AMD Unveils New AI Chip to Challenge Nvidia’s Dominance

Advanced Micro Devices (AMD) has launched a new chip designed to strengthen its position in the artificial intelligence market, taking direct aim at rival Nvidia (NVDA).

The Instinct MI325X microchip from AMD is set to go head-to-head with Nvidia’s Blackwell series, which powers AI applications in data centers. These graphics processing units, or GPUs, are among the most advanced technology available for AI processing.

Production of the Instinct MI325X is expected to begin before the end of this year. Although AMD has not disclosed pricing details, this new chip follows the successful MI300X, released in late 2023, which is already in use by major tech firms like Meta Platforms (META) and Microsoft (MSFT) for their AI needs.

AMD’s Strategy to Capture Market Share

AMD’s leadership has expressed a clear ambition to reduce Nvidia’s stronghold in the data center GPU market, where it currently commands a significant 90% market share. AMD anticipates that the GPU market will reach a valuation of $500 billion by 2028. Recently, the company reported that its data center sales more than doubled in the second quarter compared to the previous year, totaling $2.8 billion.

If the Instinct MI325X performs well in the market, it could provide a boost to AMD’s stock price. While AMD shares are up 11% this year, they still lag far behind Nvidia’s impressive 173% year-to-date gain. AMD is scheduled to announce its quarterly financial results on October 28.

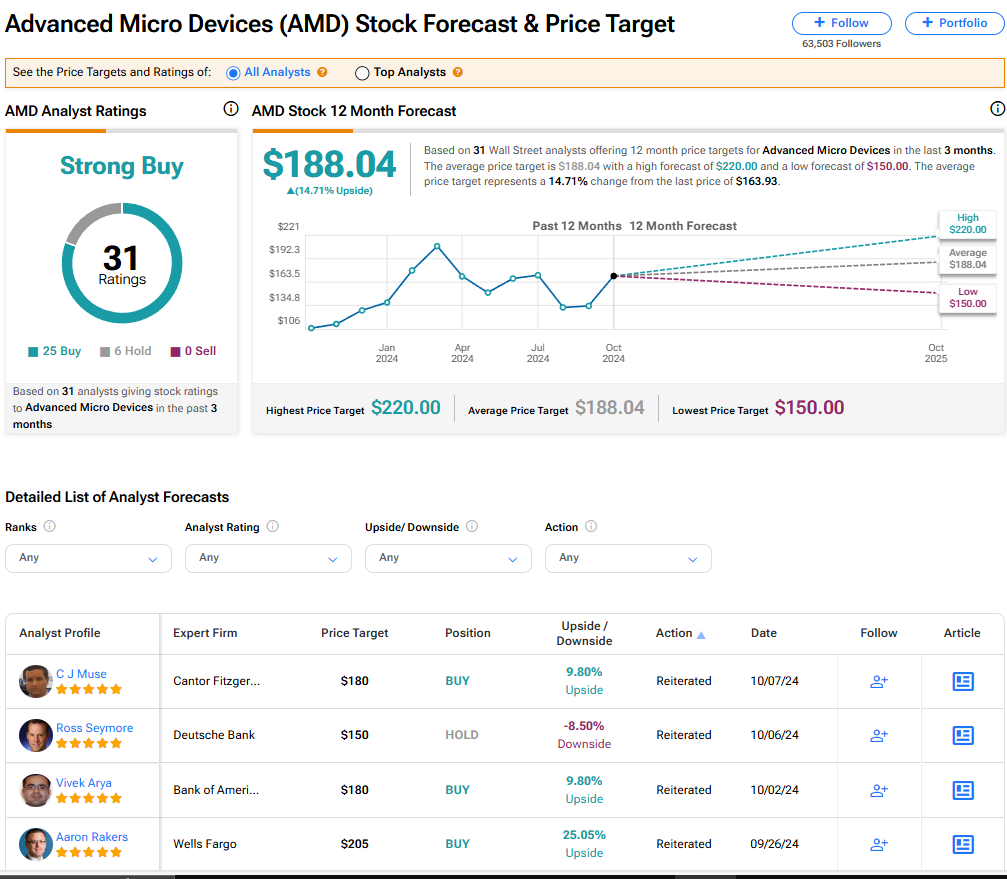

Analyst Opinions on AMD Stock

AMD stock currently holds a consensus rating of Strong Buy from 31 Wall Street analysts. This rating stems from 25 Buy and six Hold recommendations made in the past three months. The average target price for AMD is set at $188.04, suggesting a potential upside of 14.71% from its current market price.

Read more analyst ratings on AMD stock

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.