Evaluating AMD and Arm Holdings for Long-Term Investment Potential

The semiconductor sector presents significant growth opportunities for investors. The demand for computer chips continues to rise across various industries, including robotics, automotive, and artificial intelligence.

Investors may want to consider Advanced Micro Devices (NASDAQ: AMD) and Arm Holdings (NASDAQ: ARM) as two leading semiconductor companies. AMD manufactures hardware essential for AI systems, while Arm is renowned for its chip designs, holding an estimated 99% market share in the smartphone sector.

Where to invest $1,000 right now? Our analyst team has revealed their picks for the 10 best stocks to buy now. Learn More »

Both AMD and Arm show compelling investment reasons, but which one is the best choice? Below is an analysis of both companies to determine which might offer a better long-term investment.

Reasons to Invest in AMD Stock

AMD’s appeal lies in its products, which support an advanced computing architecture known as accelerated computing. This method leverages dedicated hardware to enhance data processing speeds—an essential feature for AI systems that analyze vast amounts of data.

Following the AI boom, AMD saw substantial sales increases. In the fourth quarter of 2024, sales to data centers surged by 69% year-over-year to reach $3.9 billion. This growth reflects the increasing reliance on AMD’s hardware for AI systems, contributing to the overall Q4 revenue increase of 24%, totaling $7.7 billion.

The demand for AMD’s products extends beyond data centers. The company also reported strong interest from the PC market, achieving a remarkable 58% year-over-year growth in Q4 revenue, amounting to a record $2.3 billion.

These successes translated into robust financial metrics. AMD’s Q4 gross margin improved to 51%, up from 47% in the previous year, indicating enhanced cost management and profitability. Additionally, their Q4 balance sheet showed total assets of $69.2 billion against total liabilities of $11.7 billion, with $5.1 billion in cash and equivalents—reflecting a 13% increase since the third quarter.

The Case for Arm Holdings Stock

Arm Holdings maintains a dominant position in the smartphone semiconductor market due to its energy-efficient designs. The company is now leveraging this strength to penetrate the growing AI market, which demands significant power resources.

Recently, Arm introduced integrated circuits called Arm compute subsystems (CSS) for consumer devices, utilizing a groundbreaking three-nanometer process technology. This innovation allows for denser circuitry, improving chip performance.

Arm’s management reports strong demand for CSS, resulting in record royalty revenue of $580 million in its fiscal Q3, a 23% year-over-year increase, which helped the company achieve a 19% sales growth year-over-year, totaling $983 million.

Arm’s financial health is also impressive, with a fiscal Q3 gross margin of 97.2%, up from 95.6% the previous year. Its Q3 balance sheet displayed total assets of $8.5 billion, and cash and equivalents reached $2 billion, almost matching total liabilities of $2.1 billion.

The company primarily generates income through licensing its chip designs and collecting royalties, but it may also explore new revenue avenues. Reports indicate that Arm has begun producing hardware for its designs, securing Meta Platforms as a key customer.

Acquiring Meta as a customer could be strategic, especially as Meta is developing a substantial data center. If confirmed, this would position Arm directly against AMD, which currently supplies hardware to Meta.

Choosing Between AMD and Arm Stock

With both AMD and Arm excelling in the AI sector, they are solid semiconductor companies to contemplate for investment. However, a critical factor in selecting between the two is Stock valuation.

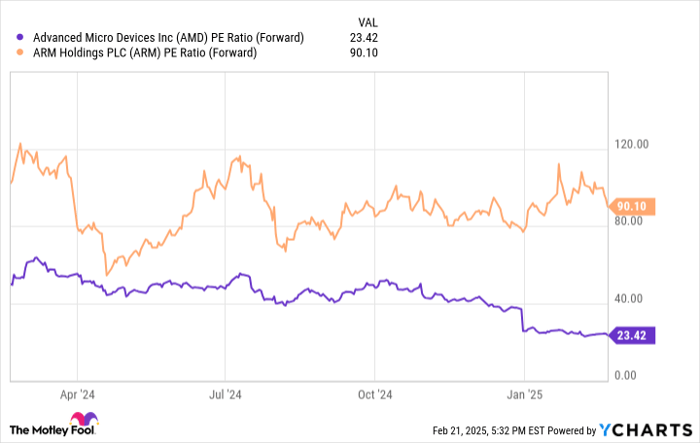

To evaluate their relative value, we observe each company’s forward price-to-earnings (P/E) ratio, which indicates investor willingness to pay for a dollar of earnings based on forecasts for the upcoming year. Currently, Arm’s forward P/E ratio is significantly higher than AMD’s, suggesting that AMD may represent better value.

Data by YCharts.

AMD’s forward P/E multiple decreased in 2025 as its Stock price dropped due to various factors. A high valuation prompted a correction, while January saw jitters in Wall Street’s confidence towards U.S. AI firms, particularly after the unveiling of a low-cost AI product by the Chinese start-up DeepSeek. Lastly, despite AMD’s strong Q4 results, they fell short of elevated market expectations.

As of now, AMD’s share price appears to be more reasonable compared to Arm’s potentially inflated valuation. While both companies possess strong business fundamentals, AMD’s better pricing makes it a more appealing long-term investment.

Should You Invest $1,000 in Advanced Micro Devices Now?

Before making a purchase in Advanced Micro Devices, consider the following:

The Motley Fool Stock Advisor analyst team has recently named their top 10 stocks for investors, and Advanced Micro Devices wasn’t included in this list. The selected stocks hold the potential for substantial returns in the near future.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $776,055!*

Stock Advisor offers an accessible plan for success, including investment portfolio guidance, analyst updates, and two monthly Stock picks. Since 2002, the Stock Advisor service has surpassed the S&P 500’s return by over four times.*

Learn more »

*Stock Advisor returns as of February 24, 2025.

Randi Zuckerberg, a former director of market development for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Robert Izquierdo has stakes in Advanced Micro Devices, Arm Holdings, and Meta Platforms. The Motley Fool recommends both Advanced Micro Devices and Meta Platforms. For more details, please see their disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.