Amazon Faces Bearish Signals Ahead of Earnings Report

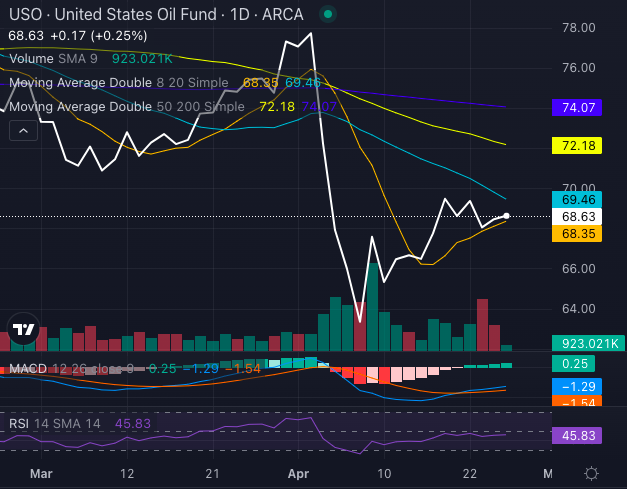

Amazon.com Inc. AMZN has encountered a series of technical indicators recently, just days before its upcoming first-quarter earnings report on May 1. The most significant indicator is the formation of a Death Cross, which is a bearish signal that occurs when a short-term moving average crosses below a long-term moving average.

In this case, Amazon’s 50-day simple moving average (SMA) of $196.50 has dipped below its 200-day SMA of $199.20, raising concerns about potential instability for the retail giant.

Chart created using Benzinga Pro

Conflicting Technical Signals: Bullish vs. Bearish

The stock shows mixed technical signs. Priced at $186.54, Amazon’s shares exceed their eight-day and 20-day SMAs, which might typically indicate a positive outlook. However, the looming Death Cross urges caution from investors.

Further complicating matters, the MACD (moving average convergence/divergence) indicator sits at a negative 4.79, reinforcing a bearish sentiment, while the Relative Strength Index (RSI) is at 50.46, suggesting that Amazon stock is not yet in oversold territory.

Expansion Strategy: A Potential Bright Spot?

Despite facing these technical challenges, Amazon is pursuing aggressive growth plans. Notably, the e-commerce leader has proposed a substantial 170,000-square-foot delivery facility in Augusta as part of its $15 billion investment towards constructing 80 new logistics centers, according to reports from The Augusta Chronicle. This ongoing investment indicates that Amazon remains committed to expansion, although the short-term impact on its stock is uncertain.

Investors should closely monitor how these technical signals evolve as the first-quarter earnings report approaches. While the Death Cross does not assure negative outcomes, it certainly merits attention.

Year-to-date, Amazon’s performance has declined by 15.08%, making the earnings results crucial for a possible recovery or continued bearish trend. It remains to be seen whether the bears will prevail or if Amazon can reverse its fortunes.

Read Next:

Photo: Shutterstock