AMD Shares Show Signs of Potential Rebound Despite Downgrade

Current Situation: Recent candlestick patterns indicate Advanced Micro Devices Inc. AMD could be on the verge of a turnaround, even as HSBC downgraded its stock on Jan. 8.

What’s the Trend: AMD’s candlestick chart depicts a rare “Bullish Stick Sandwich” pattern, a technical setup that may point to an upward price shift.

Typically, this pattern includes three consecutive candlesticks that visually form a sandwich shape on the price chart, exemplified in the chart below by Benzinga Pro.

This bullish sandwich appears when a bullish candlestick is flanked by two bearish ones, suggesting potential buying interest in an otherwise declining market.

The middle candlestick’s size enhances the reversal signal, indicating stronger buyer activity, although it might only reflect a temporary uptick. A genuine reversal is confirmed when future candlesticks break above the previous bearish highs.

John, the founder of Rock trading Group, recently tweeted, “Call me nuts, but I believe $AMD could outperform $NVDA this year,” in reference to the observed pattern.

In contrast, AMD’s daily moving averages present a more pessimistic outlook.

On Tuesday, AMD shares closed at $116.09, under the eight-day simple moving average of $121.77 and the 20-day average of $122.83.

The 50-day and 200-day simple moving averages were also positioned above the share price, at $132.86 and $151.11, indicating a prevailing bearish trend.

Moreover, a relative strength index of 35.51 hints that the stock may be moderately oversold, yet it remains in a neutral state.

What Does This Mean? Last week, Frank Lee from HSBC lowered AMD’s rating from “Buy” to “Reduce,” slashing the price target from $200 to $110, a staggering 45% reduction.

In his research note, Lee pointed to anticipated lower demand for AMD’s MI325 GPU and supply chain challenges related to high-bandwidth memory from Samsung. He commented that AMD is likely at a competitive disadvantage in AI rack solutions until the release of its MI400 series, which is expected to arrive in late 2025 or early 2026.

Conversely, on Jan. 14, Loop Capital began covering AMD with a “Buy” rating and a target price of $175. They expressed optimism regarding AMD’s growth potential, especially in the accelerated computing sector, according to Investing.com.

Loop Capital emphasized AMD’s ability to capture substantial market share in both the data center and personal computer markets. They believe AMD, which has underperformed compared to the PHLX Semiconductor Sector index in 2024, is undervalued relative to its peers.

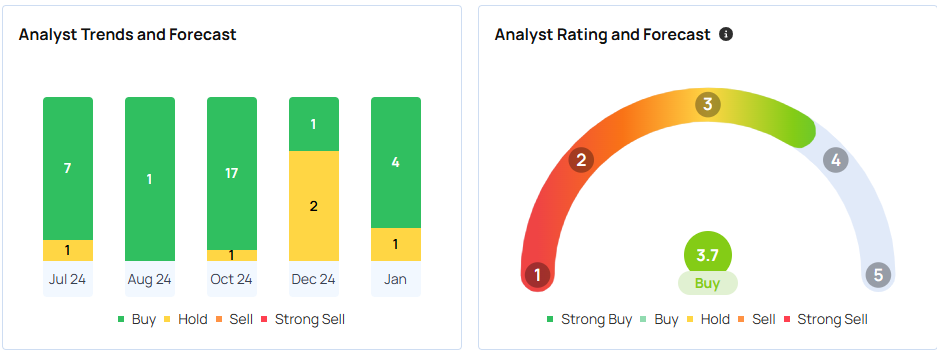

About 31 analysts tracked by Benzinga have a consensus “Buy” rating for AMD, with an average price target of $184.53. Keybanc, Loop Capital, and Wells Fargo recently gave ratings that averaged a target price of $163.33, indicating a potential upside of 41.01%.

Current Movement: On Wednesday, AMD shares recorded a slight gain of over 0.2% in pre-market trading. The stock has seen a decline of 8.37% over the past month and 26.87% over the past year.

Looking Ahead:

Photo courtesy: Shutterstock

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs