Investment Evaluation

Amazon.com, Inc. (NASDAQ:AMZN) shares have experienced an astounding 88% surge in 2023. This dramatic rise has set off a frenzy of expectations within the stock. Upon careful reverse discounted cash flow (DCF) valuation, it becomes evident that the current stock price necessitates Amazon to achieve an ambitious 16% sales growth, coupled with a 10% operating margin over the next decade. Such aspirations seem overly optimistic, given the trade-offs between margin improvement and volume growth. Besides, Amazon faces fierce competition in e-commerce and cloud businesses, tempering potential multiple expansions. Hence, my recommendation is to assign Amazon a Hold rating at this juncture, as market expectations appear overly exuberant.

Robust Performance and Macroeconomic Uncertainties

Amazon has posted robust sales and profit growth, buoyed by strong holiday spending and an optimistic outlook for the current quarter, backed by heightened interest in AI technology. However, the recent deceleration in consumer demand raises concerns, as weakening retail sales are indicative of broader economic frailties that could impede Amazon’s growth trajectory. Such trends bear critical vigilance, for they have direct implications on Amazon’s sales momentum. The reverse DCF model underscores the precariousness, as markets anticipate a ~16% top-line growth in the coming years. Any further consumer spending downturn could significantly impact Amazon’s valuation, resulting in compressing multiples.

Value Creation for Shareholders

Amazon’s heavy investments during the pandemic led to an overinvestment situation as growth slowed, causing a decline in its share price. However, the subsequent rebound, with an 88% appreciation in 2023, can be attributed to the company effectively leveraging its excess capacity to drive sales and operating margins. The key question here is the profitability of Amazon’s overall business, where managing costs and leveraging capacity can propel long-term margin growth.

Regarding Amazon’s e-commerce dominance and the potential of its ad business, it is foreseeable that the company will continue to capture market share due to its robust competitive advantage. However, the real game changer lies in AWS, where the company’s market position and strong secular trends could drive substantial sales and profitability in the years ahead. Yet, all these prospects are currently built into the stock price, suggesting limited room for further expansion.

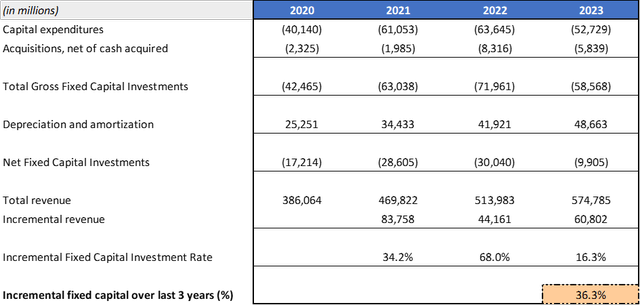

Expressing Market Expectations Through Valuation

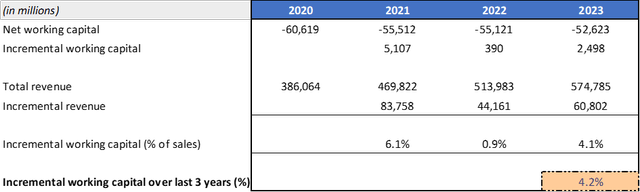

It is prudent for investors to discern prevailing market expectations embedded in the stock price. Hence, my reverse DCF model illuminates that Amazon will continue to incur significant capital expenditures, although at a moderated pace, given the ongoing capacity leverage. Besides, the company’s negative cash conversion cycle is likely to endure, with cash tied to operations hovering around 2% of sales. Overall, these factors underscore the weight of market expectations and the need for a cautious investment approach.

Assessment of Amazon’s Current Valuation and Future Outlook

Amazon is currently projected to exhibit negative working capital in the near future, driven by its sheer size and economies of scale, with an expected incremental working capital of 4.2% over the last three years.

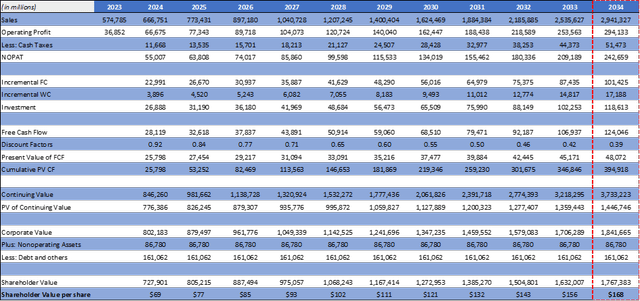

As of February 16, Amazon was trading at $168. Market assumptions leading to this stock price are based on analyst estimates for sales and operating margins. According to the model, the current share price reflects an anticipated 16% sales growth and a 10% operating margin continuing for 10 years. This projection is underpinned by a 9.0% WACC and a 2.50% growth factor for inflation, with an expectation of 17.50% cash taxes.

However, some analysts find the current expectations embedded in the stock price overly optimistic. With revenues increasing by only ~14% year-on-year in the recent quarter, sustaining the implied top-line growth seems improbable. Additionally, maintaining operating margins at 10% to justify the current stock price is viewed as challenging. The combination of achieving both simultaneously is deemed difficult due to potential trade-offs between price increases for margin growth and potential impact on volume growth. Operating margins need to outpace current levels, which stood at 6.4% in the last quarter. The rapid growth in revenue might come at the cost of margin compression for Amazon, favoring the recent advancements in top-line growth.

Challenges and Concerns

A notable concern centers on the current state of US consumers and retail. Slowed retail sales and weaker consumer confidence levels could adversely affect Amazon’s valuation. Factors such as higher interest rates, diminishing excess savings, and the return of student loan payments pose potential risks to the company’s performance.

Furthermore, heightened competition from emerging players (e.g., TikTok Shop, Temu & SHEIN) might exert pressure on margins. The possibility of Amazon adjusting its prices to match those of newer entrants is anticipated, potentially impacting its competitive position. Despite this, Amazon’s strong moat, extensive product range, and Prime value proposition are expected to sustain its dominant market position in the long term.

Summary: Weighing Amazon’s Prospects

Despite potential benefits from a shift to cloud services, Amazon faces the challenges of intense competition and excessively high market expectations. The current share price reflects assumptions of ambitious 16% top-line growth and a 10% operating margin for the next years, which are viewed as overly optimistic by some analysts. Consequently, a Hold rating is assigned to Amazon at current levels, with the key risks identified as increased competition and a deteriorating macro environment.