AMD AMD recently unveiled its partnership with Sony Semiconductor Solutions (SSS) to integrate its cutting-edge adaptive computing technology in SSS’s newest automotive LiDAR reference design.

Sony Semiconductor Solutions, a trailblazer in image sensor technology, will harness AMD’s innovative solutions to develop a highly efficient and robust LiDAR system for self-driving vehicles.

This association aims to boost the performance of the SSS LiDAR system, ensuring exceptional accuracy, rapid data processing, and unwavering reliability for next-generation autonomous driving technologies.

Further Reading: Nvidia Leads AI Chip Rivalry with New GPUs, While AMD and Intel Bet Big on AI PCs

LiDAR technology serves as a critical component in the realm of autonomous driving, responsible for accurate depth perception and environmental mapping. It heavily relies on precise and dependable sensor technology to classify images, segment, and detect objects.

The integration of LiDAR technology is crucial for 3D vision perception enhanced by AI, providing capabilities that surpass those of cameras alone, especially in challenging lighting or weather conditions.

This collaboration delivers to automakers and automotive equipment suppliers a holistic perception platform, enabling them to identify potential hazards and navigate intricate driving scenarios with precision.

The partnership responds to the escalating demands within the automotive industry by combining AMD’s scalable computing solutions with SSS’s SPAD ToF Depth sensors.

Earlier this year, analyst John Vinh from KeyBanc highlighted AMD’s modest growth, noting a 1% month-on-month and 24% year-on-year increase in processor instances, with robust Genoa instance growth predominantly led by Amazon.Com Inc AMZN AWS.

Despite the downturn in traditional server demand and a decline in China’s cloud instances, AMD’s performance, especially concerning Genoa, paints a moderately optimistic outlook.

In a prior assessment, analysts had expressed confidence in AMD reaching its $2 billion revenue target for MI300X in 2024.

AMD’s stock surged over 87% last year, emerging as the second most significant beneficiary in AI, following in the footsteps of Nvidia Corp NVDA. Investors interested in the stock can explore avenues through VanEck Video Gaming And ESports ETF ESPO and Spear Alpha ETF SPRX.

Price Action: During the most recent check, AMD shares exhibited a 0.84% decline, trading at $179.80 on Wednesday.

Further Reading: Nvidia and AMD Rule The Charts – Here Are Other Semiconductor Plays That Analysts Root For

Disclaimer: This content was partially generated with the assistance of AI tools and was reviewed and published by diligent Benzinga editors.

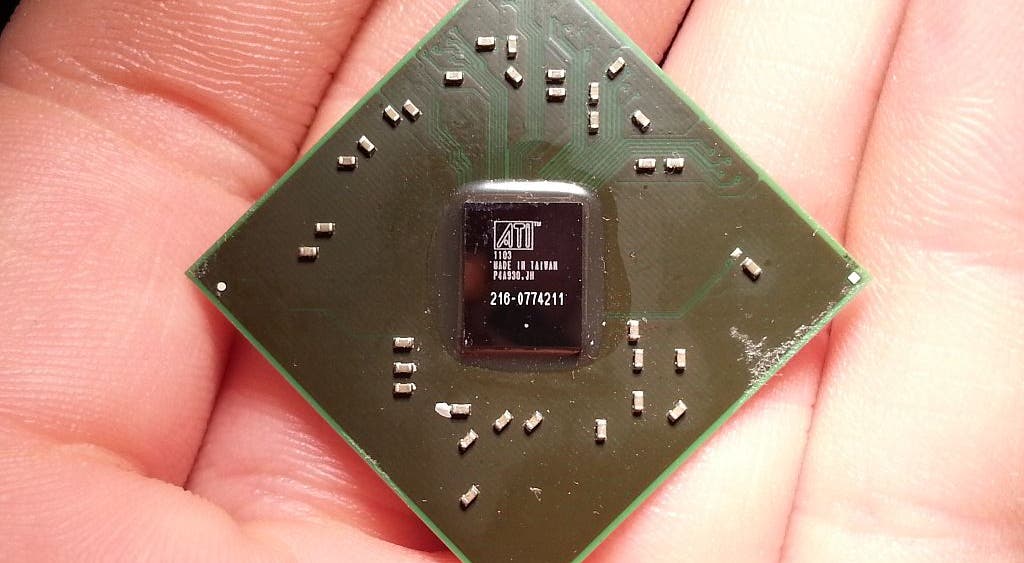

Image Credit: Wikimedia Commons