Amazon (AMZN) reported that in Q1 2025, third-party sellers accounted for 61% of total paid units sold globally, generating $36.5 billion in net sales, a 5.5% increase from $34.6 billion year-over-year. This segment contributed 23.5% to Amazon’s total revenues, with Q2 2025 revenue estimates for third-party services projected at $38.8 billion. Concerns have emerged over new tariffs on Chinese imports, which peaked at 145% and were later reduced to 30%, leading some sellers to adjust their participation in events like Prime Day.

During Prime Day 2025, Amazon proactively helped sellers manage inventory and pricing to ensure stability amidst tariff challenges. As a result, independent sellers achieved record sales levels during the event. In contrast, Amazon faces increasing competition from eBay, which reported $18.8 billion in GMV in Q1 2025, and Etsy, boasting 5.4 million active sellers.

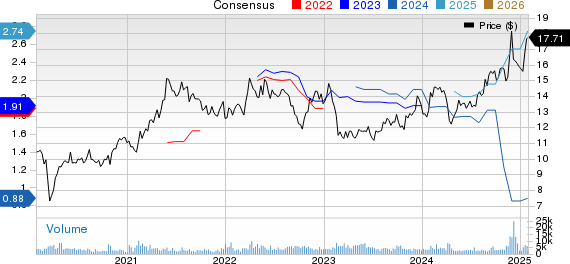

As of now, AMZN shares have risen 3% year-to-date, underperforming the Zacks Internet – Commerce and Retail-Wholesale sectors, which grew 7.9% and 5.1%, respectively. The Zacks Consensus Estimate for AMZN’s Q2 2025 earnings stands at $1.32 per share, indicating a projected year-over-year growth of 7.32%.