Advanced Micro Devices (AMD) saw its shares drop 11% following the release of its fourth-quarter 2025 earnings on February 3. The company reported non-GAAP earnings of $1.53 per share, a 40.4% increase year-over-year, with revenues reaching $10.27 billion, up 34.1% year-over-year. Despite this growth, AMD’s first-quarter 2026 guidance of $9.8 billion (+/- $300 million) prompted market concerns, indicating a potential sequential revenue decline of approximately 5%.

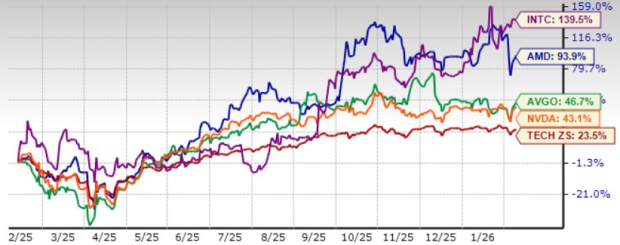

AMD is currently facing strong competition from major players like NVIDIA, Broadcom, and Intel. In 2025, AMD’s Data Center revenues benefited from significant demand for its Instinct MI350 series GPUs, contributing to the company’s optimistic outlook for a $1 trillion total addressable market by 2030. The Zacks Consensus Estimate for AMD’s 2026 revenues stands at $45.21 billion, suggesting a 30.5% growth from 2025, while earnings estimates average $6.59 per share, reflecting a 58% increase over the same period.