Comparing AMD and Lattice Semiconductor in the FPGA Market

Advanced Micro Devices (AMD) and Lattice Semiconductor (LSCC) are influential players in the FPGA (Field-Programmable Gate Array) market. AMD expanded its footprint by acquiring Xilinx, while LSCC focuses on low-power FPGAs for sectors including industrial automation and edge computing.

According to a report by Mordor Intelligence, the FPGA market size is projected to reach $11.14 billion in 2025 and escalate to $18.76 billion by 2030, translating to a CAGR of 10.98% from 2025 to 2030. This growth presents ample opportunities for both AMD and LSCC in a rapidly expanding market.

So, which stock offers greater upside potential—AMD or LSCC? Let’s explore.

The Case for AMD

The acquisition of Xilinx has allowed AMD to diversify into multiple embedded markets, primarily featuring embedded CPUs, GPUs, APUs, FPGAs, System-on-Modules, and adaptive SoC products.

This strategic move has enabled AMD to enhance its capacity in emulation devices, with each new generation nearly doubling the capabilities of the last. The latest VP1902 adaptive SoC boasts an impressive 18.5 million logic cells, doubling the programmable logic density of the previous Virtex UltraScale+ VU19P FPGA.

AMD’s portfolio has seen significant developments. In the first quarter of 2025, AMD announced a high-performance, energy-efficient 5G core powered by the Virtex UltraScale+ XCVU5P FPGA, developed in collaboration with Napatech and Druid Software.

Moreover, AMD completed initial shipments of cost-optimized Spartan UltraScale Plus FPGAs and second-generation Versal AI Edge SoCs during the first quarter, addressing the growing demand for AI at the edge.

Additionally, AMD is strengthening its partnerships with major cloud providers like AWS, integrating its products into new FPGA-accelerated instances. In early 2025, AWS launched FPGA-accelerated instances powered by AMD’s EPYC processors and Xilinx Virtex FPGAs, designed for data-intensive workloads such as genomics, multimedia processing, and cloud-based video broadcasting.

The Case for Lattice Semiconductor

Lattice Semiconductor is experiencing strong demand for its small and mid-range FPGA solutions, particularly benefitting from its Nexus and Avant product families. This focus has enabled Lattice to tap into high-growth industries.

Building on its momentum, Lattice has strategically positioned its FPGAs for high-growth applications such as AI, data centers, and advanced driver-assistance systems in automotive. Other emerging markets include security, particularly Post-Quantum Cryptography, as well as AR/VR technologies targeted at consumer interest.

In February 2025, Lattice announced a successful validation of Everspin Technologies’ PERSYST Magnetoresistive Random Access Memory (MRAM) for use in all of Lattice’s FPGAs. This collaboration aims to enhance MRAM’s suitability for mission-critical applications, such as real-time sensor processing and data logging in avionics.

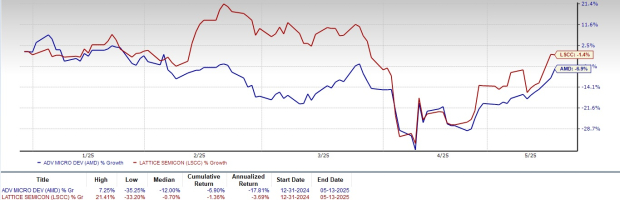

Price Performance and Valuation of AMD and LSCC

Year-to-date, shares of AMD and LSCC have declined by 6.9% and 1.4%, respectively. The downturn in their share prices reflects a challenging macroeconomic environment, including broader market weaknesses in the tech sector and persistent concerns over mounting tariffs.

AMD and LSCC Stock’s Performance

Image Source: Zacks Investment Research

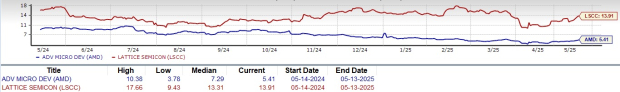

Both AMD and LSCC shares currently appear overvalued, reflected by Value Scores of D and F, respectively. AMD shares are trading at a forward 12-month Price/Sales ratio of 5.41X, which is considerably lower than LSCC’s 13.91X.

AMD and LSCC Valuation

Image Source: Zacks Investment Research

Earnings Estimates for AMD & LSCC

The Zacks Consensus Estimate for AMD’s 2025 earnings stands at $4.09 per share, having declined by 10% over the past 30 days. This estimate indicates a year-over-year increase of 23.56%.

Advanced Micro Devices, Inc. Price and Consensus

Advanced Micro Devices, Inc. price-consensus-chart | Advanced Micro Devices, Inc. Quote

In comparison, the Zacks Consensus Estimate for LSCC’s 2025 earnings is $1.05 per share, having decreased by 4.5% over the past 30 days, suggesting a 16.67% year-over-year increase.

Lattice Semiconductor Corporation Price and Consensus

Lattice Semiconductor Corporation price-consensus-chart | Lattice Semiconductor Corporation Quote

AMD has exceeded the Zacks Consensus Estimate in all four trailing quarters, achieving an average surprise of 2.30%. Conversely, LSCC has missed the Zacks Consensus Estimate in two of the previous four quarters while matching expectations in the other two, resulting in a negative average earnings surprise of 6.31%.

Conclusion

AMD’s strong portfolio expansion, coupled with strategic partnerships, positions it for significant growth within the FPGA market. Conversely, LSCC’s focus on low-power solutions remains crucial as it capitalizes on emerging opportunities. Nonetheless, given AMD’s valuation and earnings estimates, it currently shows greater upside potential compared to LSCC.

At present, AMD holds a Zacks Rank #3 (Hold), making it a more favorable option than LSCC, which has a Zacks Rank #4 (Sell).

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our analysis has identified five stocks with the highest probability of exceeding gains of +100% in the coming months. Among these, the Director of Research highlights one stock poised for significant growth.

This leading pick is backed by an innovative financial firm with a rapidly growing customer base (over 50 million) and a diverse range of cutting-edge solutions, setting the stage for impressive gains.

You can access further insights on top stock picks.

Want the latest recommendations? Download the top 7 stocks for the next 30 days.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis report

Lattice Semiconductor Corporation (LSCC): Free Stock Analysis report

This article originally published on Zacks Investment Research.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.