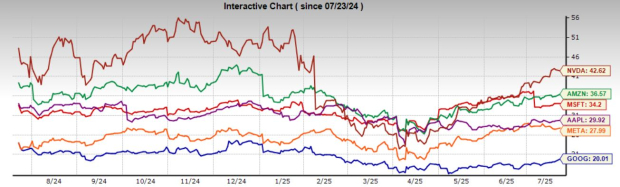

Advanced Micro Devices (AMD) has seen a stock increase of +10.5% over the past month, significantly outperforming the Zacks S&P 500 composite’s +3.3% and the Zacks Electronics – Semiconductors industry’s +6.7% increase. Current earnings estimates predict $0.67 per share for the ongoing quarter, reflecting a +15.5% year-over-year change, while total revenues for the current quarter are anticipated at $5.71 billion, a +6.6% increase year-over-year.

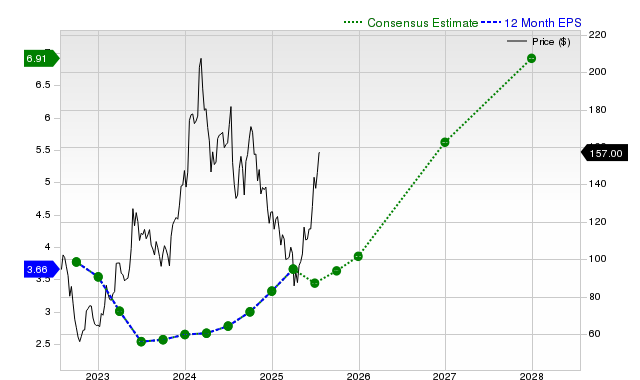

The consensus earnings estimate for the current fiscal year is $3.42, projecting a +29.1% year-over-year increase and a future estimate of $5.17 for next fiscal year, which represents a +51.1% change. AMD reported revenues of $5.47 billion in the most recent quarter, exceeding the Zacks Consensus Estimate of $5.42 billion by +0.99%. For valuation, AMD has been rated F within the Zacks Value Style Score, indicating it is trading at a premium compared to its peers.

Overall, AMD holds a Zacks Rank of #3 (Hold), suggesting its performance may align with the broader market trends in the near term.