Amazon’s Share Performance Outlook: What Investors Should Know

Shares of Amazon (NASDAQ: AMZN) have seen an increase of nearly 14% in the past year, edging out the S&P 500 return of 13%. This slight outperforming is a positive sign, especially given the strong growth from Amazon Web Services (AWS) and its e-commerce division. Notably, in Q4, Amazon grew larger than Walmart.

Amazon’s projected net sales for 2024 stand at a remarkable $638 billion. However, for investors primarily focused on the company’s future, the key financial metric to monitor may not be net sales, but rather its operating income.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Operating income captures the profit generated directly from normal business activities, excluding profits from non-operational sources such as investments. This metric is particularly significant, as unusual expenses or one-time tax bills can disrupt net profits even if operationally, a company is thriving.

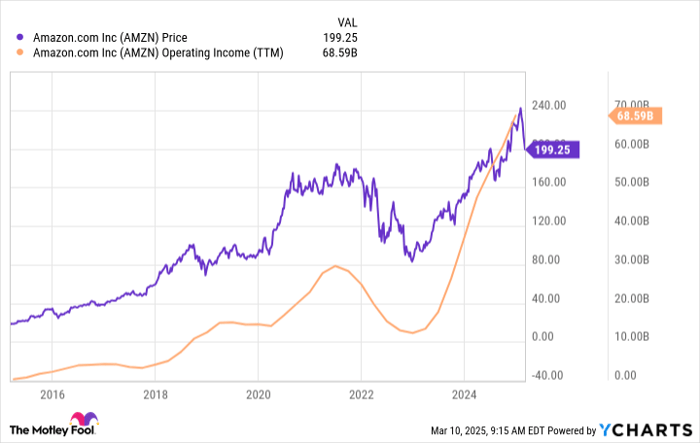

Over time, trends show that as Amazon’s operating income increases, its stock price tends to follow suit, and conversely, the stock price often declines when operating income decreases.

AMZN data by YCharts.

On February 6, Amazon reported a record operating income of $68.6 billion, which coincided with its stock reaching an all-time price of over $233 per share.

Given the correlation between operating income and stock performance, investors could face modest returns in 2025 as Amazon’s management anticipates a slight decline in operating income, possibly less than $1 billion.

What This Means for Investors

Some may view the prediction of stagnant or declining stock price as a reason to sell, but the market operates in cycles. Short-term fluctuations often stem from emotions rather than fundamentals. A variety of unforeseen events could affect Amazon’s stock in 2025, causing it to either soar or plummet, but in the long run, the company’s fundamentals are likely to prevail.

It is critical to recognize that a single year is a brief period for investments. The Motley Fool often encourages holding stocks for at least five years to allow the fundamentals to truly impact the investment’s value.

Additionally, Amazon may have already experienced its worst dip. The company is forecasted to have its second most profitable year based on operating income, with the stock currently about 20% lower than its peak in early 2025.

The anticipated profit decline is not due to any operational failures; rather, it is a strategic decision to invest in the business to fulfill strong customer demand. This commitment to investing for future growth is a positive long-term signal.

Investment patterns like this are not new for Amazon. Historically, when presented with opportunities, the company has prioritized long-term gains over short-term profits—a strategy that has established it as one of the top performing stocks historically.

In summary, if Amazon underperforms against the S&P 500 in 2025, it would not be alarming. However, this scenario is not inevitable. The company’s strategic positioning, particularly in the AWS segment, suggests resilience and potential for future growth. If consumer demand remains robust, the company’s stock should eventually reach new highs, even if the returns in 2025 are less than stellar.

Is Now the Right Time to Invest $1,000 in Amazon?

Before considering an investment in Amazon, investors should be aware of the following:

The Motley Fool Stock Advisor analysts have identified what they consider the 10 best stocks to invest in right now, and Amazon is not among them. The selected stocks have the potential for significant returns in the upcoming years.

For example, when Nvidia was recommended on April 15, 2005, an investment of $1,000 would now be worth $666,539!*

Stock Advisor offers a straightforward investment strategy with guidance on portfolio building, updates from analysts, and two new Stock picks each month. Since 2002, the Stock Advisor service has more than quadrupled the S&P 500’s return.* Don’t miss the latest top 10 list when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 10, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.