“`html

Advanced Micro Devices (AMD) anticipates its data center total addressable market (TAM) will reach $1 trillion by 2030, reflecting a compound annual growth rate (CAGR) of over 40% from an estimated $200 billion in 2025. In the next 3-5 years, AMD expects data center AI revenues to grow at a CAGR exceeding 80%, driven by increasing demand for its Instinct GPUs and a broadening clientele that includes major hyperscalers.

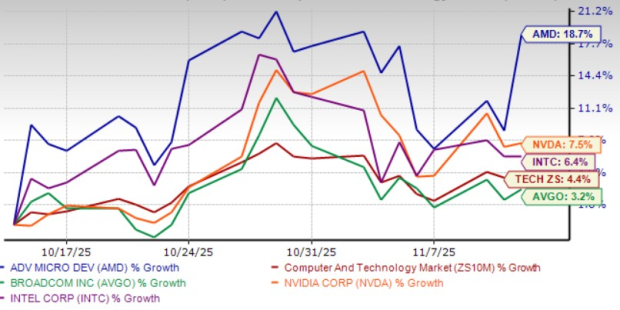

AMD shares have surged 18.7% over the past month, significantly outperforming competitors like NVIDIA (7.5%), Broadcom (3.2%), and Intel (6.4%). The company attributes this growth to robust demand for its EPYC processors, which are essential for cloud and enterprise workloads. The firm expects fourth-quarter 2025 revenues of $9.6 billion (+/- $300 million), indicating a year-over-year growth of approximately 25% and a sequential growth of about 4%.

At the same time, AMD’s valuation appears stretched, trading at a forward 12-month price/sales ratio of 10.22, significantly above the sector’s 6.88. While AMD’s expanding portfolio and growing footprint in the AI sector bode well for future growth, macroeconomic uncertainties and competition, particularly from NVIDIA, may present challenges.

“`