December 2023 witnessed a markedly bullish trend, culminating in a robust year-end close at $151.94. The monthly chart also points to a mid-level RSI bottom, indicating a probable continuation of the bullish momentum into 2024. The presence of bullish hammer candles in March and October 2023 further solidifies the anticipation of an upward surge.

Investor Guidance

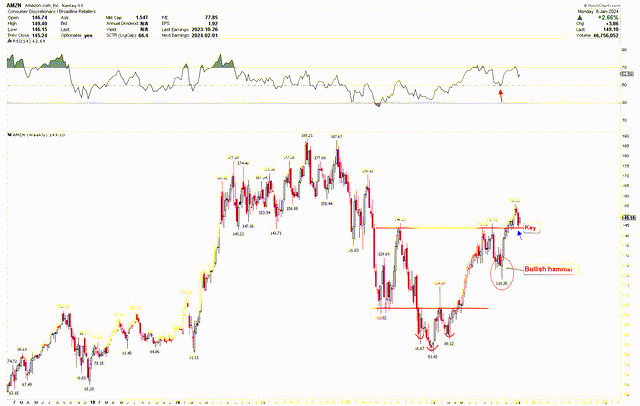

The analysis indicates that Amazon’s stock is primed for a significant uptrend, potentially achieving new highs in 2024. The weekly chart unveils a short-term bullish pattern, presenting potential investment prospects. Notably, the stock exhibits a bullish hammer on the weekly chart, echoing a similar pattern observed on the monthly chart. This bullish hammer has ignited a fresh rally, evidenced by consistently strong closes in the weekly charts. This rally is underpinned by the formation of an inverted head and shoulders pattern, with the head at $81.43 and shoulders at $85.67 and $88.12, establishing a robust bullish price framework, signaling a sturdy rally into 2024. Moreover, the emergence of the bullish hammer coincided with the RSI reaching a mid-level, reinforcing the bullish sentiment.

Despite indications of overbought conditions in the RSI, the observed bullish patterns on the charts suggest that Amazon’s current rally is likely to persist, potentially reaching new highs in 2024. Any price declines may present favorable opportunities for investors to consider.

Market Challenges

Economic downturns, inflation, and shifts in consumer spending behaviors can significantly impact Amazon’s sales and profitability. The company’s extensive global presence exposes it to currency fluctuation risks and varying regional economic conditions. Additionally, Amazon’s high growth prospects render it sensitive to shifts in investor sentiment influenced by broader economic trends. The e-commerce and cloud computing sectors are fiercely competitive, with Amazon facing strong rivalry from companies like Alibaba Group Holding Limited (BABA), Alphabet Inc. (GOOG), and Microsoft Corporation (MSFT), as well as numerous nimble competitors. These competitors, particularly in emerging markets targeted by Amazon for expansion, are incessantly innovating and could potentially erode Amazon’s market share.

As Amazon scales, it increasingly attracts regulatory scrutiny across multiple jurisdictions. Furthermore, Amazon’s future growth hinges on continued innovation, especially in AI, a space known for its rapid evolution and intense competition. Any failure to keep pace with technological advancements or to effectively integrate new technologies into its offerings could hinder Amazon’s competitive edge. Disruptions in supply chains, whether due to geopolitical tensions, natural disasters, or labor disputes, can impede Amazon’s product delivery capabilities. The company’s growing reliance on automation and AI introduces operational risks, including potential technical failures or cybersecurity threats.

Final Thoughts

In conclusion, Amazon’s Q3 2023 earnings report paints a picture of a company strategically positioned for sustained growth in the future. The considerable surge in net sales, operating income, net income, and substantial enhancements in free cash flow testify to Amazon’s robust business model and its ability to adapt and excel in diverse market conditions. The technical analysis of Amazon’s stock price further underscores the company’s solid financial standing and growth potential. The breach of the pivotal $146 threshold and the bullish indicators in the monthly and weekly charts suggest that Amazon’s stock is on a trajectory of sustained upward momentum. This notion is reinforced by bullish hammer candles and the formation of an inverted head and shoulders pattern, pointing to a potential rally in 2024. Investors may consider purchasing Amazon shares at the present price and adding to their holdings if the stock price experiences declines, positioning themselves to capitalize on the anticipated upward surge.