Amazon Introduces AI-Powered Interests Feature for Enhanced Shopping

Amazon.com AMZN has launched a new AI-driven shopping feature called Interests, aiming to reshape how consumers find products. This personalized conversational search experience enables customers to create specific prompts based on their preferences, hobbies, and budget constraints—ranging from model building kits for engineering enthusiasts to brewing tools for coffee lovers priced under $100.

Launched on March 26, 2025, Interests employs large language models to convert everyday language into queries that traditional search engines understand. This results in enhanced product recommendations tailored to users. Additionally, Interests operates in the background, providing proactive notifications about new products, restocks, and deals that align with user-defined preferences.

This innovative feature is currently accessible to a limited number of U.S. customers via the Amazon Shopping app on iOS and Android, as well as through the mobile website. Amazon plans to broaden access for more U.S. customers in the months ahead.

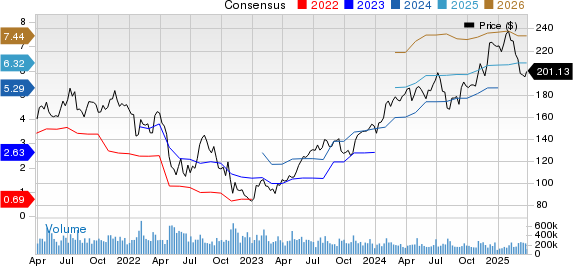

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

Continued Focus on AI Integration

The introduction of Interests follows Amazon’s strong performance in Q4 2024, where the company reported $187.8 billion in revenue, reflecting a 10% year-over-year growth, and $21.2 billion in operating income, marking a 61% year-over-year increase. Amazon’s increasing emphasis on AI, particularly with AWS advancements like the Trainium2 AI chips—which offer 30-40% better price performance than existing GPU options—Amazon Nova foundation models, and improved features in Amazon Bedrock showcases the company’s commitment to innovation.

Interests adds to Amazon’s expanding suite of AI-driven shopping tools, which also includes the Rufus shopping assistant, AI Shopping Guides, and review summaries. The consistent implementation of AI technologies across its retail platform illustrates Amazon’s determination to enhance customer experiences. This focus on personalization aims to increase both purchase frequency and average order value.

Intensifying Competitive Landscape

As competition in e-commerce grows, other tech companies are also creating AI-enhanced shopping experiences. Notably, Alphabet GOOGL has revamped its Shopping tab with Vision Match, allowing users to provide descriptions for desired items and receive AI-generated suggestions, supplemented by AI tools for product information summaries.

Amazon’s first-mover advantage in developing comprehensive AI-powered shopping tools, paired with its extensive product variety and strong logistics network, positions it favorably against competitors like Alibaba BABA and eBay EBAY in the dynamic retail landscape.

Investment Perspective: Hold or Wait for Better Opportunities

Amazon’s AI advancements present promising long-term opportunities. Investors may want to hold onto their current positions or wait for a more advantageous entry point in 2025.

The Zacks Consensus Estimate for AMZN’s 2025 net sales stands at $697.68 billion, indicating a growth of 9.36% from the previous year’s figure. Additionally, the consensus estimate for 2025 earnings is projected at $6.32 per share, representing a 14.29% increase from the year-ago period. This prediction has not changed in the last 30 days.

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

Despite exceeding fourth-quarter revenue expectations and demonstrating significant operating income growth, several concerns prompt caution. The company recorded capital expenditures of $26.3 billion in Q4, with similar spending expected to occur in 2025, which may impact profit margins in upcoming quarters.

Although AWS has experienced a year-over-year growth of 19%, it remains under pressure from strong competition and capacity constraints highlighted during the recent earnings call. Such constraints could slow the rate of AI-driven revenue growth, despite significant investments in infrastructure aimed at facilitating future expansion.

For investors with existing holdings, maintaining positions through 2025 could be wise as Amazon’s AI initiatives evolve and yield tangible results. The company’s consistent efforts to enhance customer experiences and improve operational efficiency provide a robust platform for sustainable growth.

New investors may find better entry points by waiting for potential market corrections, as the full effect of Amazon’s AI investments becomes clearer throughout the year. Currently, AMZN holds a Zacks Rank of #3 (Hold). For a full list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Only $1 for Access to All Zacks’ Buys and Sells

We’re not kidding.

Several years back, we surprised our members by offering 30-day access to all our picks for just $1, with no obligation to spend more.

Thousands have taken advantage of this offer, while many hesitated, suspecting a catch. We do have a motive; we want you to explore our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, that secured 256 positions with double- and triple-digit gains in 2024 alone.

Seeking the latest recommendations from Zacks Investment Research? Today, you can download the 7 Best Stocks for the Next 30 Days. Click here to receive this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

eBay Inc. (EBAY): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.