“`html

A Comparative Analysis of Amazon and Oracle’s Cloud Strategies

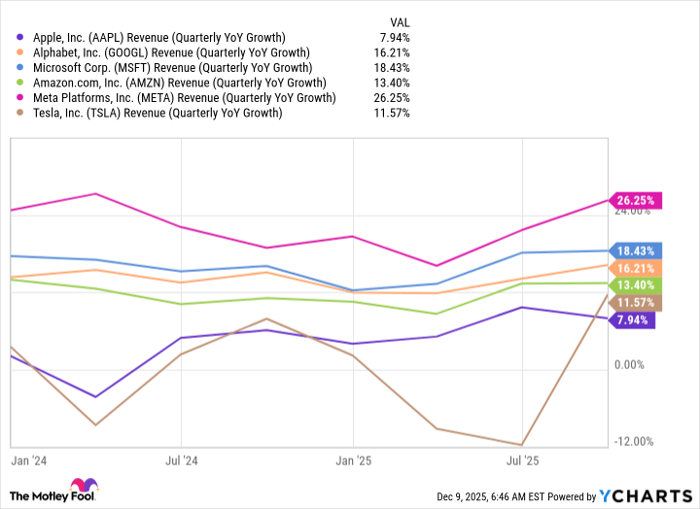

In the high-stakes world of cloud computing, Amazon.com (AMZN) and Oracle (ORCL) showcase contrasting strategies to harness the rapid growth of artificial intelligence and enterprise computing. Amazon, leveraging its dominant Amazon Web Services (“AWS”) platform, capitalizes on its first-mover advantage and vast scale. In contrast, Oracle focuses on specialized database and enterprise applications while expanding its cloud ambitions through Oracle Cloud Infrastructure.

Both companies have made substantial investments in AI infrastructure and services, aiming to benefit from a transformative technology that reshapes industries globally. In this analysis, we will compare the fundamentals of both stocks to identify which presents a better investment opportunity at this time.

The Case for AMZN Stock

Amazon’s cloud division, AWS, posted impressive first-quarter 2025 results, with revenues increasing 17% year over year to $29.3 billion. This achievement establishes an annualized revenue run rate of $117 billion, reflecting AWS’ market leadership amid growing competition. The company’s aggressive AI capabilities expansion, including new P6-B200 instances powered by NVIDIA Blackwell GPUs, positions Amazon prominently in the AI landscape.

Amazon’s retail segment also displays remarkable resilience, marked by record delivery speeds and robust consumer engagement. The company has successfully optimized its fulfillment network, enabling quicker deliveries and reduced costs. As noted by CEO Andy Jassy, essential items saw growth at double the rate of the overall business, making up one-third of all units sold in the U.S.

Further demonstrating its global ambitions, Amazon announced a partnership exceeding $5 billion with Saudi Arabia’s HUMAIN to create an innovative “AI Zone.” Additionally, Amazon has rapidly expanded its AI model offerings in Bedrock, incorporating top models from firms such as Anthropic, Meta, Mistral AI, and DeepSeek, thus building a robust AI ecosystem for developers and enterprises.

On the financial front, Amazon’s first-quarter operating income grew 20% year over year to $18.4 billion. The company also surpassed Wall Street expectations with earnings per share (EPS) of $1.59, exceeding forecasts by 23 cents. Its diversified revenue streams—encompassing e-commerce, cloud computing, digital advertising, and subscription services—offer multiple growth vectors and naturally mitigate market volatility.

The Zacks Consensus Estimate predicts 2025 net sales of $693.74 billion, signifying an 8.74% increase from last year. Meanwhile, earnings are projected at $6.3 per share, reflecting an anticipated growth of 13.92% from the prior year.

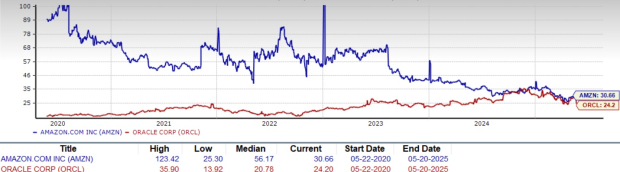

Amazon.com, Inc. Price and Consensus

Amazon.com, Inc. price-consensus-chart | Amazon.com, Inc. Quote

The Case for ORCL Stock

In contrast, Oracle’s recent performance has not met investor expectations. Its third-quarter 2025 results showed revenues of $14.13 billion, representing just 6.40% year-over-year growth, falling short of projections by $259.18 million. EPS came in at $1.47, missing estimates by 2 cents and indicating difficulties in a competitive landscape.

Oracle’s cloud revenue, totaling $6.2 billion, pales in comparison to AWS’ $29.3 billion in quarterly revenue. Executives have indicated “capacity constraints,” highlighting Oracle’s struggle to keep pace with demand. Although the company has added its 101st cloud region, it lacks the global reach and availability zones that AWS offers.

The company’s strategic focus appears disjointed, with efforts spread across healthcare, financial services, and government initiatives. This contrasts sharply with Amazon’s coherent vision. Oracle’s heavy reliance on its database business leaves it vulnerable as companies move toward cloud-native alternatives and multi-cloud strategies that bypass its higher-margin offerings.

Although Oracle reported a 63% increase in Remaining Performance Obligations (RPO) to $130 billion, there are doubts about its conversion rates and timing. The company anticipates 15% revenue growth for fiscal 2026, a target many view as overly ambitious given its ongoing execution challenges and history of overpromising. Oracle’s AI strategy seems narrowly focused on its database products, rather than presenting a comprehensive AI ecosystem like AWS does.

The consensus estimate for fiscal 2025 earnings stands at $6.03 per share, marking a slight decrease of 0.3% over the past two months.

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Despite management’s assertions regarding cost advantages for AI workloads, Oracle lacks the extensive semiconductor investments and specialized infrastructure that Amazon has developed. With Oracle’s annual capital expenditure of $16 billion being modest compared to Amazon’s, challenges surrounding its ability to compete at scale in the capital-intensive cloud and AI sectors have arisen.

Stock Valuation and Price Performance Comparison

Both Amazon and Oracle trade at premium valuations, but Amazon presents superior value considering its growth prospects. With a forward price-to-earnings (P/E) ratio of approximately 30.66x, Amazon’s valuation reflects its diverse revenue streams and strong market position across multiple high-growth sectors. In contrast, Oracle’s forward P/E of 24.2x may appear cheaper but raises questions given its slower growth and ongoing execution challenges.

AMZN vs. ORCL: P/E F12M Ratio

Image Source: Zacks Investment Research

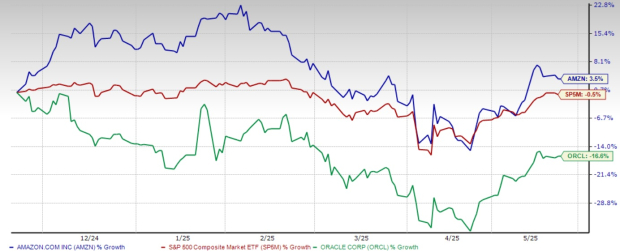

Recent price performance reflects strong investor confidence in Amazon, with its shares rising 3.5% over the past six months, in sharp contrast to Oracle’s 16.6% decline. Concerns about Oracle’s growth trajectory have led to its relatively discounted valuation.

“`

Amazon Outshines Oracle in Cloud and AI Growth Potential

AMZN Exceeds ORCL Performance Over the Last Six Months

Image Source: Zacks Investment Research

Amazon’s enterprise value to free cash flow ratio underlines its strong investment appeal. The company has demonstrated a solid track record of reinvesting cash flows into ventures that generate high returns. Despite both Amazon and Oracle holding positions in the cloud market, Amazon’s broad diversification and scale create a significantly better risk-adjusted return profile compared to Oracle’s more focused and smaller operations.

Investment Outlook

Amazon stands out as a more promising investment opportunity in the cloud and AI sectors. Its unmatched scale, extensive AI capabilities, varied revenue streams, and reliable execution set the stage for sustainable growth. In contrast, Oracle is positioned as a specialized option with its limited scale, execution challenges, and inconsistent strategy, leaving it trailing in the competitive cloud landscape. Investors looking to tap into the transformative potential of cloud computing and artificial intelligence should consider increasing their stake in Amazon while reevaluating their positions in Oracle. Currently, AMZN holds a Zacks Rank of #3 (Hold), while ORCL is rated #4 (Sell).

Zacks Highlights Top Semiconductor Stock

In a related industry, Zacks also identifies a leading semiconductor company, significantly smaller than NVIDIA, which has surged over 800% since its recommendation. This new top chip stock is well-positioned for substantial growth, driven by robust earnings and an expanding customer base, particularly in Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to grow from $452 billion in 2021 to $803 billion by 2028.

For more insights on stock recommendations, investors can explore today’s highlighted picks.

Amazon.com, Inc. (AMZN): Free stock analysis report available.

Oracle Corporation (ORCL): Free stock analysis report available.

This analysis originates from Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.